The other day I posted about my first experience with Discover’s Apple Pay promotion. To participate in the promotion I purchased an iPhone 6 and was able to successfully use it to buy a couple of items at Staples. According to the terms, I should earn 10% back from Discover on my purchase. I also have the double cashback promotion on my account, so I should also earn another 10% at the end of the year.

In the comments of my post from the other day, several people are having a very heated debate about the safety of purchasing gift cards. Discover has added language that excludes gift cards from earning the 10%, however it remains to be seen how this will be enforced. I have a lot of respect for commenters on both sides of the argument, so I thought I would share my opinions.

To start, here are some of the concerns people seem to have:

- Discover will somehow find out you purchased gift cards.

- Discover will make you show them receipts in order to get the 10%.

- Discover will investigate and shut down your account(s).

- Discover will decide to nullify rewards you have already earned and/or decide not to pay anytime during the next year.

- Discover already changed the terms once to add the gift card exclusion and will do it again.

Discussing the Pitfalls

Lets analyze each of those five points in a little more detail.

Discover will somehow find out you purchased gift cards.

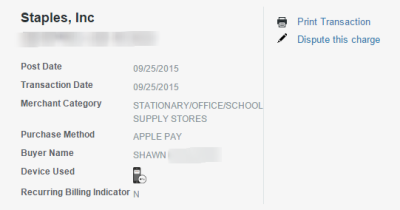

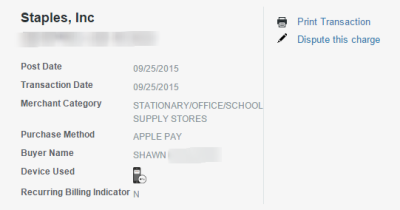

First off, in order for Discover to see what you have purchased, they need to be provided with level 3 data. My Staples purchase from the other day has now posted and this is what it looks like.

This doesn’t guarantee that Discover hasn’t received level 3 data, but it doesn’t look like they have anything other than the purchase amount, etc. In this case it wasn’t gift cards, but I don’t believe a gift card purchase would show any differently. Discover could of course analyze purchase amounts and investigate ones that look like gift card purchases, but I have not ever heard of any bank doing it on a wide scale.

Discover will make you show them receipts in order to get the 10%.

This is the second argument made and one that I don’t necessarily agree with. One commenter mentions that Chase has asked holders of their Ritz Carlton credit card to send receipts proving airline incidental charges qualified for a credit. This did apparently happen, but I think that is comparing apples to oranges. Is Discover going to ask you for every receipt for every purchase? I don’t think so. Could it happen? Anything could happen.

Discover will investigate and shut down your account(s).

The way this goes is Discover finds out you purchased a whole bunch of gift cards, investigates and then decides to shut down your account. Of course any bank can end the relationship at any time, but I highly doubt this will happen unless you do an insane amount of spending. Remember the gift card exclusion only pertains to the 10% cashback. Discover has no rule against purchasing gift cards normally as far as I know.

If you hang around this community long enough you will meet people who have been shut down by just about every bank. If you go too hard and draw attention to yourself, then perhaps you are asking for it. This 10% promotion is capped at $10K in spend, which is only $3,333 per month. That is far from a ton of spending.

Discover will decide to nullify rewards you have already earned and/or decide not to pay anytime during the next year.

I am not a lawyer, but I want to be clear about what I believe to be true. (Personal opinion) Discover cannot advertise something and then decide it isn’t valid. In other words, they can’t say you will get 10% back and then just not give it to you. They do of course have good lawyers and reserve the right to change a promotion, but they can’t go back retroactively and do that. (Once again I am not a lawyer and thus this is personal opinion only.)

So the argument comes back to whether they can prove you purchased gift cards or whether they can make you provide receipts. I simply don’t believe those things will happen, but who knows. The one thing I do believe is that they cannot change the terms for legitimate purchases and those would have to be paid out. I also don’t think you are doing anything wrong by purchasing gift cards normally. It is up to Discover to enforce their terms and make sure you don’t earn the bonus rewards on gift cards.

