| Miles to Memories does not have a direct relationship with the card issuing bank(s) and this post does not include any affiliate links. If you wish to support the site by applying for credit cards or using other referral links, you can do so here. Before applying I highly suggest reading the following posts: Slow & Steady Doesn't Make You A Loser and A Mandatory Waiting Period to Apply for Credit Cards?. You can find all of our credit card reviews here. |

A New AAdvantage Executive Offer

As many of you know, the Citi AAdvantage Executive card became popular last year because of a very generous 100K offer that also came with a $200 statement credit. It was like getting 100,000 miles for $250 plus Admiral’s Club access for a year. What a great deal!

Then people figured out you could get the card more than once and some even learned how to avoid the annual fee altogether. Some people got upwards of 10 or more cards, while I personally got 4. It was definitely a great deal and my AAdvantage balance is fat because of it.

Eventually that 100K offer went away and a 75K offer replaced it. Then the 75K offer was gone, but you could still get a 50K offer. For many people it was still worth it, especially considering this card could be churned over and over. Then Citi came out with their new churning rules and the card has sort of dropped off the radar until today.

The Increased Offer

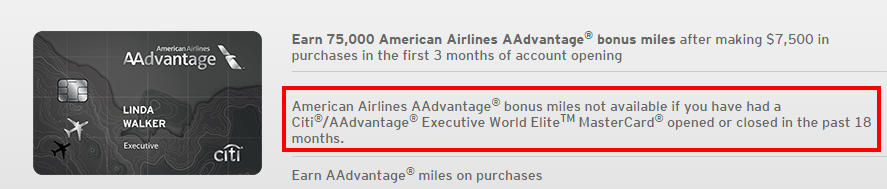

Citi has increased the offer on the AAdvantage Executive card from 50,000 miles to 75,000 miles after spending $7,500 in the first three months. The $450 annual fee is not waived the first year. Among the card’s benefits are:

- Admiral’s Club membership (Entry for you and 2 guest or your immediate family.)

- $100 TSA Precheck or Global Entry credit every 5 years

- 10,000 Elite Qualifying Miles for spending $40,000

- No foreign transaction fee

- First checked bag free

Why You Probably Don’t Care

Unlike last year’s versions of this offer, the application for this card now reads, “American Airlines AAdvantage® bonus miles not available if you have had a Citi®/AAdvantage® Executive World EliteTM MasterCard® opened or closed in the past 18 months.” This means that anyone who has opened or closed one of these cards in the past year isn’t eligible. That is probably most of you old timers.

For those who are new to the hobby, this card might be worthwhile if you value Admiral’s Club membership or are looking for a nice chunk of miles. There is no statement credit like with previous versions, so you are on the hook for the hefty $450 annual fee.

Conclusion

It is nice to see a great offer return on a card that has given me so much, but unfortunately I am not able to take advantage. While I have fond memories of my multiple 100K bonuses with this card, that isn’t the world we live in anymore. My relationship with the Executive AAdvantage card is one that best belongs in the past!

HT: The Points Guy

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I got a 100k version 18 months ago. It’s still open, due to a nice retention bonus, among other things. Do you think I could try for this as well, since I’ve neither opened nor closed one in the last 18 months? Just finished an AOR on Friday (Hyatt card still doesn’t show on my cards, so no luck there, btw), so could do one as soon as next week.

[…] at $450. There’s another difference in this offer and some that have existed previously as Miles to Memories pointed out […]