Banana Republic Visa 5X Offer

Back in December I shared the details of my latest round of credit card applications. This round of applications wasn’t quite cookie cutter. Among the cards I applied for were the NBA Amex for the potential of 5X everywhere on certain days (including this weekend!) and the Banana Republic Visa card.

The Banana Republic Visa was a bit of a gamble, only because it didn’t come with any sort of a sign-up bonus. (Well, that I knew of.) My reasoning for applying was simple. I hoped that some time in the future I would get some of the lucrative spending offers I had seen friends get. Think 5X everywhere or even 10X in certain categories!

My First Offer

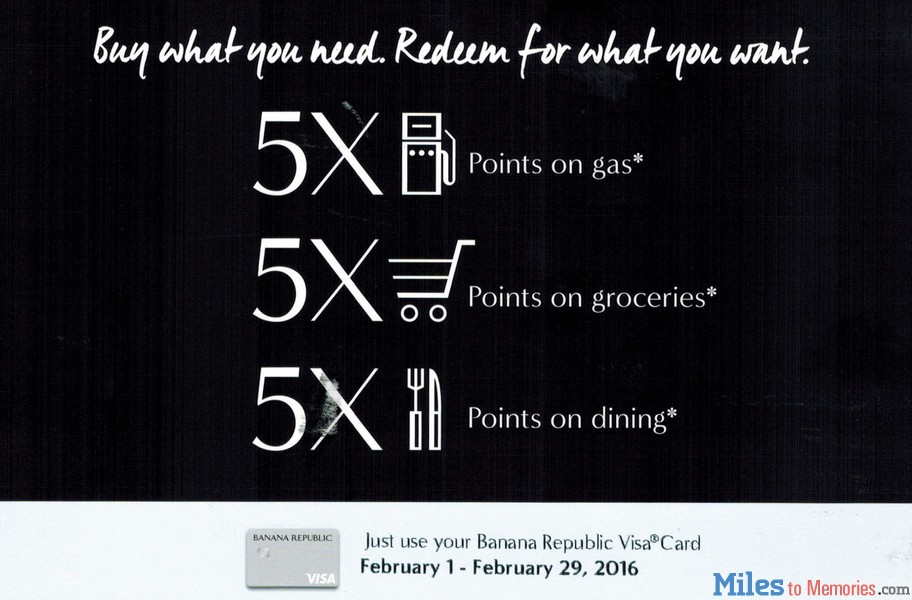

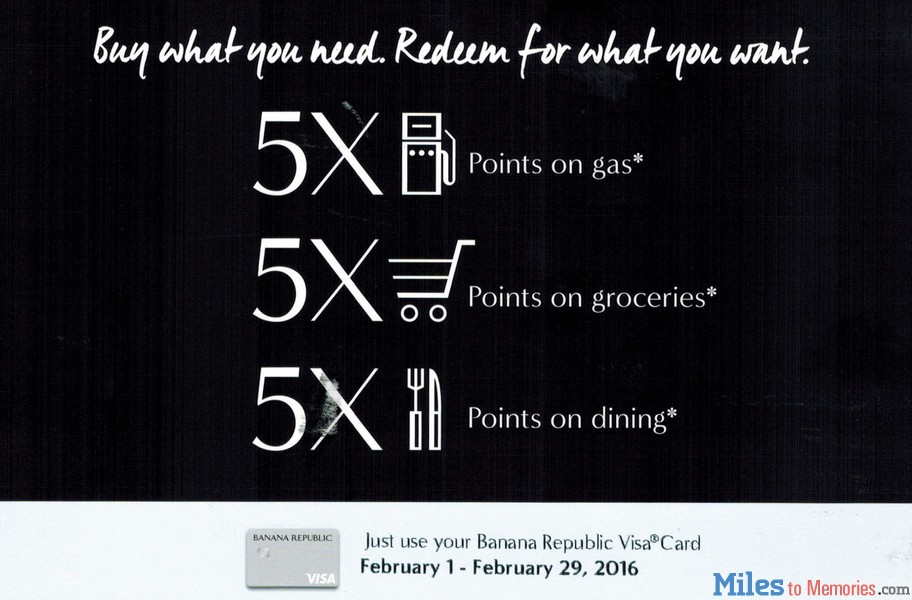

After getting my card in the mail, I only used it for a single $1.08 purchase and then put it in the sock drawer. I wanted it to earn a place in my wallet and it has! Monday, I received the following postcard in the mail:

My Thoughts

I am a little frustrated that this just came in the mail on Monday, considering I lost a whole week of using this card in the bonus categories. With that said, I think this offer is great, especially considering there is no cap to be found and these categories present a lot of opportunity. At the very least I will probably earn their Luxe status which should earn me a 20% points bonus in the future.

How Rewards Work

With this card every 500 points earned generate a $5 certificate that can be used at Banana Republic or other Gap brands. Normally it would take $500 in purchases to reach that level, but with this offer it only would take $100 in spending. Another way to look at it is that a $500 purchase a grocery store (maybe gift cards, maybe something else) would generate $25 in credits. That is pretty good.

Conclusion

I am really happy to have this offer and hope it is the first of many to come on this card. As of Monday, the Banana Republic Visa started its February long run in wallet slot #2 so I can pull it out when shopping for groceries and dining.

I know others received different offers for February. Do you have this card? What offer did you receive?

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

typo, like = link

I used your like to apply for the visa card and I got the Store charge card instead.

Great offer! I’m curious, does this application work with that shopping cart trick? I’m being stingy with the hits on my credit.

