Redeeming Citibank Checking ThankYou Points

Last year my wife and I (along with many of you) took part in the very generous Citigold promotions going on. I personally signed up for the bonus giving 50,000 AAdvantage miles while my wife opted for 50,000 ThankYou points. It took many many months to get my bonus to post and even longer for her bonus to post.

Fortunately I was able to get Citi to waive the $30 monthly Citigold fee for almost every month because of the delay, but that isn’t happening anymore. Additionally, my wife just signed up for her own Citi Prestige, so she was able to get the reduced $350 annual fee as well. In other words it is time to shut ‘er down, because we simply aren’t using the account.

Cashing the Points In

In addition to the 50,000 point bonus, my wife accumulated 500 more points from other things like bill pay, etc. I think it should have been more, but I decided it wasn’t worth the hassle to audit the account. So I went to shut it down, but I had to do something with the points. Here were my options:

- Transfer them to another one of our ThankYou accounts where they will expire in 90 days. (Note: They cannot be transferred to travel partners.)

- Redeem them for gift cards and/or merchandise.

There is one other consideration with these points. Since they were earned from a bank account and not from a credit card, they can trigger a 1099 if you receive more than $600 worth of value from them. So if for example I transferred them to my Prestige ThankYou account and redeemed them for 1.6 cents each, then I would get $800 value and a possible 1099.

Disclosure: I am not a tax professional and thus am only talking in generalities. Consult your tax professional for advice about bank bonuses and how they are taxed.

Staying Simple

Now I do realize I could have transferred over some points and redeemed them at the 1.6 cents value and redeemed others at a lower value in order to squeeze out as close to $600 as possible, but that is complicated. I wanted simplicity and so I cashed them in for gift cards at 1 cent each which is something I would never do otherwise with ThankYou points.

Finding the Right Gift Card

Since I do a fair amount of reselling, I looked for gift cards to merchants where I shop often, but there is another factor to consider. I can normally buy gift cards for many of these merchants at a discount of 10-20% off of face value. If I redeem these points, then I must value that redemption with the same discount. I thus looked for a merchant where I cannot often get a good discount on gift cards.

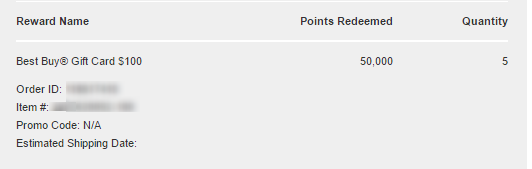

Thankfully, the ThankYou portal lists Best Buy gift cards as one of their options. Best Buy gift cards are rarely discounted more than a couple of percent and they have a high re-sale value. This means that my points lost less value when redeeming them compared to if I had used them for a Kohl’s gift card for example. So I purchased 5 X $100 Best Buy gift cards for 50,000 points and was happy about it.

Burning Off the Last 500

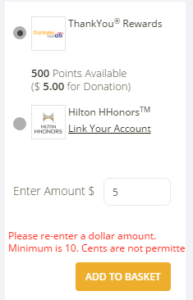

Since I still had 500 points left that I didn’t want to waste, I decided to do something noble. Citi allows you to Donate the points to charity at a value of 1 cent each. That sounded good to me, so I linked my ThankYou account to PointWorthy (the service they use) and tried to donate $5 to Give Kids the World. (A truly AMAZING charity.)

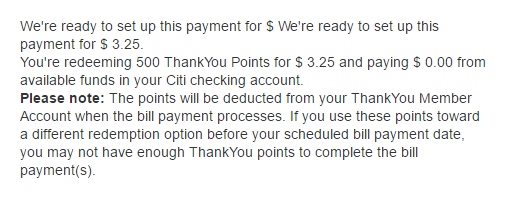

Unfortunately, they didn’t want to take my $5. When I tried to redeem the points, the site said the minimum was $10. You would think they would let you kick in the difference with a credit card, but I couldn’t find that option. In the end I had to settle for using bill pay to liquidate my points at a terrible value. $3.25 for 500 points. Don’t worry though, I went ahead and made a Give Kids the World donation in a much greater amount directly on their site.