Discover already changed the terms once to add the gift card exclusion and will do it again.

Update: Richard has said in the comments that the exclusion was added a day or two after the launch.

I actually don’t think this is true. Discover announced the promotion through a press release, but I believe the gift card exclusion existed within Apple Pay from the first day Discover was added. Could Discover have decided to add the exclusion because of all of the attention? Yes that is entirely possible. What is also possible is that the exclusion was always going to be there, but just wasn’t mentioned in the press release.

Will Discover decide to change the promotion again and add more exclusions? Possibly, but that happens all of the time. That is why it is always advantageous to take advantage of deals when they are first rolled out. Companies often learn the hard way when promotions are too generous and try to change them to stop the fire.

Is It Safe to Purchase Gift Cards?

First off, I would never tell you it is safe or not safe. I truly don’t know and everyone’s threshold for risk is different. With that said, there are a lot of stores that take Apple Pay. You may not need to purchase gift cards if you don’t want. Many grocery stores take Apple Pay, so you could use your Discover card for 20% off groceries. The holidays are coming up as well. I am sure a lot of people will have thousands in actual spending and 20% off is good.

I haven’t decided if I will purchase gift cards or not, however I don’t believe Discover will be cracking down on the average person. There simply isn’t a huge precedent for it on a wide scale, but of course anything is possible. Remember though that Discover has already limited their losses per account with the $10K spending limit and as I said above, I don’t believe Discover excludes gift cards in their general card terms. The worst they could do is just not give you or take away the bonus.

Alternatives to Gift Cards

If you don’t have a lot of spend to do, a great alternative is reselling. That is of course not excluded and Staples has a great price match guarantee. When you are starting with a 20% advantage, many deals suddenly start to look good. Even if you break even on the retail price that you paid, you get to keep the 20% cashback and store rewards. That actually beats purchasing Visa gift cards, since you don’t have any fees. There are a ton of stores other than Staples with plenty of opportunities as well.

Conclusion

I hadn’t actually planned to write a post like this, but 57 comments in the other post motivated me to do it. I’m certainly not worried about maximizing this promotion and have laid out the reasons why. With that said, it is important to weigh all outcomes and make a decision for yourself. If you are worried about Discover cracking down, use this for normal expenses or resell if you want to take advantage. There is a lot of opportunity here and several approaches to maximizing the outcome.

Please share your opinions in the comments.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Do you think the cash back will work on in App purchases? I know it says in store, but there are a few stores that accept apple pay from an App (ie Staples)…

I can confirm that my statement closed yesterday, and I just received the 10% apple pay back for purchases made TWO cycles ago- i.e. not the statement that closed yesterday, but the one prior to that. So it looks like they’re a full month behind in issuing apple pay credit. However, I did receive the full 10% apple pay credit. I didn’t try any gift cards yet though.

Thanks Erica!

What was the largest transaction you made that you received the 10% on?

-does anyone have a link to any discover webpage or a screen shot that actually shows “10%” please?

-when is the 10% cash back supposed to post? each statement or in january, 2016?

thanks!

Discover is no longer promoting the 10% cash back on apple pay on their website or on the apple pay screen

Did anyone receive the 10% for gift cards?

No, but Discover has said it could take up to 2 statement cycles. Everyone is still waiting to see.

My last comment was in response to rick b. I might have responded to Sus by mistake.

I bought a $50 gift card at an eligible store. My statement closed on already for October and I only got the usual 1% on it. Is it because all the Apple Pay promotional stuff will post next year?

I think they have said 6-8 weeks. No one has received their extra 10% as far as I am aware.

[…] How Cautious Should You Be With Discover’s 10% Apple Pay Promotion? – Discussing 5 Worries Naysa… […]

There is nothing wrong with buying gift cards on the Discover card. If they choose to not pay an additional bonus on them, that’s their call. They set a very low limit for the total purchases, so they should be expecting to pay out a lot of $2,200 bonuses as part of their investment to get their card on a lot of Iphones.

I’d be fine if we could still get the cashback for 3rd party gift cards if they exclude the Visa cards. I could still come out pretty good that way.

