Chase 5/24 Bypass Targeted Offers Online

Chase has gotten stricter with their approvals over the past couple of years. It used to be a free for all when getting their cards and then they implemented the 5/24 guideline where they deny most applicants for new cards if they have opened up more than 5 new credit card accounts across all banks within the past 24 months.

Of course over the past year we have learned of ways you can avoid this guideline. For example becoming a Chase Private Client is one way to do it and another is checking in-branch to see if you are pre-approved for a specific card. The third way is to get lucky like I did when I applied for the Sapphire Reserve during the brief time an early app link was released.

No matter the case, we know 5/24 isn’t in place 100% of the time and that Chase is looking to target customers they value. That is why pre-approved in-branch offers often bypass 5/24 and that is certainly why Chase Private Clients can get approved without too much hassle.

New Targeted Offer

Now, it seems like Chase is rolling out an additional way to present offers to valued customers and these offers seem to bypass 5/24. Via Patti from The Travel Sisters, if you are logged into the new version of the Chase site (personal accounts only I believe) they may display a targeted offer right on the home page.

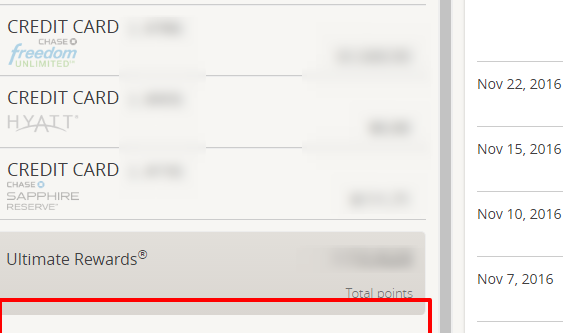

According to her description, the banner offer would be displayed roughly where the red box is above. She describes the offer as showing, “…on the Accounts screen where all the accounts and balances are listed. Right below the total Chase Ultimate Rewards balance.”

She notes in her post that three members of her family who are all over 5/24 have applied for these offers (The Freedom Unlimited specifically) and been approved. Approval is not guaranteed of course and I am sure we will see more data about how these offers avoid 5/24 as more and more of you login and check.

Conclusion

It is always nice to see banks roll out additional ways to get targeted offers and I like that Chase has made it so easy. Unfortunately I am not targeted for anything at this point, but hopefully you are! If you are targeted and care to send a screenshot, feel free to send it my way. (shawn@milestomemories.com) Thanks and good luck!

HT: Doctor of Credit

[…] appear to be two ways to see these offers. Check out this article by the Doctor of Credit and this one by Miles to Memories to see exactly where these pre-approvals might show up on your […]

Much to do about nothing. Unless there’s a 5/24 jailbreak, don’t post this nonsensical clickbait.

How does the 5/24 rule work? Lets say my oldest of the last 5 cards complete 2 years today (12/29/2016). Can I apply for the new card tomorrow? What is the wait period beyond 24 months?

There is no published rule, but yes they look back 24 months from the application and see how many new accounts have been opened. There is no waiting period, but there are factors other than 5/24 which could affect their decision as well.

Hey Ted, glad you are looking out for DoC’s content. I missed their post and saw this one. Had Shawn not posted this I never would have known.

Did not work for five of us. Even called the reconsideration number with no luck. All of us was told over 5/24

[…] A New Possible Way to Bypass the Chase 5/24 Rule – With the rollout of their new website, Chase is offering targeted deals that may bypass the 5/24 rule. […]

I see the HT and all but damn, Shawn, you sure piggy-back on DoC’s content a lot.

I enjoy this site and DoC. One is not a copy of the other. Ted needs to keep his negative opinion to himself regarding this free site.

Umm… considering that DoC credits the post to The Travel Sisters, I’m not sure you picked the greatest post to make this point. Plus, the whole point of these posts is “this week around the web.” FWIW I don’t read DoC regularly, just too many low value posts for me. So to get a link to a worthwhile one is super helpful. Keep ’em coming!

I just got Steph Curry looking back at me from that part of the screen. As much as I admire his basketball skills, I would much prefer a 5/24 buster

Lol

I saw one for me at the top left of the main screen. This is for a business account and tbe ad is for the new chase ink preferred. I couldn’t find any 5/24 language in it.

They have 5/24 language in the terms?

What is 5/24 language?

You sound like you could be the Chase Private Client Banker I talked with while in branch. He asked me that question without even waiting for the answer. Then he tried playing me for a fool the rest of the meeting. Ah, bankers!

So, what’s the answer? AFAIK, the terms don’t mention 5/24 at all.

5/24 doesn’t show up in the terms. It is an internal underwriting guideline.

Interesting. Nothing in that area of the screen for my wife or myself.