Amex Pay Over Time 10K Bonus

American Express is well known as a bank with a good selection of “charge cards”. While they have certainly diversified their portfolio of products to add many credit cards, charge cards still seem to be the base of their business. So what is the difference between a “credit” and a “charge” card? It is quite simple. The ability to pay over time.

To further confuse things, American Express has a program for their charge cards called “Pay Over Time”. This program essentially changes your charge card into a credit card for large purchases. Here is how Amex describes the benefits:

- No fee to enroll.

- Added flexibility to pay eligible charges over time with interest.

- Simply choose each month to pay in full, the minimum amount due, or anything in between. It’s your choice.

- All eligible charges of $100 or more can be paid over time.

Pay Over Time Formula

Now, let’s tackle the elephant in the room. You should NEVER PAY OVER TIME. NEVER NEVER NEVER.

Actually there is a simple formula that may explain it better:

- Paying over time = Interest

- Interest = Bad

- Paying Over Time = Bad

Remember that credit card debt is evil and paying off your bills in full each month is essential to actually getting any benefit from credit card rewards. So then, why would I enroll two of my American Express OPEN Business card accounts in Pay Over Time? Because they paid me too!

Targeted 10,000 Point Offer

This morning I logged into my Amex Business Platinum account to look for offers and I saw the following:

I have seen this offer covered on blogs before from time to time. Each and every time a link has been posted or someone has talked about it, I haven’t been eligible. Thus, I was excited to see this in my account. Additionally, this is the first time I have seen this type of offer in my Amex Offers section. Naturally I clicked “Learn More”.

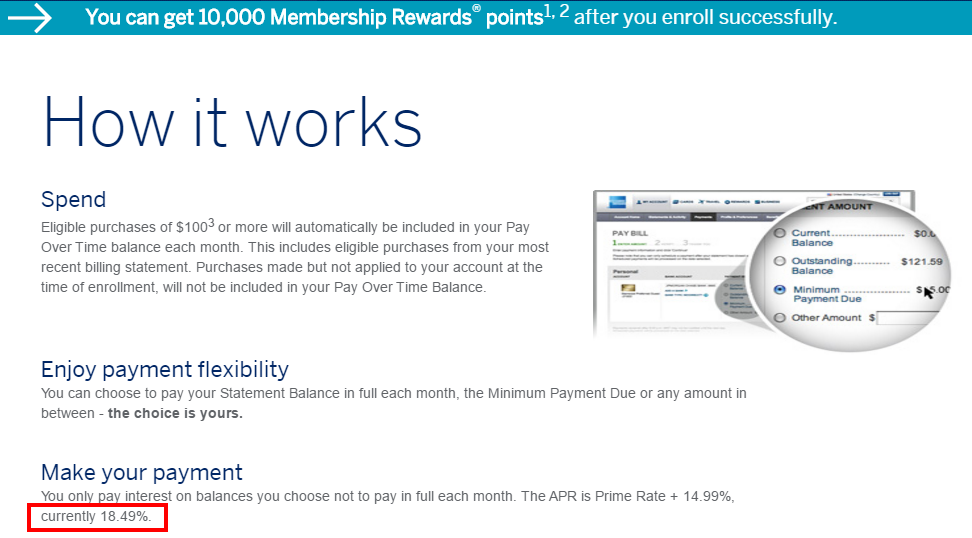

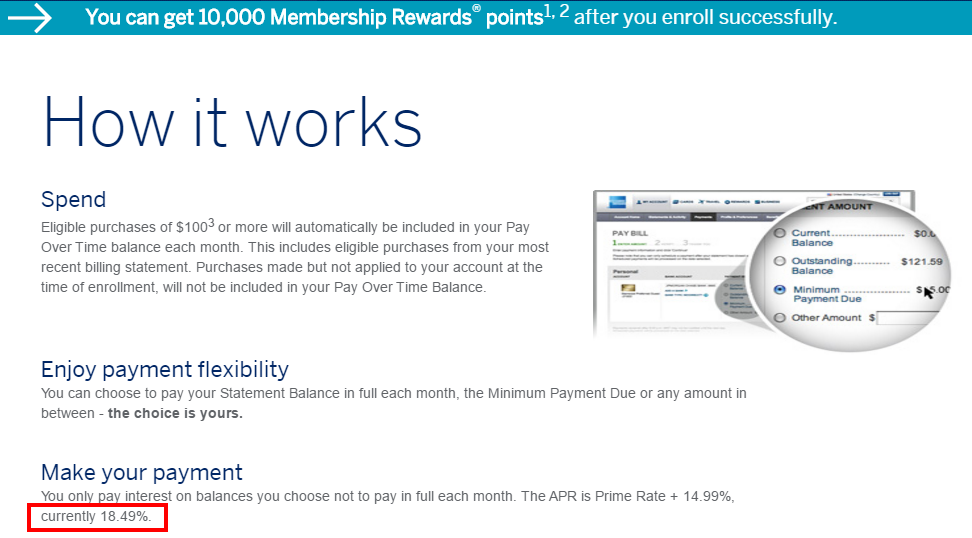

Prime + 15%? Ouch! Amex definitely isn’t doing you any favors for paying over time. Still, 10,000 points just for the option works for me. Funny enough, when I clicked to enroll, I noticed that this offer was applicable on my Green Card as well. So I went through and enrolled my Business Platinum card and then the Green Card.

