The Death of GiftCardMall

Update: As I reported earlier, the site temporarily reverted back to its old state, but the new version has returned along with the $250 limit.

Update 2: There is a backdoor link that still works for $500 cards, however it does not work with portals. You can find out more info here.

This morning I awoke to a comment from Michael on my recent post about negative changes at GiftCardMall. In that post I described how the company was cancelling many orders and how they had altered their designs to prominently place the word “Gift” on them. Michael’s comment alerted me to a stunning development.

The Return of GiftCardMall for MS

Before we go over the new changes, lets get a little background. A couple of months ago GiftCardMall once again began offering cashback through portals for the purchase of Visa gift cards. That was huge, because without the cashback, buying Visa gift cards through GiftCardMall for MS just didn’t make sense considering the cost.

At the time, I showed how a purchase of a $3,000 (6 x $500) in cards through GiftCardMall lowered the overall cost of each card down below $5 or 1% of the face value. Since these cards can easily be loaded to Bluebird/Serve or REDbird, this made it a simple avenue of manufacturing spend.

The New GiftCardMall Visa Program

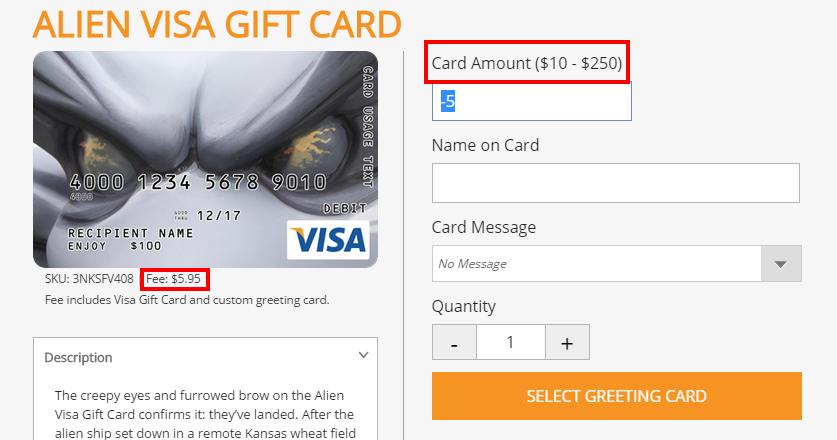

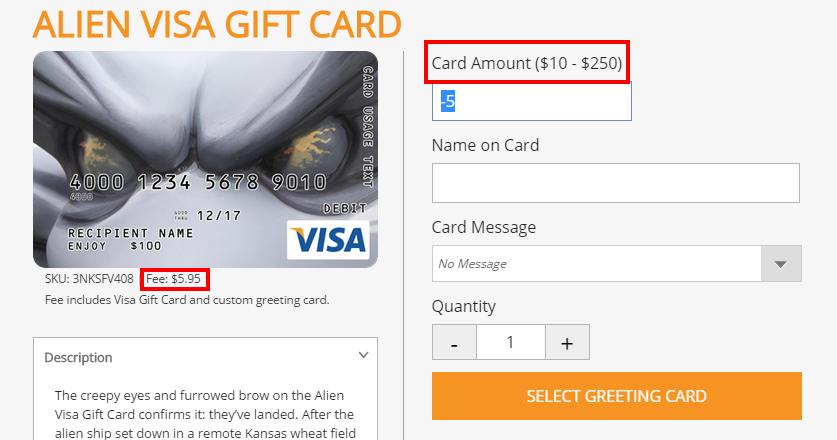

Well, things aren’t so simple anymore. Today GiftCardMall made some major changes to their Visa gift cards. First off, they added a ton of new designs which are very nice. They also ship a greeting card with each order to go along with the gift. None of those things matter to us though.

The big change that effects us is the maximum denomination. It has changed to $250. Unfortunately this change means that GiftCardMall no longer makes sense for manufacturing spend, which is perhaps their goal at this point. It is obvious based on this development that the company didn’t want to take on the risk.

Old & New Math

In my original post, I calculated the cost for $3,000 (6 x $500) in gift cards. Here it is:

- Initial cost: $3042.54

- Cashback: -$15

- Total cost: $3027.54

- Cost per $500 card: $4.59

- Cost percentage: .009

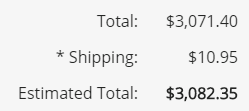

Now lets look at the new cost of $3,000 (12 x $250) in gift cards:

- Initial cost: $3082.35 (Each card carries at $5.95 fee + shipping is $10.95)

- Cashback: -$15

- Total cost: $3067.35

- Cost per $250 card: $5.61

- Cost percentage: .022

So as you can see, under the new system, the cost of a $250 card is more than the cost of a $500 card under the old system. This means that the cost to MS with GiftCardMall has more than doubled from less than 1% to 2.2%.

