AT&T Access More Caution

Last week I was really excited when learning about Citi’s new AT&T Access More card. While we still don’t know the extent of how good this card is, it has a few standout features that could be very lucrative. Among them are:

- A very nice sign-up bonus in the form of a free phone up to $650.

- 3x ThankYou points on purchases made at online retail and travel websites.

In my post last week I tackled Citi’s definition of online retail and travel websites. We will just have to wait and see how purchases are categorized with this card. Lets just hope that GiftCardMall is an online retail site! 😉

Caution With the Bonus

The one area that I feel needs to be explored more is the sign-up bonus. To be honest I sort of glossed over it last week in my excitement for this card, but there are some very important things to consider. (Thanks to Ben Turnbull on Twitter for reminding me of this.)

The $95 annual fee is not waived – Since you do have to pay the annual fee the first year, that amount should be subtracted from the value of the sign-up bonus. So lets call the bonus $555 for now.

Now lets look at the terms of the bonus:

Only phones (smartphones or basic/feature phones) purchased from AT&T at full retail price (no annual contract) through the link provided are eligible. You must activate the phone with qualifying AT&T postpaid wireless service (including voice and data as applicable) and keep the phone, and remain active and in good-standing, for at least 15 days.

15 Days of Service

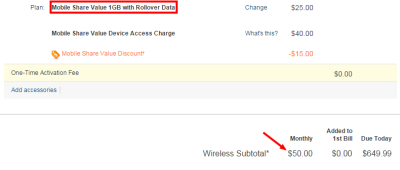

So you must activate voice and data service for at least 15 days. The cheapest plan I could find for this was the mobile share value 1GB with rollover data that is $50 per month. If you keep the service for 15 days it will cost you the full $50.

Why? I dug into AT&T’s terms section 5.1 and found this: “Final month’s charges are not prorated.” This means that you will be required to pay for the full month of service. Also remember that you will be paying the sales tax on the phone, since that is not reimbursed by the sign-up bonus.

What Does Postpaid Mean

For me, the key word in the terms of the card offer is postpaid. While no contract is required for the phone, you still need a postpaid account. That is important for one key reason. Postpaid accounts require a credit check.

So basically if you aren’t a current AT&T customer, you most likely will incur two hard credit inquiries to get this card and take full advantage of the bonus. That is a tough pill to swallow.

Actual Value of Bonus

So in exchange for two credit checks you will get up to a $650 phone for the cost of:

- $95 annual fee.

- $50 in service.

- $52 in sales tax (varies by state.)

This brings the net value of the bonus to $453 or just $226.50 per credit check. Yikes! (You may argue that sales tax is paid with or without the bonus, so feel free to leave it out of your calculations.)

Who Is This Good For

There are a couple of scenarios I can see where this will be good for people. First off, current AT&T customers are going to make out with this deal. At some point you are going to want a new phone and by getting this card you will be able to realize a significant discount and avoid the double credit check.

Second, this card actually may be worth the double inquiry if the online category bonuses work out to be as lucrative as they sound. I am skeptical that this will be the case, but we will just have to wait and see. If you can earn 3x on a variety of online purchases, this may be a card worth having even without the sign-up bonus.

Update: Doctor of Credit seems to agree about the double hard inquiry. He also has information from his AT&T contact about how this offer works for existing customers.

Conclusion

This card really looked amazing when it was announced. It still has the potential to be amazing, but that postpaid requirement and the hard inquiry it brings really kills a lot of the overall value here. Hopefully the bonus categories will make up for it, but we will just have to wait and see.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

[…] the AT&T Access More card. One of those products that just seems to good to be true. 3X ThankYou points on all online […]

[…] of the cool things about the AT&T Access More card is that it comes with a free phone up to $650. The main reason I haven’t picked up this […]

[…] iPhone 6 or 6s and use it. There are definitely some drawbacks to this card, so take a look at my detailed review before going that […]

I was considering this phone, but, as a T-Mobile customer, it’s not such a great deal and it’s a hassle. Also buried in the ATT site is that you need to be a customer in good standing for 60 days in order for them to unlock your new phone. So, another $50 monthly fee on top of the above costs. And there is a $40 “activation fee”. It’s a good deal for current and continuing ATT customers though.

Which CRA does AT&T pull though?

Could the phone just be use as replacement to a current phone you have with ATT?

Yes and then you wouldn’t need an AT&T credit check.