Amex Platinum 100K Membership Rewards Frozen

Last week I shared my wife’s experience with getting in on the recent Amex Platinum 100K offer that surfaced on Thanksgiving Eve. She applied through a publicly available link and didn’t do anything special to get the application to work. Additionally she confirmed via chat that the 100K bonus was attached to her application. All was good, or was it?

Earlier this week reports began surfacing (HT Doctor of Credit) of people who applied under that offer having their Membership Rewards accounts frozen. This is the same type of behavior Amex showed towards applicants of a similar 100K offer earlier this year so it isn’t entirely unexpected.

While I saw those reports earlier in the week, I have been traveling and just got around to checking my wife’s account. To test to see if it was frozen, I decided to transfer 500 Membership Rewards points to my wife’s Plenti account with their current 50% bonus.

Attempting the Transfer

First, in order to transfer points I had to link my wife’s Plenti account to her Membership Rewards account. That worked perfectly.

Then I went to the transfer page and input the numbers for the transfer. Everything looked like it was going to work!

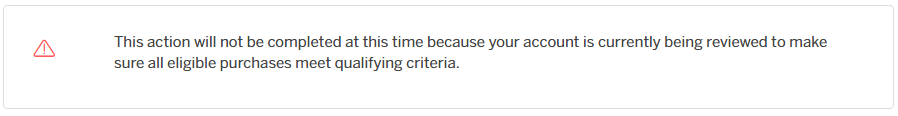

Then the problem came. As soon as I clicked “Confirm & Transfer Points” I got the dreaded notice. My wife’s account is under “review”. Boo.

Where To Go From Here

Thankfully my wife’s Membership Rewards account had the lesser of our balances and thus this isn’t a huge deal in the short term. She hasn’t even used the Platinum card yet, but will be earning the bonus through 100% normal spend. In fact, she received an Amex Offer giving 3X points at Amazon and we do a lot of shopping at Amazon. My guess is most of the spend will be completed there and we plan to spend more than the minimum to avoid any issues.

Other than spending on the card, we plan to let Amex do their investigation. During the deal earlier this year they eventually unlocked people’s accounts, so we will just let this go a couple of weeks and see what happens. My wife has never had another flavor of Platinum (where she is the primary), so Amex shouldn’t be able to deny the bonus based on those grounds. Remember too that she has confirmed the bonus in writing with Amex.

Is This Harassment?

The term harassment is a strong one and I fully believe Amex is within their rights to review accounts, but this is really ridiculous. My wife has not made one purchase on that Platinum card and thus there are no purchases to review. It is clear that they only froze her account (and the accounts of others) because she applied with a public application link that they don’t like. Call it what you want but at the very least it is very customer unfriendly.

On the other side, I was well aware of how they treated customers during the last 100K offer and even had a warning in my post covering this deal that people should use caution. In other words I am not trying to play the victim here. Should Amex treat customers this way? No, but I knew this was a possibility. An unfortunate one though.

Conclusion

My wife and I value our relationship with Amex and have no problem staying within their rules and terms. The simple fact is they had a public application that she applied through and now they are going to make life difficult for her because of it. It really is unfriendly behavior, but we’ll cross our “T”s and dot our “I”s to make sure we get the bonus.

Did you apply under this offer link? Has your Membership Rewards account been frozen? Please share your experiences in the comments!

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

[…] scary… Amex points frozen from latest 100K offer from Shawn of Miles to […]

[…] Last month a link surfaced offering a 100K bonus on the American Express Platinum card after $3K spend. I know many of you applied under that offer as did my wife as well. Unfortunately it seems the offer was not meant to be public (although it was publicly accessible) and Amex decided to freeze the Membership Rewards accounts of people who applied. […]

I can’t even access my MR account. Got the error code LA01-101. Should I wait it out or call?

Meh – just bankers being bankers. Lucky for you that AMEX did not open additional Membership Rewards accounts without your permission and then freeze them too. Not so far fetched when you consider that Wells Fargo initiated discussions to merge with American Express back in 1995.

My account was frozen before I even received the card. This is extremely customer unfriendly. My wife’s MR account only has 1 other card, an everyday preferred, that is used entirely for grocery and gas station spend. I doubt there’s a single transaction above $150 in the last year. The fact that it is just a blanket freeze and not just those with suspicious spending patterns makes no sense.

[…] Caught in the Amex 100K Crackdown: My Membership Rewards Account is FROZEN! […]

My Platinum. application is still pending and under review. This is very troubling since it’s been more than a week. I have not tried transferring any MR point to find out if my account is frozen

Just confirmed my account where I added my first Platinum Oct23 is frozen during transfer: “This action will not be completed at this time because your account is currently being reviewed to make sure all eligible purchases meet qualifying criteria.” I don’t have any plans for MRs for the next several months as I will use different currencies to book flights.