Other Changes

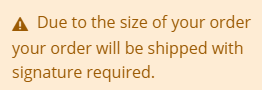

As part of these changes, they seem to have streamlined the shipping options. You can no longer get normal first class postage, but instead can do Priority Mail or UPS shipping. All delivery options now require a signature as well for purchases over a certain amount. (The $3k order triggers the signature requirement although I am not sure of the limit.)

Conclusion

GiftCardMall is now essentially dead as a method of manufacturing spend. This may still be a good option for gifts since they have enhanced their designs and improved their website, but most of you probably aren’t interested in that.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

[…] used to be a somewhat decent way to purchase Visa gift cards online to meet minimum spending requirements on credit cards, especially with .5% back from portals. It wasn’t the cheapest or best way, […]

How were you guys making this work, making this worth your time? Sincere question.

You were still incurring nearly 1% after any portal bonuses. Arrival pays 2% but at a 1% return for say $5,000 from Serve or BB, you’re looking at only a $50 return/mo. I know some of you scale that up with multiple BBs, but worth driving to WM, MOs, etc for $50? I’m missing something here obviously. I’m sure GCM was great for meeting bonuses. I use Simon Mall Corporate personally for that, but can’t figure out how GCM would have been a money maker for MS?

They only way I can see this working is if you were using a CC that was paying more than 2% and I don’t know of any paying that for GCM purchases. Are there?

Please enlighten this seasoned MSer who now feels like he missed the boat somehow. Thanks.

Its possible they are loading multiple cards (multiples of $50 quickly equate to reasonably serious money).

Also, its not always a cash-back play. I received my Southwest Companion Pass today in part, due to GCM purchases.

Shawn:

Thanks for the shoutout! I wish I could have shared better news with you this morning, but I was stunned by the change too (I was going to put in a big order too!)

Thanks for your blog and input into MS; it’s much appreciated!

[…] morning I wrote about the new GiftCardMall website. In addition to adding hundreds of new designs and overhauling their fee and shipping structures, […]

Update for those who commented. For now the website seems to have reverted back. You can find more details here: https://milestomemories.boardingarea.com/giftcardmall-old-site-returns/

what’s next! all my giftcard mall orders have been cancelled over the last two weeks. now all i have is grocery stores and the hope those can be bought using a cc.

[…] MilesToMemories broke the news earlier today that Giftcardmall stopped carrying $500 Visa gift cards. The highest denomination then was $250, which of course kills the deal. […]

Couldn’t use them to load serve at CVS or Walmart. Both wanted to see name in the card. Was useful for me even before it died.

Wow, and I just got my confirmation of the $1,000 coming my way.. Same thing happened with the AmEx cards to REDbird.. the same day I got some, they closed the loop. I’ll just dump these into RB and move on.

Well, dontcha think bloggers yammering about GCM were the major reason why this died? Before y’all became “expert bloggers” you could buy $1K cards with Amex gcs and use codes for free/discounted shipping plus get portal bonuses.

Now, which method you going to kill next? Pickings getting slimmer by the day.

True, but its a (very) rare phenomenom to have any such blogger “own” it. When one sees things through the proverbial GREEN tinted lenses, its (very) hard to see things any other way.

and it was through the bloggers, net, FT that you found out about these offers. Another ego gone mad, pickings getting slimmer, yea if you call, getting 100,000s of point/miles every few months slim pickings. Please.

As if bloggers were here before the sharper MSers? Please FT and bloggers are always slower to find out what is happening out there. Try opening your eyes and realizing the damage being done by those that out the deals.

Wow, this is bad news!

Simon Mall Visa GC is still the best. $3.95 fess for $500 GC. With Citi double cash:

2 x $500 GC cost $7.90 and you get $20 back so you make $12.10

Nope. Can only buy $500 at a time, 500 + 3.95 fee + 3.99 shipping = 507.94 total

Nope I can buy 5 X $500 without filing paper. The Manager told me someone came in and bought $10000.

Hoang, I was talking about buying Simon GCs online (fulfilled by GCM … who we are discussing here), not at the malls themselves.

Ha ha ha… they are on to us. 2.2%… exactly matching the effective cash back rate of Barclay Arrival Plus… 🙂

Noooooooo. This is terrible news. Why GCM, why?!

It was good while it lasted. Let’s nominate this one to the mfgspend hall of fame and look for the next adventure.