But you did mention you’d rather have 80%+ off than 20+% off, so if you were able to breakeven selling the Gap gift cards on Raise or other exchanges, than you could generate free store credit AND gas. That’s almost 100% discount on clothing!

The points can only be used at the Gap Brand stores, so you probably won’t want to put too much spending on the card unless you shop there a lot. Also, you said that every $100 generates 500 points or $5 store credit. Safeway and other supermarkets have been selling Gap Brand gift cards at 20% discount. So your $5 credit is really only worth $4. But consider this – if you buy Gap Brand gift card with any of these cards – AMEX Blue Cash Preferred, Everyday Preferred, your BN card, you can triple dip.

Example : buy $500 Gap gift card with your BN credit card, you pay $400 out of pocket . You earn 2000 points which is the equivalent of $20 store credit. You also earn 1000 gas points good for $1/gallon discount on gas up to 25 gallons. If you fill up your car (or two) to the max, you save $25 in gas. So you’re paying $400 for $520 worth of clothing and $25 worth of free gas. Not bad!

Or if you paid with a 6% cashback card, you’ll get $24 cashback. That’s $376 for $500 gift card and $25 free gas. Then you take that $24 cashback to buy $29 worth of Gap gift card. So you are better off paying with the AMEX Blue Cash Preferred than with the BN credit card.

Wife has had this card for about 9 years. It has come with some very lucrative offers over the years, but the best was last fall of 2 months of unlimited 10x at grocery, gas & dining. Now I have a pipeline of $250 certificates coming in for the foreseeable future. The only problem is spending them on something decent. Old Navy is good for kids’ clothes. I find BR’s clothes to generally be overpriced (even after stacking sale prices and discount codes) and poor quality. At 92% off can’t complain too much though.

I’ve long been a Luxe member. When I log into my account, it shows that they sent me the Visa card over two years ago, but I never received it.

Regardless, I do plan to put in a formal application for the card. I could spend my paycheck in one shopping trip.

Glad you got such a great offer! Fingers crossed we’ll all have similar luck.

If it shows you’re a card holder, why not just contact them and ask for a replacement?

Got the Banana visa card last April. Never ever got a single promotion like this.

Does the * after each one mean anything important?

I’m glad your happy about it. I still don’t get it. It seems like your getting 5% cash back at a retailer which has huge markups on clothes anyway. I guess if you love Banana Republic it’s a good deal.

You can use the rewards at Gap, Old Navy and Athletica too. Stack them with a sale and coupons for four great savings.

I got 100 points for every day in Feb I use the card anywhere – in store or out. 2900 pts is worth a tiny Amazon gc every day. 😉

Amazon gift card? Is there any way these points can be redeemed for anything other than merchandise from Gap brands?

No they are only good at the Gap brands which works for my family.

It is good at all Gap brands and can be stacked with coupons, etc as Dee mentioned. This works for my family and amounts to an 80%+ discount on clothes. So you are right that it may not be the full 5% value as if it were cash, but it is pretty close in our circumstances. I will also make sure not to go overboard so all of the credit earned is used.

I tend to agree with DaninMCI… there are better alternatives

gas bonus – 5% UR quarterly bonus with Chase Freedom or 10% (5% doubled) with Discover IT – both are far more valuable

grocery bonus – 6% with AmEX BCE or up to 4.5% Everyday Rewards

dining bonus – the one category that is better, 5% is better than CSP or Citi Premier/Prestige

However, I find it quite easy to purchase GAP/Old Navy/BR GCs at a hefty discount (20% using Discover Rewards comes to mind), so this deal isn’t as good as it sounds.

All of those deals are highly limited spend wise. I can maximize those deals and this one too. Yes you can purchase Gap gift cards for about 20% off. This deal gives me 80% off though.

I’m not sure if I follow your math comparing something like Discover Rewards to this deal. We are talking strictly about redemption value….

You are redeeming points earned from spending in specific categories, at a 100 points = $1 GC redemption rate. No discount.

With Discover Rewards, it’s $20 Discover Cash Back = $25 GC redemption rate. 20% discount.

How those points were earned are calculate separately. Those other avenues of earning give you the same or better cash value for the money spent.

Dining is the only category where this deal has an advantage, but that’s such a limited spend category.

What typically happens is you will receive the email about a week or so after the postcard. I know, it’s frustrating that they don’t just send an email on the first of the month. I got a kind of complicated offer for February that I don’t remember off the top of my head, but I have made out like a bandit lately with this cars. In August, October, November, and December I got 5x on ALL purchases. Needless to say, I hit it hard and did some nice “free” holiday shopping with several hundred reward dollars left over. In January I got make any two purchases outside their brands, receive a $20 reward.

It seems to me like if you keep using the offers, they keep sending more. I have had the card for almost three years and would receive an offer once or twice a year, but these last six months have been wonderful.

I applied several months ago for the VISA card that can be used anywhere but they only approved me for the card that can be used in store. They never mention that you might not get the one you apply for and they never told me that they only approved me for the lower one, just sent it in the mail. Boo.

Hey Shawn, I hope we get a little primer tomorrow so we get ready for the NBA weekend? Can you share some of your plans?

Nice Man! Happy you got that!

I wonder if there is/was any way for you to find out about the offer, other than waiting for the postcard. I supposed you could call in and ask (or maybe they have secure mail or chat?), but how would you know to do so (other than reports of other people getting offers). Would be nice if they would email the offer, or at least show the offer in your online account. Have you checked to see if it shows up in your online account?

Enjoy your 5x. I assume the BR card will get a bit of a break from slot #2 during the NBA all-star break?

It doesn’t show in my account, but I do know others receive similar offers via email. I have checked and my email is opted in for special offer so I don’t know.