New Authorized User Process on Amex Business Cards

American Express has long been one of the few banks that requires an authorized user’s Social Security Number and Date of Birth. In the past, they have required this information when adding the AUs. While the process still remains that way for personal cards, American Express has changed it on business accounts. I’ll walk you through the process, share some observations and a simple mistake that I made when activating a card.

The Old & New Process

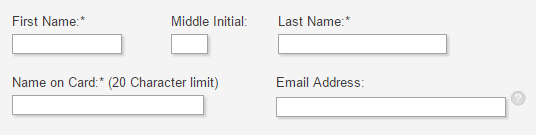

Before I show you the new process, here is the screen to add an authorized user on a personal card. This is basically how business cards worked as well before this recent change.

Now here is the new screen when you add an authorized user (or employee) on a business account:

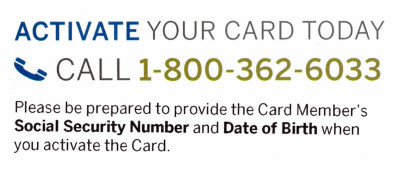

As you can see, American Express no longer requires the authorized user’s address, Social Security Number or Date of Birth when requesting the card. Instead you receive the card in the mail with the following message:

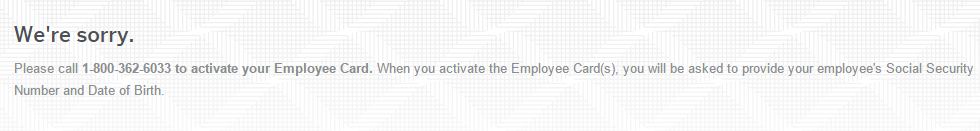

But that only shows a phone number. American Express also has an activation website that doesn’t require that information. What happens if you try to activate the card there? Perhaps you can get around the Social Security Number and Date of Birth requirement. Well unfortunately Amex isn’t stupid.

So you have to call 1-800-362-6033 to activate. Thankfully it is just an automated system. It will ask for the card number followed by the “Employee” or authorized user’s Social Security Number followed by their date of birth.

I Screwed Up – Oops!

As I wrote about recently, my wife was approved for the American Express Business Gold Rewards card with a 75K bonus! Her card arrived yesterday along with an authorized user card in my name and one in a family member’s. When I called to activate the family member’s card, for some reason I stupidly mixed up a digit on their Social Security Number. (And it still worked.) I have never done that before so I don’t know if it has to do with the new system or not. Either way, I’ll make sure to be more careful next time.

Takeaways

- You no longer need to provide a Social Security Number and Date of Birth when requesting an authorized user card for a business credit or charge card.

- Authorized user business cards must be activated via the telephone.

- The Social Security Number and Date of Birth of the authorized user must be provided when activating.

Conclusion

Since I know a lot of you were able to pick up the Business Gold card during yesterday’s 75K deal, I thought it would be worthwhile to share this new process with you. Adding authorized users can be a great way to take advantage of Amex Offers. A big thanks to Vinh at Miles Per Day for originally pointing out this new process. Happy activating!

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

So I have an Amex gold business open card (that doesn’t report on my personal credit). I just ordered a card for an employee of mine. Are you telling me they will ask for his ssn when I activate the card?

Hi Shawn

I have an Amex Gold Business card through my employer. Am I supposed to have that show up on my credit report? Currently does not,I have had this card since November ’15.Trying to boost my score!

Thanks!

If it is a corporate card then it probably won’t show up on your credit.

I’ve long held a platinum card and gotten gold cards for my ee’s. I have never provided a social when I activate the cards, which I do for all of the ee’s so I can track the expiration date, number, etc. You say it shows on their credit report as an AU. In credit terms, what impact does that have on the ee’s credit, ability to obtain credit under their name, etc.?

I got the SPG business card recently, with an employee card. Employee is currently using the card to make purchases, which I had considered to be “activated” along with my card (I never provided SSN or DOB, and Amex never asked during my online activation). But I’ve received an email from Amex asking me to activate the employee card. He couldn’t use it if it wasn’t activated, right?

When I provide a social security number for an authorized user, does Amex do a hard credit pull on them? I would hate to waste an inquiry on an authorized user card.

No, but the account does generally end up on their credit report as an authorized account. No hard inquiry is performed though.

I can only see the add employee card option for my amex biz cards. Is that the same as adding authorized user card?

Or do you have the options to add authorized user cards AND employee cards to amex biz cards (I’m talking about the spg biz but I assume other biz cards would be the same)

Thanks!

Amex calls authorized user cards employee cards on the Business side. They are basically the same thing.