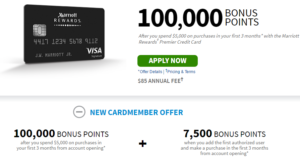

100K Bonus Points With Chase Marriott

A few days ago I wrote about this targeted 100K offer for Marriott Rewards® Premier credit card. Now the offer is public and available to everyone.

The Offer

- Receive 100,000 bonus points after you spend $5,000 on purchases in your first 3 months from your account opening with your Marriott Rewards Premier credit card.

- Receive 7,500 bonus points when you add the first authorized user and make a purchase in the first 3 months

Unlike the targeted offer, this public offer doesn’t have an expiration date, but if interested you should apply sooner than later.

Card Details

- Earn 5 points per $1 spent at participating Marriott Rewards & SPG hotels

- Earn 2 points per $1 on airline tickets, car rental agencies and restaurants

- Receive a one-night stay every year at a Category 1-5 after account anniversary

- $0 foreign transaction fees

- $85 Annual Fee (not waived)

As always, “This bonus offer is available to you if you do not have this card and have not received a new cardmember bonus for this card in the past 24 months.”

Elite Status Benefit

With this card you receive 15 credits toward your next Elite membership level after account approval and every year after account anniversary. You also earn 1 Elite credit for every $3,000 spent on purchases.

Should You Apply?

The usual public offer for this card gives you an 80,000 points bonus after you make purchases totaling $3,000 or more during the first 3 months. That means that with this offer you’re spending $2,000 more to get the extra 20,000 points. This is definitely better.

But keep in mind that you can also earn Marriott points with an Amex SPG card that has a 35,000 bonus offer. That would convert to 105,000 Marriot points, just slightly less than the 107,500 that you would get through this offer. But most likely a bit more in total since you’d earn 1 SPG/3 Marriot points per dollar on that $5,000 spend requirement.

Ask to Be Matched If You Applied For a Worse Offer

Chase is pretty good at matching higher bonuses, if you’ve applied within the last 90 days. It’s almost guaranteed if the bonus is public, such as this one. You can send them a secured message through your account and you’ll be required to complete the $2,000 of extra spend in order to get the extra 20,000 Marriott points.

Conclusion

This is a good bonus, but the card also falls under the 5/24 rule. If that’s an issue, but you still want your Marriott points, you should take a look at the business version of the card that’s offering an 80K bonus.

There’s a possibility that you could get the bonus if you apply with link provided above, but keep in mind that the offer is targeted and sent by email to some. I wouldn’t risk it, unless you see some positive data points.

HT: r/churning

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

[…] Public Offer, Get 100K Bonus Points With Chase Marriott Rewards Premier Credit Card […]

I would disagree with this argument:

“The usual public offer for this card gives you an 80,000 points bonus after you make purchases totaling $3,000 or more during the first 3 months. That means that with this offer you’re spending $2,000 more to get the extra 20,000 points. This is definitely better.”

You must spend 66.7% more money in order to receive 25% more points than the regular offer gives. How is this better?

I think you should be looking at the extra spend and extra points that you get, and compare it with other Marriott earning opportunities. Not as a percentage rate compared to the first 80K.

Can you get the reward a second time?

This bonus offer is available to you if you do not have this card and have not received a new cardmember bonus for this card in the past 24 months.