Bank of America Credit Card Application Strategies

Back in December I wrote about my latest credit card application round where my wife and I picked up 12 credit cards from 7 different banks. While I don’t generally apply for cards in huge waves like that, it had been awhile so it made sense at the time.

One of the banks both my wife and I applied at was Bank of America. They are very generous with their Alaska Airlines credit cards and we were both able to get some valuable miles plus a $100 statement credit. (I was only awarded 5,000 miles because I was approved for a low credit line, while my wife was approved for the full 25,000 miles.)

At the time I had just read an interesting fact about Bank of America. They are one of the few banks who merge inquiries. This means if you apply for more than one Bank of America credit card in the same day, they only run your credit once. This presents a unique opportunity to stretch more value from that hard inquiry.

So after applying for our Alaska Airlines cards, I immediately applied for a BankAmericard Cash Rewards card with a $175 bonus after $500 in spend. (Thankfully I didn’t mess up and switch our social security numbers.) You can find out more info about the special version of the card we applied for in my original post.

By applying for the second card, we received another bonus for the same credit inquiry. But the fun didn’t stop there. Bank of America offers a 10% bonus when you redeem cash rewards from the card to a Bank of America checking account. So my $175 bonus was really $192.50!

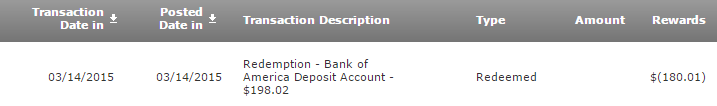

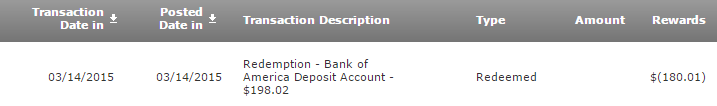

I just recently was able to make this transfer and the bonus posted immediately. My rewards balance was $180.01 since I earned $5 cash back for my $500 minimum spend. After transferring it to my checking account, it turned into $198.02.

Conclusion

When applying for a Bank of America credit card, it may be a good strategy to try to go for two cards in the same day to stretch more value out of the hard inquiry. Of course this depends on a variety of factors, so it is not going to be a good strategy for everyone.

For us though it turned out pretty good. My wife walked away with 25,000 Alaska Airlines miles plus $292.50, and while I only got 5,000 miles, the $292.50 in cash made me feel a little better about the whole thing.

Have you ever done something similar? Let me know in the comments!

| Miles to Memories operates under the Value for Value model. If you receive value from this site, find out how you can provide value back. |

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Shawn,

Don’t you live in Ann Arbor, MI? What good are Alaska miles to you (unless you can book AA flights with those miles?

I live in Las Vegas actually. From here they fly to Portland, Seattle, Salt Lake City & Anchorage. My main use for them will probably be to book on Emirates though. Don’t forget Alaska has a ton of partners.

You live in Vegas, wow…now, I’m really jealous (mostly for the weather)…sick of the cold here in the Midwest

BoA has 3 more tiers on top of that first 10% tier: 25%, 50%, 75%. E.g., to get to 25%, one needs to have over $20K deposited with them via checking/savings/investment account(s). Moreover, those three tiers have rewards ($200-$600) that can be applied against mortgage origination/refinancing fees.

I don’t think the 25%/50%/75% rewards apply to sign up bonuses, only on base points earned (depending on the card).

The redemption bonuses on the Cash Rewards card do apply to the sign-up bonus as well.

In my first month with the card I earned $16.00 in cash rewards on $1600 in spending. I also earned 8.32 in bonus cash rewards for grocery (2x) and fuel spending (3x). I also earned $100 for meeting the initial $500 spend requirement.

BANKAMERICARD CASH REWARDS

16.00 BASE EARNED THIS MONTH

108.32 BONUS THIS MONTH

.00 REDEEMED THIS MONTH

124.32 TOTAL AVAILABLE

I’m a Platinum customer and I have my rewards transferred to a qualified MerrillEdge account automatically each month. The amount posted in the target account was 1.5 x 124.32 = $186.48

I value the 30 free trades a month at about $420/yr (I don’t trade that often).

At 1.5% net cash back on everything (plus 3% on groceries & 4.5% on gas), I have a hard time justifying using any other card.

I’ll be easier for you if you recall that your 3% and 4.5% Cash Rewards are limited to $1500 of spending per quarter, and you need to tie up a sizable amount of cash with BoA instead of letting it earn a higher interest elsewhere.