The t&c don’t say the exclusion is only on Visa (like) gift cards. Third party party gift cards are also excluded.

Yes, I know that.

I am also wondering what will happen to this promo.

I believe Discover will honor this promotion and not go through receipts. They do however discourage the hype around it. Let’s see what happens.

Subscribe.

Selling iPhones seems like a no-brainer. You can buy them two at a time in Apple stores with Apple Pay, they’re selling over list price on eBay, and there’s a current promo that caps your eBay fees on selling phones (though not PayPal fees) at $5/item up to five items. I’m making profit before even taking into account the 22% off.

Now the biggest concern I seem to gather from reading all of these posts is concern of whether or not discover will hold up it’s end of the deal and award the 10% back on ANY ApplePay purchases. Most of the comments I’ve seen so far make me wonder. Haha.

Nice, more measured and restrained post — a welcome change from the “deal of the year” and “crazy” and “insane” characterizations you and greg were using to hawk (ok, draw attention to) the Discover card that obviously butters your bread.

I’m going VERY cautious on this whole thing, waiting to see if this works for you. (in part as I’m loathe to switch to an I-Phone)

Yet I’m also still waiting to see even my Discover card cash back and discover deals cash backs (the first half) even post. I’ve been using the card for about a month now….. and carefully going through the discover portal when it works.

I’ve not yet seen ANY points post. Where am I supposed to see the indications that a given post has tracked? I’m not a novice to portal shopping. With topcashback, chase, southwest, AA, and even ebates portals, I get very quick indications that a purchase has tracked, sometimes same day! But with discover, everything seems sooooo up to chance, to “trusting” them to get it right…. eventually.

Am I doing something wrong? Or is like AMEX, where you have to wait for a statement — sometimes even two months for a transaction points credit to post….

Guess which I prefer? (another reasons for me to be very dubious of the Discover promos…. all sorts)

Well, mine posts pretty quickly….just redeemed >$50 cash last mo. Why not call them & discuss 800-347-2683

I can confirm i received 1% cash back on all the gift cards I purchased. My statement closed on the 25th. I however did not receive the 10%, I made purchases at trader joes as well that were not gift cards and also did not receive the 10%. But I saw the positive as I got my money back for the gift cards. I messaged discover referring to the promotion and they said we will receive the 10% in 4-6 weeks… SO only time will tell I assume.

If I recall correctly, I read a similar thing on Reddit where someone hit the Discover twitter feed with that question. I wouldn’t be alarmed but time will tell.

What I wonder is that if one does $10k legit spending and $5k gift cards, if the $5k is invalid, would the remaining $5k be counted towards the cash back promo?

Time will also likely tell on that front…

follow

Or we could talk about a real risk… All/many/almost all purchases, gift card or not, are getting entered twice by those using Apple Pay at Walgreen’s. It appears to be in Walgreen’s implementation, don’t know if it is just Apple Pay or other contactless systems as well. Anyway, lots of people have reported this. Some have had both charges show up, for others (like me) the 2nd instance vanishes from the “pending charges” and never shows up (seemingly, at least so far). If they do show up you’d presumably dispute the charges but you’re going to have to watch your charges at WG very very carefully for this problem unless/until they resolve it. The risk here is that you could be out a lot more than the 20% you’re hoping to get back. You could be out all of one or more $503.95 charges. Even one of this would wipe out 4% of your gain (approx).

I think it’s prob wise just to save your receipts in an envelope. I save mine for each CC every mo. to check them off…so it’s no more of a nusance just to transfer them after I ck them off to another envelope, just in case, labeled “Apple Pay”…that’s what I’m doing, but it’s prob overkill anyway. I believe and trust Shawn, end of story, period!!!

@glenn wrote: “Or we could talk about a real risk… All/many/almost all purchases, gift card or not, are getting entered twice by those using Apple Pay at Walgreen’s.”

That sounds like a danger inherent in using Apple Pay, irrespective of what you are buying. Good tip – I’ll keep an eye on my recent transactions. I don’t know how common this problem has been, but I can tell you that it isn’t happening on all Walgreen’s Apple Pay/Discover transactions.

