Pay In Foreign Currencies to Save Big Money

Part of our mission at Miles to Memories is to save you money. Yes, a lot of that focus is often put on credit cards and travel, but there are so many ways to save money in all areas of your life. For example, I have written in the past about ninja tricks which involve stacking a bunch of discounts to achieve savings on everything from flooring to Valentine’s Day!

One of the coolest ways to save money is by paying in a foreign currency. Not all merchants allow this of course, but if it is an option you should always see if it is beneficial to you. I have found that lately with the strong dollar it is often cheaper for us “Americans” to pay in a foreign currency.

Saving 27% with Russian Rubles

One such example just came up in my life. As many of you know I am a huge roller coaster and theme park fan. There is a new game coming out called Planet Coaster which is of interest to me. While I am not a big gamer at all, I have always loved this type of game. Anyway, the developer has given nerds like me the ability to purchase early access.

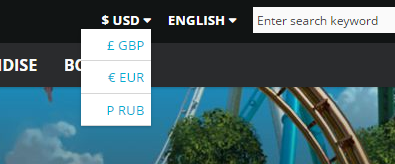

When I visited the developer’s website I noticed something right away. At the top of the page, there is a currency and a language toggle.

I also noticed that the website’s URL changed depending on the currency. For example, the U.S. store has the following address:

https://www.frontierstore.net/usd/

Immediately after seeing this I checked the price of the product that I in each of the three currencies. The prices are:

- $74.99 USD

- £49.99 GBP

- RUB3,750.00

My next step was to head to Google. They actually have a very handy currency calculator built into the search engine. There is no need to visit a 3rd party site. Google told me the following:

So I can either pay $74.99 in U.S. dollars or choose another currency and save. Do you see that chart next to the Russian Ruble. It has stumbled compared to the dollar. With all geopolitical discussion aside, that is good for the purpose of this purchase.

No Foreign Transaction Fee Card

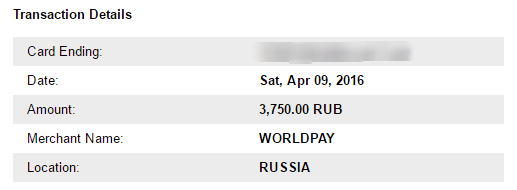

The next step was for me to use a card that doesn’t have a foreign transaction fee. I chose my SPG Business Amex card since I am still meeting the minimum spend requirement from the 35K offer. Thankfully the website allowed me to put in my correct address for billing and since this is a digital download no shipping will be required. After inputting all of the information I hit submit. Moments later, success!

American Express even sent me a transaction notification since I have it setup to tell me when there is a foreign transaction:

The Final Cost

While you can debate whether it is smart for me to pay $55 for early access to a roller coaster game, you can’t deny that by simply changing a setting, a 27% savings is tremendous. My final cost for this was actually better than what Google said. It only cost $55.31. That is certainly better than $74.99!

Other Uses For Foreign Currencies

Using the foreign currency “trick” is something that can be done in a lot of cases. Just about anything without a physical deliverable will work.

For example, look to pay in a foreign currency for:

- Hotel rooms

- Plane tickets

- Cruises

- Game downloads

- Software downloads

- Train tickets

- Online services

- Monthly subscriptions

Of course you will always want to check to make sure that it is beneficial to pay with a foreign currency and will always want to use a card that doesn’t have a foreign transaction fee. If you put a subscription in a foreign currency then make sure to check back periodically since currency markets fluctuate quite a lot.

When it comes to travel, many companies will price something cheaper in the home currency than your own. For example, you might get a cheaper plane ticket from Japan Airlines by paying in Yen as opposed to dollars. That isn’t always the case, but it never hurts to check. The one thing I caution against is lying about your address or where you are located.

Conclusion

I am happy with this purchase and to be honest, I would not have paid $75 for this game, but paying $55 made sense to me, plus this is the first time I have ever paid in rubles anywhere. I think that is kind of cool, or perhaps I am just a nerd. I am sure it is the latter.

Do you have any foreign currency tricks or suggestions to add? Let us know in the comments!

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

How in the world can we find Merchants who would accept payment in foreign money? Home Depot? Walmart?

Purchased tickets from Amsterdam to Budapest and Heathrow to Bordeaux on BA for less than 1/2 the price by logging into the British version of their website and paying in Euros last year. The US BA site had greatly exaggerated prices as did the AA site.

Good point, Shawn. In February I went on a bicycle tour in SE Asia promoted and operated by an adventure tour company with offices in the US and UK (and perhaps elsewhere). I carefully compared the prices on the US website with the ones on the UK website for the same tour. In converting the UK’s tour prices in GBP to USD and comparing them with the US company’s USD prices, I found that I saved over $100 by booking through the UK website. The UK branch had all my US address/contact information and never batted an eye about my having booked through them.

I paid the tour fee a couple of months ahead of the actual tour date using my Barclaycard Arrival Plus after, of course, having notifying Barclaycard that the $1000+ fee amount would be charged in GBP by a UK company. One of the best features of the Barclaycard Arrival Plus is no foreign transaction charge.

Shawn,

I have a Schwab ATM/DEBIT card no foreign transaction fees and ATM fees reimbursement.

It has been over 3 months where I have filed FRAUD complaints on a Canadian Bank(CIBC) Vancouver, CA, and VISA(Department of Justice) and now Schwab.

All there of these institutions FAIL to provide written transactions of ATM fees charged to me.

Schwas just has ignorant Bank employees who cannot understand ATM transactions

Thus recommend when using a Credit Card or Debit card go to the network(AMEX, VISA, or MasterCard) and verify the exchange rate. Googling VISA exchange rate will take you to the VIUSA web site where there is a lookup table for each day of exchange rate.

Banks like to show ONLY a conversion rate and a conversion may have EXTRA fees embedded in which banks never break down unless regulatory complaints are made against the institutions.

Thus when I was in Europe last year multiple merchants asked me “DO you want the charge is US currency”? NEVER I told them as they markup the conversion rate with administrative fees passed into the conversion rate.

Thus I agree NO FOREIGN transaction cards(Credit and DEBIT) are essential while traveling internationally but also look for ATM reimbursement fees. But beware even a company like Schwabh who has a debit card that is NO foreign transaction fee and all ATM fees allowed excessive fees to be charged.

After 3 months of hassle SChwab is so incompetent it still has not gotten a full breakdown of the fees.

VISA WILL never cooperate to help you nor will the foreign bank(CIBC since you re not a client).

In the end it also essential to pick a good BANK. I cannot recommend Charles SChwab due to financial incompetency!

Awesome Trick!!. Since you’e a roller coaster fan, I’m curious if you’ve heard of Cannibal at Lagoon in Farmington Utah. the theme park is about 20 minutes north of Salt Lake City. This ride opened July of last year….it is a cool roller coaster: http://www.lagoonpark.com/ride/cannibal/

I just thought of an instant way to save you money…

Nevermind. I now realize the price I was looking at was euros not rubles.

This sounds interesting. There is a room I want that will run me over $200. Courtyard Philadelphia Downtown, May 21, Renovated Studio Suite, Suite, 1 King, Sofa bed, Corner room. You’re telling me if I pay in Rubles it will cost me $3.25? Would you take a look and let me know if I did that correctly?