Would Amex consider paying bills (car, house, etc.) via plastiq to be manufactured spending? should I avoid doing that given all that is going on with this offer?

did you find the URL on their website? No. then it isn’t clearly a publicly exposed link. definitely Amex has right to do what they want as long as it’s with in the terms.

Amex has a lot of links that aren’t found directly on their website. Links can be found via Google or even via their affiliates. It also doesn’t matter if it is an “exposed” link. If it is available to the public without the public having to manipulate anything then it is a public offer. That aside, I agree that they can enforce their terms, however applying through a public link that they don’t want you to use is not a violation of their terms. It absolutely and simply is not. As I said, I will comply with all of their terms, but they are proactively punishing customers who used a link that was public.

Some advice — My husband’s account was frozen last May as part of that entire deblace with the leaked Amex Platinum sign up offer. But it didn’t take a couple of weeks to unfreeze his account. It actually took 2 months. I would advise to let Amex do what they need to do. Once we realized it was frozen, we called in a single time were told that his account was under review. He never did nor does any MSing. Once they informed us it would take 6-8 weeks, since he’d already completed (and went over) the spend required for the bonus, he just put the card in the sock drawer and we waited. We didn’t call back, didn’t go the CFPB route. Nothing. We just let it run its course. After 8 weeks his account was unfrozen and he was able to transfer out MR points. This all happened back in July.

When I read the title of this post (“[m]y Membership Rewards Account is FROZEN!”), I thought that Amex froze your MR account because your wife applied for the 100k Amex, and they somehow associated the two accounts. You should really correct the title. Your wife’s MR account is frozen, not yours. Please don’t unnecessarily frighten your readers—especially those of us who did the 100k Amex last year and just recently applied for a spouse.

Such freezes, it seems to me, devalue a customer benefit and should require future compensation. Look, the only Amex accounts I ever opened were Serve and such-like, eventually shutdown after Amex identified them as a key liquidation link in a vast, multi-billion dollar, narcotics-sourced international money laundering conspiracy, mainly routed through the purchase of $200 gift cards. So we already know Amex thinks we will believe any campfire story they want to tell us.

LMMFAO!!!

My wife and I applied for the Mercedes Benz 75k Platinum offer back in May. Both of our accounts are still frozen to this day. It will be 6 months soon. I decided to simply wait it out until the new year. I doubt that the ban will go away on its own at this point. It only affects transfers by the way. It is still possible to redeem points at McDonald’s or use them at Amazon for payment.

File a CFPB complaint – they should respond in a few days and unfreeze them….6 months is insane.

Maybe this was their “big announcement” they were supposed to make to compete with the Sapphire Reserve.

I applied through a targeted offer in August, met the spend and had the points post by September, and have had them frozen since then. I’ve started the mediation process and filed a cfpb complaint, but this is getting ridiculous. 100% organic spend. Amex sucks.

Joseph, is your CFPB complaint public?

I’ll be complaining to top CFPB, FTC officials and the media regarding Amex’s Unfair, Deceptive & Abusive Acts & Practices.

I am the “miles and points-er” in the family. I’ve got well over 30 cards and churn on a semi-regular basis. I’ve got 5 Amex cards right now. My husband uses one Plat Amex for practically everything and he’s had it for years so, no recent application link or anything that could be considered odd. He (I) received the exact same message when I tried to do a 51,000 MR transfer into an airline account the other day. At first I thought it might be related to the 2x shop small promo because it said verify purchases. He did buy ONE 500.00 Amex gift card using the offers link in his account. He (I) chatted Amex and “Alex” said they were reviewing the account and that he would get a notice when the account would be eligible for transfers. “Alex” also asked if the transfer had been to an airline account but didn’t elaborate on why that might make a difference.

I had the issue when there was the 100k offer last time (June or so?), and the points were frozen until 90 days before they were available…

I too applied for my wife who was approved. Didn’t receive the card until last night so there’s been no spend. Haven’t checked to see if the points are frozen but if I had to guess I’ll say they probably are. Not a big deal as I’ll be doing 100% organic spend. In fact we’ll probably wipe it out with a property tax payment. Not a fan of how amex is handling this but I’m also not surprised. We knew what we were getting ourselves into so there’s no victim card here. Just is what it is.

I did read though recently that the $200 credit and gc route was having issues. Have you heard of or experienced similar problems? THAT could be a bigger buzzkill if it’s not a viable option because I don’t anticipate any opportunities over the next year given the fact we have a newborn and a 2 year old with severe allergies. Just not a good mix right now with travel.