Key Offer Terms

There are of course some terms to this offer. I did manage to save them and I’ll post the key terms below for those of you interested. Notice you can get this offer once on each OPEN account if it is eligible.

1. Offer valid through 11/01/2016. To be eligible to earn Membership Rewards points, you must be enrolled in the Membership Rewards program at the time of enrollment in the Extended Payment Option feature. Only one offer per American Express OPEN Business Card account is permitted, and points will be credited to your account within 6-8 weeks after enrollment is approved. Maximum 10,000 points per account.

2. Card Member must be eligible to enroll in the Extended Payment Option at the time of requesting enrollment. This enrollment offer is only available if you complete the online request for enrollment. The Extended Payment Option is issued by American Express Bank, FSB (“Bank”).

Hard Inquiry?

I do not believe I will incur a hard inquiry for this, although I suppose it isn’t guaranteed. Nowhere in the terms did it explicitly state they would check my credit and a search seems to indicate that most/all people who have done this before have reported that their credit wasn’t checked. I also have credit monitoring in place and didn’t receive a notice of an inquiry. I’ll assume no check was run, but will update you if that is wrong for some reason.

Conclusion

American Express is paying me to open up my card to an option to pay over time. I don’t carry credit card balances, but I suppose they hope something will happen where my business needs some time to pay. Nothing is impossible I guess, so why not sign-up for the program considering the generous bonus? Getting the offer on a second account was icing on the cake and I am happy that my Membership Rewards balance is soon to be 20K fatter.

Have you received this or a similar offer on your account? Please let us know in the comments.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I signed up for the pay over time with my AX green card. Had problems ever since because each customer rep has explained something totally different. I purchased something that i could have placed on another card and earned cash back but no, with regret I chose to take advantage of the program. They do not tell you that there are two payment due dates, one for regular purchases which is due on the 15th of the month and the pay over time which is due on the 10th of the month. Unfortunately, they did not send me the updated bill that displays this info. I also noticed something else – around the time I signed up for this special offer, my credit score dropped 15 points. Still I am in good range but when I checked with the credit bureau, they and I could not find any negative info on my credit report. I am no longer using my green card.

I wonder if this is part of a way to retain subscribers – I was told that this offer was available the month after I was charged the annual fee. And I’ve been thinking of canceling.

But if it’s going to take 6-8 weeks to appear, that will be outside of the time window for me to cancel. (You get 60 days, I’m told, after the charge appears for a full refund.)

It could be but I have received it months before my annual fee was due. The points usually only take a few days to post though despite the terms.

I did not receive the points yet even after few weeks of enrolling. I called customer service and asked them why and they asked me for the promo code. I told them I did not keep the letter I received and they had no clue. Please let me know if there is a promo code because the pathetic customer service cannot trace the offer. Thanks.

I did mine the day of the post here but still haven’t received any points.

Strange. I would probably follow up with them, although I suppose it is still within the time it says in the terms.

I did after 5 days. They told me to allow 6-8 weeks. Weird no one else is having to wait.

shawn,

did you get 20k for enrolling for both cards?

The offer was 10K per card so I received 20K total for the two cards.

Did this offer just appear under your Amex Offers & Benefits tab when you log in to your account? Or is it available elsewhere? I don’t appear to have it with any of my Amex cards.

Yes it was under my Amex Offers.

I enrolled my business Platinum and Green cards. It said 10,000 points for each one’s enrollment. So far as of 5/12 I haven’t received the points. I called Amex and they have no clue what I’m talking about.

I used to have a JetBlue Amex which was converted to a MasterCard. I wonder if this offer would be available on new credit cards? And also where do you use the points?

[…] My Amex 20K MR Surprise Bonus: Getting Paid to Pay Over Time […]

I have the personal plat and didn’t request to be enrolled in the “Select and Pay Later” feature. Instead I received a letter saying I was enrolled, and if I didn’t want it, I should call AMEX to cancel.

My husband had it on his business platinum but it didn’t offer any bonus points.

There is no hard pull. I have signed up for this over the course of multiple platinum cards. Also has never led to a FR

I have the offer available on my Amex Platinum Personal card, however there is no 10k MR bonus to go along with the offer. Maybe I don’t spend enough with the card.

I remember once seeing an offer on the top of my screen for getting 15,000 MR. I procrastinated and then the offer went away after a few days. Is it possible that waiting longer will bring better offers?

Were there any other requirements to get the 10K points? Any minimum spend?

Or was it just for signing up?

Just for signing up. They had to approve me once I decided to sign-up but that happened instantly.

I feel like it will end up being a HP (hopefully just a SP). Even if it is pretty much everyone would take 20k MR with no spend and 1 combined HP. I think it is only for biz cards since I didn’t see anything for my personal cards.

What is HP?

SP?

FR?

Morse code is easier to decipher!

HP= hard pull; SP= Soft pull; FR=Financial review

Hard Pull

Soft Pull

Financial Review

Did you get the points instantly?

No they haven’t posted yet. The terms said 6-8 weeks.

I applied the day you posted this (may 6). Just checked account and the points posted today!

Just checked and mine did too! Good stuff.

I’ve read that activating this is something thought to lead to FR. I’ll be curious as to whether or not you find that to be the case. I’ve been tempted to believe that it doesn’t, but I’m also not so interested in FR, so I’ve been cautious about trying not to instigate it.