Anthonyjh21,

Some good points made except for the one that says spread the resell purchases out over a number of merchants. If I can find a single item I can resell and find 1 or 30 of them for that matter from the nearest place that accepts Apple Pay and I am able to to complete the reselling angle, I am doing it and will be done with it. I don’t see how it makes any difference how much or from where that matter things are purchased so long as it isn’t gift cards.

In regard to the receipts, I know nothing about the referenced incident about having to provide them, however, if I made $10k of legit transactions through my Discover card that weren’t gift cards I would be pretty peeved to find out later on I absolutely HAD to have my own receipts for the same items possibly up to a year later…

If you find 10 computers on sale for $400 and you want them all, at the very least it would be a good idea to split the order in half if you have more than one participating Discover card.

I definitely hear you on the point that you want to get in and out and not waste more time than you need when making purchases Spreading purchases out at the very least is terrible logistics and a waste of time on the surface. The benefit though, including preventing immediate fraud alerts, is that your spending won’t look as obvious and trigger red flags now or the in the future upon any possible manual review. So if I participate in this deal I’ll probably mix it up and try to make “under the radar” type of purchases and blend whenever possible.

If I’m spending $10k on any transaction I’m retaining that receipt. I think this should be in the rule 101 for MS and reselling. I have a giant open box where I throw used gift cards and receipts in. It’s a big ugly monster that grows by the day too. Not sure how long I’ll keep them, but at least 1 full year sounds about right.

I appreciate you creating this post. Honestly, all I ever wanted to do was create some discussion about the risks of this promotion (especially in regards to gift cards). Seeing your new post more than accomplished this.

I agree with some of your points and disagree (obviously! 🙂 ) on a few others. I’ll address your points in the order written.

I believe having access to level 3 data is only partially effective as a deterrent. Will it decrease the chances you’re clawed back? Absolutely. It won’t however eliminate them. You could apply the same logic to an alarm system on a car; it’ll deter but only to the extent that the benefit (they see a Rolex sitting on your car seat) doesn’t outweigh the risk (alarm going off, drawing attention). The Rolex in this case being a highly scaled, incentivized and accessible deal offered by Discover/Apple.

You mention the Ritz Carlton receipts requirement is comparing apples and oranges in relation to Discover. Could you elaborate on why you believe this? If it’s about putting the burden on the customer to prove they didn’t buy gift cards then I’m having a hard time understanding how it’s not an apples to apples comparison. Also, there’s a great comment on Reddit and subsequent responses (including his replies) that I think people should read. Fiscal_rascal brings up some great points as an insider who’s job was to write fraud detection queries for cc transactions:

https://www.reddit.com/r/churning/comments/3l8e3w/mega_thread_all_things_related_to_apple_pay/cv7wtrh

I agree with you that the odds of an account closure are slim. Even if they have all the proof in the world, I can’t see Discover wanting negative publicity for mass account closures. What’s more likely is a claw back of bonus funds. The reason I brought up possible account closure in the first place was to shed light to the fact you should understand the entire range of scenarios before jumping into a deal. With that said, if your normal purchasing patterns are no where close to purchases made during this promotion, it will open the door for Discover and their army of lawers to do more than slap you on the hand if they decide it’s in their benefit.

I agree that even if they do an audit and itemize your receipts, you’ll most likely receive the bonus cash back for real purchases. However, even if you’re a reseller, I believe there is the possibility they (again at their discretion) limit your cash back to what they’d consider normal purchases. While I think this is far less likely than with gift cards, there is always that chance they’ll do whatever they can to protect themselves from what they deem to be abuse of a promotion.

My personal philosophy is to sometimes over-analyze opportunities, from top to bottom, left to right, then sometimes do it all over again. If you read my comments in the other thread it should come as no surprise that I love reading Julian’s Devils Advocate posts as well! My father once told me to measure twice, cut once. Sometimes I make myself (and my wife) go nuts in the process but if I can reduce the possibility of negative fallout I’ll happy do it. We all have our own methodology for MS (and life) and overall I’m content with how I go about things. I think that’s the bottom line on this deal as well – be content with your decision on how (or if) to capitalize on this pretty amazing Discover promo.