Conclusion

While I am all about maximizing everything and often write about ways to do it, for me the simplicity of redeeming these points for gift cards couldn’t be matched. I don’t have to worry about them expiring and I will get close to the full value out of them. $500 for signing up for a Citi account (plus the rewards from funding it) ain’t bad.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

[…] cashing our her points from the Citigold deal last year and getting the reduced annual fee on the Prestige, my wife closed her checking account. An […]

shawn,

under the cashing points highlight, u indicated that bank-bonus pts xfer to prestige could redeem for 1.6. will those pts still be expired after 90 days in the TY acct whether a prestige cc is still active or not, correct?

Do you not plan to keep her Prestige after the first year? I got the Prestige last year and a Citigold account at the same time, got the reduced fee and TYPs, then downgraded the account to basic and left $1500 in it to waive the fee. When I log in to see the account, the Citigold banner is still there, so when my Prestige came up for renewal this year, the reduced annual fee came as well. To me, that $100 savings is worth keeping $1500 in a checking account.

Unfortunately not given all of the announced changes. I don’t have enough four night stays to use that benefit and with the loss of Admiral’s Club access along with 1.6 cents redemptions on AA, I just don’t think the card has the value anymore, especially considering the Sapphire Reserve.

I am actually keeping my checking account open for the exact reason you just mentioned. My Prestige comes due in a couple of weeks and I do want to keep it another year (hopefully with a good retention offer), so I am hoping to get the same $350 benefit you did. Then I’ll close it.

I went with student loans for myself and mortgage payment for the wife. Cashed both checks via Mobile deposit. As you probably know you don’t need to actually pay the loan. Was really simple and resulted in $500ish each, well below the $600 threshold.

Kind of surprised you went with the gift card option but I can hardly blame you. I’m a big believer in keeping it simple and not always going the extra mile for that incremental added value when you have enough on your plate.

Very true…

That must have felt so terrible given your skills… but I dont get it. So you opted for the 50k TYP fully knowing you had to go down this path of BB GC??? Or did things change and you had to just liquidate for GC suddenly?

I assume you knew all about the taxable TYP and you were already planning for a 1099 right? Or were you planning something else?

This was pretty much always my plan. We have a ton of AA miles so I didn’t think we needed more and I also have enough TYP to transfer/book flights, so I saw this as a $500 bonus from the beginning. In this case given the complicated complexities of TYP, how they expire when an account is closed and how it is hard to tell which points are used for what redemption after transferring them to another account, I opted for this.

I see. Makes much more sense now. Nice man!

Couldn’t you have downgraded her checking to Basic? Also, couldn’t you use $400 AA in one fiscal year and $400 in the next?

Yes I could downgrade and then either keep $1,500 in the account or do a DD and bill pay to avoid the fee. Adds more complication that I don’t want considering I have a lot of accounts already and have more than enough ThankYou points to redeem at 1.6 cents until the devaluation.

Hyatt GC was an obvious choice for me.

I would’ve gone with a $505 mortgage check.

Definitely an option, but not one I wanted to go with. I don’t have a mortgage that needs paying that way and while there is a workaround, these gift cards are close to 100% value for me, so I didn’t see the advantage in doing it.

I did the same thing except Lowes instead of Best Buy.

Another good choice. I shop more at BBY which is why I went in that direction, but Lowe’s and Home Depot cards both have a generally high value if you shop there a lot.

Rather than creating a new Thank You account for my wife’s Citigold bonus, they credited her existing Premier TY account with 50K. Would you safe that these points are safe from expiration once I downgrade the CitiGold account?

I would think so given they put them in that account. Perhaps confirm via secure message so you have something in writing?

Like SDO, for some reason, the points I was supposed to earn from the gold checking account were credited to my thankyou premier account. They appear to be transferable to airlines as well. Any idea why that may have happened? Would you transfer the points out quickly if you were me?