Citi ThankYou Premier Card, 50K Bonus is Back Again

The Citi ThankYou Premier 50K bonus is back again. We have seen a 50,000 bonus occasionally in the past, but if you have yet to apply for it, now is your chance.

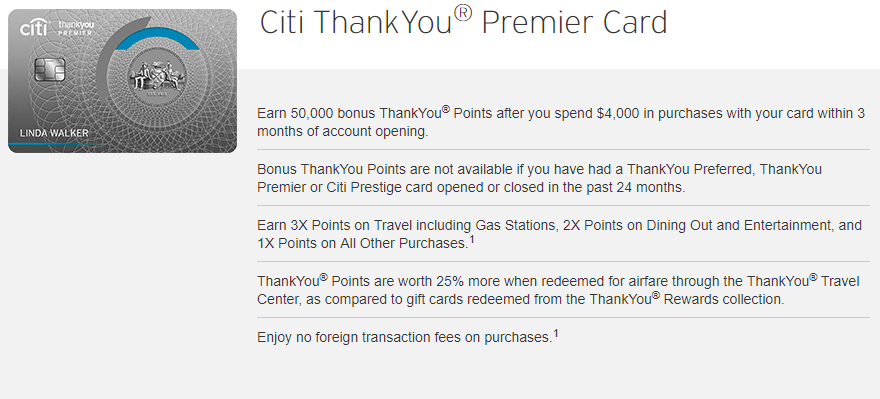

The Offer

Earn 50,000 bonus points after making $4,000 in purchases with your card within the first 3 months of account opening.

Annual Fee $95 (Fee waived for the first 12 months)

Citi ThankYou Premier Earning Structure

The Citi Premier earns points at the following rates:

- 3X ThankYou points on Travel including Gas Stations

- 2X ThankYou points on Dining Out and Entertainment

- 1X ThankYou points on All Other Purchases

You can check out our Citi ThankYou Premier Credit Card Review for more info.

Need to Know

- The bonus is not available if you have opened or closed a ThankYou Premier, ThankYou Preferred or Prestige card within the past 24 months.

- If you don’t have a Prestige, this is a good card to get to open up points transfers for ThankYou points earned with other cards such as the AT&T Access More.

Analysis

When deciding whether or not to apply for Citi products, it can be tough because of their restrictions on getting the bonus. The bonus had been just 30,000 points online, so this offer is significantly better. We do see this offer somewhat often. If you recently applied for a lesser offer, you can try asking to be matched to this new offer.

If you’re in the market for a ThankYou card and didn’t need any of the benefits of the Prestige, you should probably apply since there is no guarantee that we will see anything better soon. It’s easier now that the offer is available online, and we do not know how long it will last.

Conclusion

This is another opportunity to get this card if you missed out previously. It has decent earning rates at 3X on travel and 2X on dining. This is a great bonus which is probably the highest we will see, and much better than the normal 30K bonus.

HT: Doctor of Credit

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Can you manufacture spend to reach the $4K?

I haven’t heard of Citi denying bonuses because of MS but there are always risks involved when you MS so I would mix in regular spend too.

ECHO…Echo…echo…

DDG?

I also would like to know if you could get a second one.

Sorry for the late response but see above.

Can you get a second one if you have one open?

In the past Citi has given out second cards when you still had one. I know people have done this and then downgraded their original one after approval so they wouldn’t restart the 24 month clock. The Citi Reserve was one people did this on in the past. So I would say yes but YMMV.