In summary, I think the best strategy is to go the reseller route and to blend your purchases at different merchants and not in overly alarming quantities per transaction. You could also throw in a few gift cards here and there. Perhaps to the surprise of some here, but I’m still considering this deal. My biggest constraint at this point is how much time I’ll have to buy and resell items. Especially considering the fact I’m not familiar with Amazon.

That post by Fiscal_rascal is pretty crazy. Exactly what anthonyjh21 is talking about and all this burning speculation of how Discover may or may not handle it. Crazy hot topic!

I can confirm there was no notice on Apple Pay on day one of the promo. I was added a day or two later that gift cards are excluded.

Thanks for the clarification Richard. I didn’t have an iPhone on day one. I’ll update that section.

I concur with this comment.

What I don’t understand is that I have read on many blogs about being charged cash advance fees for gift cards using other credit cards. If the other credit card companies have figured out that you bought a gift card and they charged you a cash advance fee what makes you think Discover cant figure it out?

I’ve never been charged such a fee by Citi, AmEx, Chase, or Discover.

Do you think you are *entitle* to the 20% if their system doesn’t enforce the gift card cashback?

The key thing is that you aren’t breaking rules by purchasing gift cards, you are just doing something outside of the realm of the promotion. In other words, I am not aware of a rule that Discover has prohibiting you from using their card (or their card through Apple Pay) to purchase gift cards. For that reason, if I go to a store and buy a gift card, I am not doing anything wrong. Discover has said they won’t pay the 10% (20%), but it is up to them to enforce that.

So my answer is no. If I purchased a gift card and Discover knew it was a gift card and didn’t pay out the bonus, then that would be legitimate. I think that is probably the worst thing that would happen to most people. I just don’t see Discover shutting down your account for doing something that is quite normal.

I’m talking about ethics. I’m saying if Discover gives you 10% (or 20%) for gift card purchases even though they didn’t want to as they mentioned in the terms of the promotion. It might be due to lack of engineering effort to enforce that rule. Don’t you think the cashback is not yours and you have to give it back?

I’m not saying all churning techniques are unethical. For example, you could churn a sign up bonus completely within the terms and conditions of the sign up bonus and throw away the card afterwards since they don’t have you MUST keep using the card afterwards. I understand this is not what they want but you comply with their rules.

I just wanted to know what you think about this issue?

THIS IS SPARTA~!

What you talk about is a grey area. Technically it is called a loophole, but ethics wise it can go both ways. One can argue they should come up with the means to enforce it if they really cared about it, or one can argue as you said that they have a lack of engineering to enforce it so you shouldn’t take advantage of them with that in mind. In the end do you think a multi billion dollar company wouldn’t have calculated whether the risk/reward for certain promotions is worth it?

Is it ethical for credit card companies to collect massive interest charges from broke people who aren’t able to afford basic necessities?

Sorry, but ethics and financial companies are like oil and water. I will never feel bad doing something within the law to one-up a large financial institution. Most of their business is based on doing just that to someone else.

My take on this is that the consumer (me) should know what I am able to spend and pay off so I’m not charged interest. If you go into massive debt during this promotion, that’s MY problem, not Discover’s issue. I know that’s what they are banking on (no pun intended…well, maybe.) Anyway, this a GREAT promotion, if it holds up, as long as you only spend what you are able to pay off. This makes it no different from any other cash back rewards programs. That’s my two cents.

Very well said. My point exactly from day (1) one!

Don’t they disclose the terms to each cardholder? Isn’t that the “broke” peoples’ fault for not understanding what they are getting themselves into? It sounds like you (and probably others) are just trying to justify doing “unethical” things? I’m not arguing that Mohammed is correct either. As I’ve said previously if Discover gives 10% on the gift card purchases they only have themselves to blame.

When I purchased a gift card at Office Depot, the transaction posted online and said pretty much the same thing.