Discover Credit Scorecard – Free FICO Score For All

Over the past few years consumers have finally gained much greater access to their credit information. It started when Congress passed a bill requiring the credit bureaus to give one free report per year and since then we have seen almost all of the major banks jump in to offer their customers a FICO score. We also have seen a number of companies like Credit Karma and Credit Sesame popup to offer FAKO scores along with some form of credit monitoring.

Today Discover became the first company to offer free FICO scores for everyone. Customers and non-customers alike can access their score at CreditScorecard.com.

Related: Comparing Free FICO Offering From Each of the Major Banks & How to Get Your Score Free

About Discover Credit Scorecard

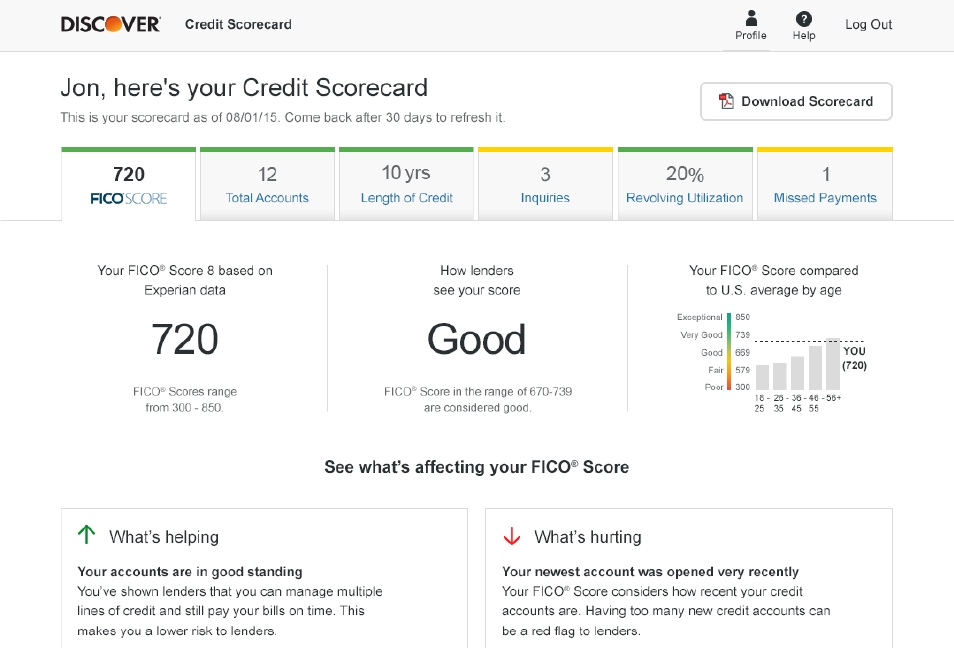

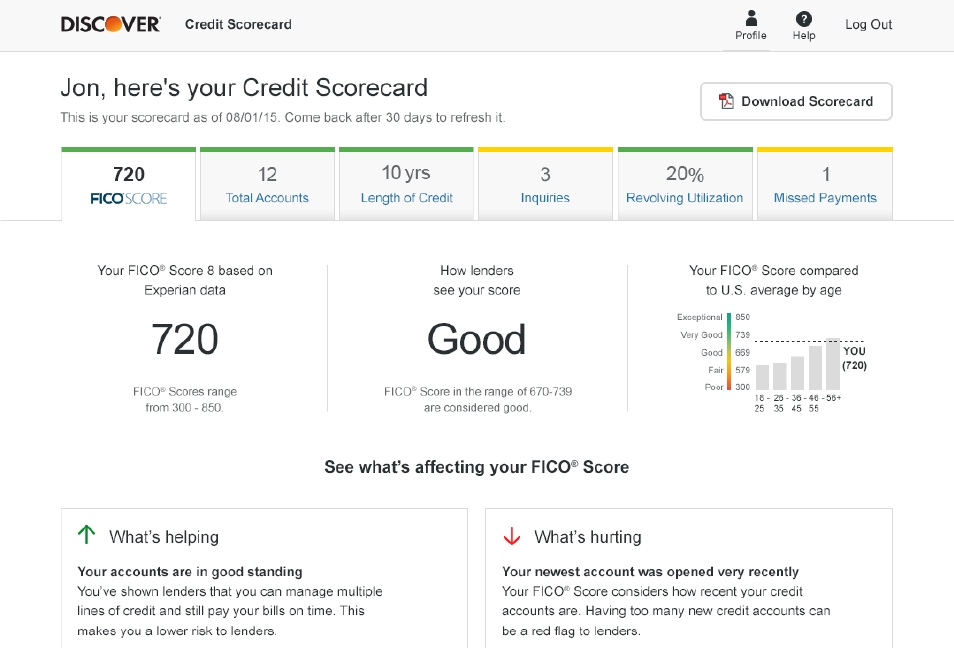

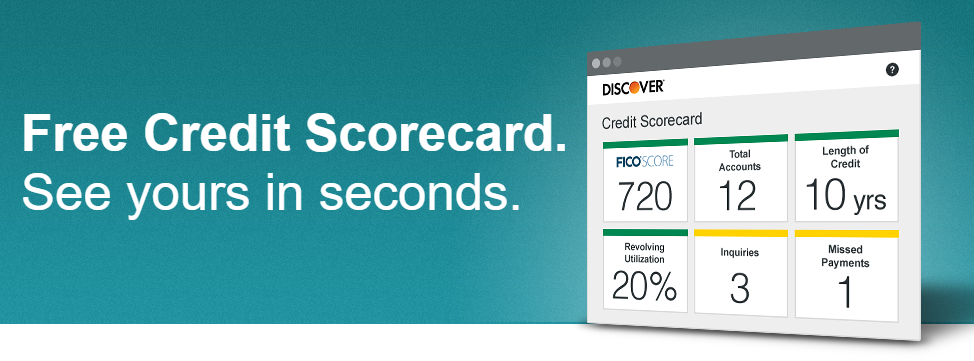

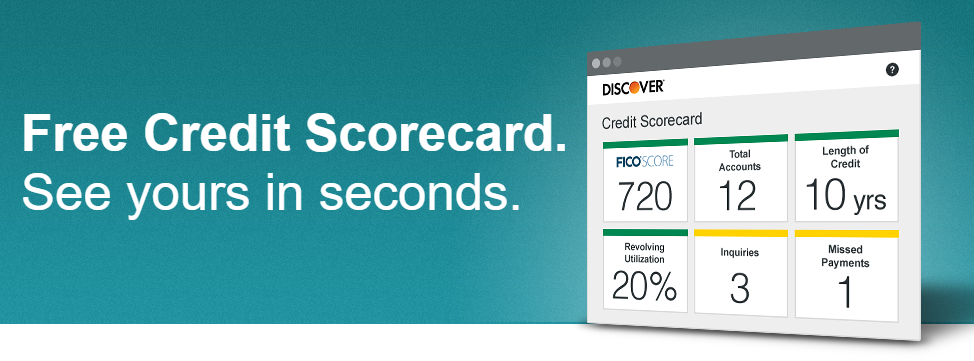

Discover uses Experian as their credit reporting bureau and the score is based on the Score 8 model (I believe the Bankcard version, but it doesn’t say specifically.) Scores range from 300-850. In addition to the score, Discover gives a breakdown of all of the factors going into the calculation. Here is how the interface looks.

As you can see, Discover displays the total number of accounts, length of credit history, number of inquiries, utilization rate and how many missed payments you have. There is also a breakdown of what is helping your score and what is hurting it. The interface is clean and the information is definitely easy to digest.

Signing Up For Discover Credit Scorecard

The process of signing up is easy. You will need to sign-up for an account whether or not you are currently a Discover customer, although you can get most of the same information (displayed differently) by logging into your credit card account. During the sign-up process you will be asked for your basic information including your social security number. According to Discover your score won’t be affected by signing up for this program.

After the intial sign-up you will be asked to answer some identifying questions before getting access to your information. The sign-up process is seamless and takes less than five minutes. Even though I am a Discover customer and can see my score through the credit card account, I signed up anyway since I think Discover Credit Scorecard gives a bit more information.

Conclusion

Yes you can now get your FICO score from most of the major banks, but this move by Discover represents the first time a bank has decided to provide this information for non-customers. Discover Credit Scorecard also represents the first free service to provide FICO scores which are used by almost all banks. While I am sure Discover will try to monetize this service by selling their own products, Discover Credit Scorecard represents a further progression of consumer empowerment when it comes to credit and for that reason I think this is a great product.

HT: Doctor of Credit

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Very nice. Currently matches my EX08 score I get from my 3B myFico subscription which uses FICO 08.

Thank you so much for this. I signed up and it’s great. Believe it or not I’ve had credit cards for the past 21 years and never knew my credit score. Now I do.

Glad this helped!

All signed up. Thanks for this