Amex HHonors Surpass Best Offer – 85K Points!

Yesterday I wrote about my wife’s latest round of credit card applications. If you haven’t read it yet, then you might find some useful information as I cover her six apps. One of the apps I mentioned was the 80K offer on the American Express Hilton HHonors Surpass card.

Unfortunately that 80K offer ended, but that isn’t bad news actually. A new offer giving 85,000 HHonors points after $3,000 in spend has surfaced. Before I go into the value of the offer, let’s look at the card itself.

Bonus: 85,000 Hilton HHonors points after $3,000 in purchases in the first 3 months. (Note: You cannot get the bonus if you have or have had this product before.)

Earning:

- Earn 12X Hilton HHonors Bonus Points for each dollar of eligible purchases charged on your Card directly with a participating hotel or resort within the Hilton Portfolio.

- Earn 6X Hilton HHonors Bonus Points for each dollar of eligible purchases on your Card at U.S. restaurants, U.S. supermarket and U.S. gas stations.

- Earn 3X Hilton HHonors Bonus Points for all other eligible purchases on your Card.

Benefits:

- Enjoy complimentary HHonors Gold status. Plus, spend $40,000 on eligible purchases on your Card in a calendar year and you can earn HHonors Diamond status through the end of the next calendar year.

Annual Fee:

- $75 (Not waived the first year.)

Direct Application Link (Not an affiliate link)

Analysis

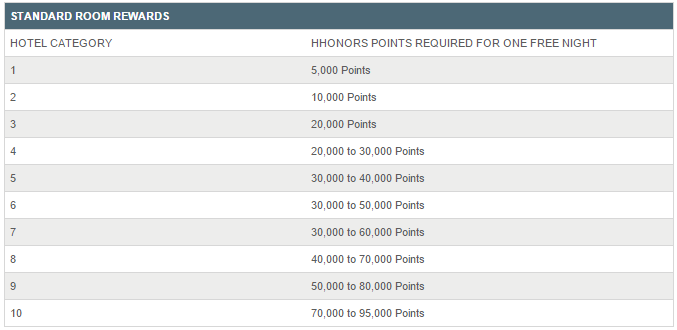

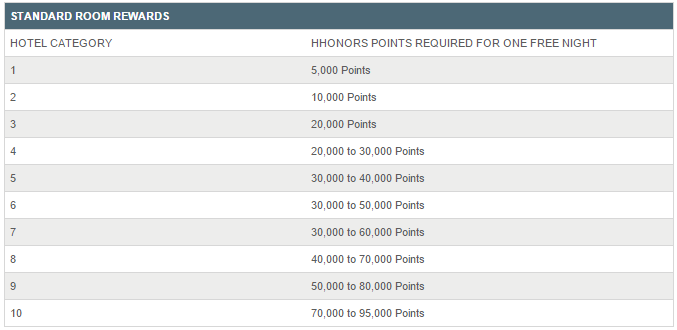

The real value of Hilton HHonors is finding good redemptions on the low end. Category 1 is just 5,000 points and in the low season a Category 4 hotel is just 20,000 points. I have found some very good value redemptions and some terrible ones. I personally like to keep a stash of Hilton points for the times I find those great value hotels. The Doubletree Kuala Lumpur comes to mind.

If you don’t currently have Hilton Gold status or higher, then this is a great benefit as well. You often get lounge access with Gold (not guaranteed) and are at least guaranteed breakfast at most properties. I have found Hilton HHonors Gold is the best mid-tier status around and gladly enjoyed it before Hilton generously gave me Diamond status recently.

Amex Offers

I know you are probably tired of me screaming this from the rooftops, but this is an Amex card and thus the primary and each of the authorized user cards are eligible for Amex Offers. Each one of my Amex cards was worth hundreds of dollars in statement credits last year! I really love Amex Offers.

Matching Offers?

If you recently got this card with a lower offer, then you probably won’t get American Express to match the higher bonus. Unlike other banks like Citi and Chase, American Express doesn’t like to match. Of course it never hurts to ask, but don’t expect a nice answer. At least based on my personal experience and the experience of others.

Conclusion

If you are in the market for a nice chunk of Hilton HHonors points then this is a great offer. While the public offer is only 60,000 points, the direct non-affiliate link above will give you 85,000. If my wife hadn’t recently picked up the card, then we would definitely be jumping in, but our Hilton balances are at healthy levels for now.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

[…] couple of months ago American Express released an 85,000 point offer on their co-branded Hilton HHonors Surpass card. My wife actually applied and was approved under […]

Well,

Hubby just got the Ink+, and we have the NBA All Star Weekend coming up next week, so I am really tempted to get this card, but want to make sure I can easily cash out the VGC’s I get.

Gonna try to “ration” my remaining BB/Serve accounts, to make sure they dont get shut down….

Subscribe

Any idea how long this offer will last?

[…] H/T: MTM […]

if i have this couple years ago will i not receive the bonus again?

No unfortunately it is once per lifetime like all Amex personal cards. I have added that to the post for more clarity.