Bank of America Statement Credit Towards Payment

In the credit card game it is the little things that can kill you. Even if you know what you are doing and know the rules, you are going to make mistakes. Recently I made a stupid mistake, even though I theoretically knew better. For teaching purposes (and to shame myself) I thought I would share my tale of woe to help you my readers avoid the same situation.

The Better Alaska Airlines Offer

A couple of months ago I signed up for the Alaska Airlines Visa Signature 30K + $100 statement credit offer. Since I signed up for this card along with a few others, it took me a few weeks before I began working towards the very modest $1K spend on the card. Before I had been able to spend anything, the first statement had printed with the $75 annual fee as the balance.

Then, I picked up the card rather quickly after the statement printed (disappointed that I hadn’t done it sooner) and spent my $1K to both trigger the 30K bonus and also the $100 statement credit.

So let’s step back for a second and look at the series of events in order so I can highlight my mistake:

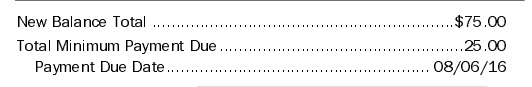

- 7/9/16: The statement prints with a $75 balance, a minimum payment of $25 and a due date of 8/6/16.

- 7/25/16: $100 statement credit is issued after I hit the $1K spending.

- 8/6/16: $25 is due at the minimum, $75 at the maximum. I briefly look at the account and see the $100 debit and quickly think it is paid.

- 8/6/16: Since no payment is made on the account I am charged a late payment fee of $25.

- 8/8/16: I notice the late payment charge and pay the entire $75 balance.

So was Bank of America correct in charging me the late fee? Drum roll………………………………

YES! Almost all banks have it written into their terms that statement credits apply as additional payments and not as minimum payments on the account. Since I had an additional balance from that $1K spending I did in the next statement period, I was supposed to pay my $75. I knew that, I really did, but in a quick glance didn’t put two and two together. Sigh.

How to Fix It

The first thing you should do when you notice your account is past due is PAY IT! No matter if you feel you are wrong or the bank is, there is no benefit in letting the account sit past due. In this case the entire balance was $75 so I paid it, but if the balance was higher you could pay the minimum payment until the dispute was settled. Either way, there is no reason to leave the account in past due status. That just undermines your conversation with the bank.

A Happy Ending

About a week after I paid the account off (including the late fee and extra $1K in purchases), I decided to hop on chat with Bank of America and explain my error. I explained that I saw the $75 amount due along with the $100 credit and somehow interpreted that to mean the payment was made. Without hesitation the agent waived the late fee.

Over the course of the past decade or so, I have been late (and by late I mean by a day or a couple at most) a few times by mistake and the banks have always waived the fees for me. When you pay your bills on time and are a good customer they will almost always do it. They usually will reverse interest charges as well. Either contact them via secure message or chat to ask. Of course, do this too often and you not only will pay the fees, but will likely not be approved for new cards either.

Conclusion

This experience just reinforces what I already know. First, I will make mistakes and second it isn’t the end of the world when I do it. While it may seem counter-intuitive that statement credits don’t count as payments, I do understand why that rule exists in the scheme of things. Hopefully my lapse in judgement can help some of you.

Are there any obscure rules/policies you have run across that you care to share? Let us know in the comments!

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I once applied my amex blue cash preferred as statement credit after the billing period ended and thought it would apply to payment but it didn’t. It only applied to future charges.

That’s still better than Citi’s auto pay not applying payments

First thing I do with my new cards is set up autopay for minimum due, occasionally this leads to me having a negative balance(Credit) balance because I inadvertently pay the entire balance + min due, but it is better than not having peace of mind.

I generally do this as well, but not with BofA for some reason. It is always a good idea to at least have the minimum payment taken out to save yourself late fees and hassle. Good advice!

First, when I take out a new credit card I immediately sign up for an auto-pay in full on the due date with the bank act. that I want it debited from which generally goes into effect by the time of the first statement. FYI, the only credit card company that I was required to submit a fax with info., not one but three time and it took 9 months, was BBVA Amex so I just did not use there card until it was set up….their loss after I met promo and made their one time pmt @ website. They did not seem to care!!!!

Second, I use quicken software financial program. It is unexpensive, easy and allows you to download most banks, from setup including all entries/activity, credit card companies, investment companies business you deal with. I have it AUTOMATICALLY record my credit card pmts in bank of choice for auto pay. Most importantly, I set reminders for due date of promos, requirements for promos, etc. for everything I need to remember and it will pop up on that day or however days I want it to in advance. If I’ve not gotten my promo when it was due, then I know to call them. In your case your auto-pay would have taken care of the above and avoided the late fee which may be reported to credit bureau(s). Can’t say enough about Quicken. Have used it for 30 years and could not live without it with all of my bank acts, credit card acts and investment acts. Does much, much more than I detailed, but I know you like Capital One. Keep up with all the good research to us. We appreciate you so much.

Yes auto pay is the way to go. I generally set it up on all of my accounts and this is a good lesson as to why I need to be more thorough.

Do they usually report it to the credit bureaus as a late payment?

no. it usually needs to be past due more than 30 days.

No only payments in excess of 30 days are ever reported to the credit bureaus. With that said, multiple late payments can cause problems with a bank and in many cases can cause them to jack up interest rates. Not a good thing to do.

Thanks for the heads up. I always wondered about these types of situations.