Amex Platinum 100K Application

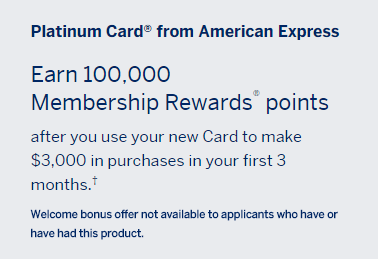

Last Wednesday a new 100K Amex Platinum link surfaced. I covered it here on the blog and advised those who were looking to apply to use caution. The last time a similar link surfaced, Amex borderline harassed people who applied by freezing their Membership Rewards accounts and even clawing back bonus points in some cases. It seems these links may be targeted and thus Amex doesn’t like them going public.

For more info on what happened during the last round, see: Caution: Why You Should Probably Be More Careful with Spending & Amex Bonuses (Clawbacks & Frozen Accounts)

My Wife’s Application

I have had the personal Platinum card before (I got it during a previous 100K offer), but my wife has not. Knowing she was eligible for the bonus, I quickly decided that it would be good for her to apply and urged her to do so. Since I can be very convincing 😉 she went ahead and applied. The application went to pending.

Within a couple of hours the 100K link died which made me think of two things. First, it was probably supposed to be targeted and second will Amex be tough on customers who applied through it? Truthfully I had thought about those things before the link was shutdown and had determined it was worth the risk for 100K.

Getting the Approval

While my wife’s application went to pending, by Thanksgiving morning the website was showing that she was approved. She was even able to add the card to her online account. Another card to load Amex Offers to. Yay!

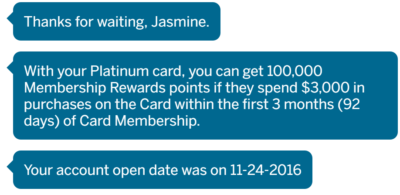

The final step was to hop on a chat with Amex just to make sure everything coded correctly with the bonus. Thankfully after a quick chat she was able to confirm the 100K bonus after only $3K in spend. Good stuff!

Meeting the Spend Organically

The $3K spend on this card will be met organically. We will not be buying cash equivalents or even gift cards to meet the spend. This should hopefully spare us from Amex trying to clawback any points. We will comply with the bonus terms as written. In fact we are doing this for all of our American Express cards. Even if we buy gift cards during a promotion or with an Amex Offer, from this point forward I won’t consider that as spend towards the bonus threshold.

Conclusion

Being able to jump on opportunities as they present themselves is a big key to this game. Another key is making sure you get the best possible bonus on Amex cards since you can only get it once. In this case my wife will get a great bonus and the timing will allow her to maximize the airfare credit twice in a relatively short period of time so our out of pocket cost is minimal.

Did you apply during the brief window when this 100K application was live? Were you approved? Share your experiences in the comments!

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

[…] week I shared my wife’s experience with getting in on the recent Amex Platinum 100K offer that surfaced on Thanksgiving Eve. She applied through a publicly available link and […]

DOC (Doctor of Credit) is reporting that the last AMEX Plat link was a “hack”, and that Amex is freezing the MR accounts of folks who applied using that link.

Any data points here, from folks that actually got a chance to apply for the Plat, using that link?

As I posted earlier today my points are frozen.

My wife has reported no problems with her new Amex Platinum. So far.

That is why I stay away from the Platinum Business. Can’t do all the spending organically so have to let it go. I got the personal Platinum for hubby last round and did nothing “creative” in spending and his 100K is fine. So only bite if you can digest it.

Have there been data points of claw backs on Amex Platinum Business? I’m just reading about this a little too late after buying $1000 of Albertson’s gift cards. It is a tall order for most people to do a $10000 min spend completely organically in 3 months.

10K spend down is very tough to do. Try aiming for the 5K instead, without MS.

That card, and the offer, is not for most people. That’s is why the spend is so high.

I’m doing the min spend on the Amex enhanced business platinum. It’s a 10000 targeted min spend. I’ve already bought about $1000 in gift cards. Do I have to worry about Amex claw backs with this card just as much as the card you are writing about?

Yes. NEVER MS Amex spend down, you will lose your points and have your account frozen sooner or later. The writing is on the wall concerning this in capital letters. MS an Amex spend down, you will get busted.

Shawn, if this opportunity comes up again… do you think one can get it if they were an authorized user for their spouse. His card is now closed. Thanks!

Yes if you were only an authorized user then you can get the bonus for yourself as the primary.

I would not even buy ANY gift cards during meeting the minimum required spend, even through MPX. Keep it 100% organic, even if you need to buy tires or something or whatever. And then I would wait until the bonus posts before I even thought of gift cards or cash equivalents.

Why take the risk that they will see even ONE gift card and then claw back. Amex is using a bigger magnifying glass these days! Stay safe, my friends!

If she has had any form of the platinum, she can have the points clawed back. That is what happened to me.

I had my wife apply as soon as I saw the offer. Instant approval! As always, it is best to never MS a spend down. There are too many easy ways to pay bills, etc. to meet the requirements. I will wait for another day to apply myself.

Shawn,

Were Plastiq transactions considered MS/cash equivalent purchases by Amex and resulted in clawback last time?

I’m not sure they named specifically what they considered to be MS purchases, but considering you are paying a bill it would be hard for them to make that argument. Of course fighting them isn’t exactly an easy process.

Hey Shawn. Thanks for the update. I applied when I saw your article and was also approved. Yay! Quick question though: how do you ask them on the online chat? Do you just outright ask if you’re eligible for the bonus? Just wondering how to word the request. Thanks.

I always confirm bonuses via either chat or secure message. It is always nice to get it in writing plus I like to get them to confirm the date the spend needs to be made by.

I simply say, “I recently opened XXX card and want to confirm the bonus amount, spend threshold and date the spend needs to be completed. Thanks!”

Applied and got approved for the card. What will be your suggestions to get maximum value from $200 airline credit? I reckon MileagePlusX app spend is a no-no to prevent Amex’s wrath. Are airline GCs in $50-$100 denominations still a go? Or, it strictly needs to be airline incidental spend?

I wouldn’t worry about buying gift cards as much as I would subtract out those purchases when calculating your spend. If you can show you met the spend without any gift cards they have no basis to claw back the bonus. Buying gift cards is not forbidden. Check the Flyertalk boards for the latest and greatest methods of maximizing the credit.

Unfortunately I took a break from points & miles Thanksgiving week. You snooze, you lose…

congrats on ur wife’s approval, shawn. wanted to apply for the wife too after seeing the post, but it was dead