ThankYou Premier 40K Bonus Returns

For a long time we were riding high with Citi sign-up bonuses. For example, for much of 2015 the ThankYou Premier card had a 50K sign-up bonus with the annual fee waived the first year. Then in April that bonus dropped to 40K before disappearing completely over the Summer. Thankfully Citi has decided to bring back a bonus on this card. Let’s take a look.

The Offer

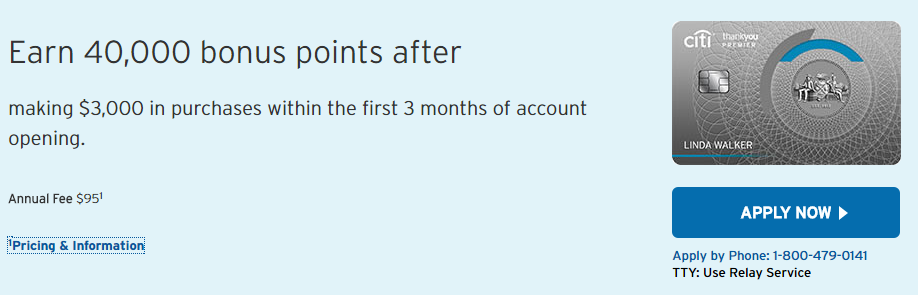

Earn 40,000 bonus points after making $3,000 in purchases within the first 3 months of account opening. $95 annual fee is NOT waived.

Card Benefits

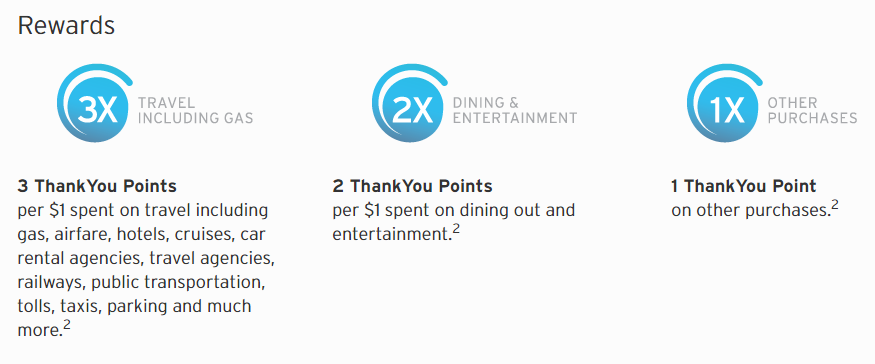

- Earn 3X on travel including gas.

- Earn 2X on dining and entertainment.

- Earn 1X on everything else.

- ThankYou points are worth 1.25 cents each when used towards travel.

- Transfer points to loyalty program partners.

- No foreign transaction fee.

Need to Know

- This is slightly worse than the bonus before it disappeared since the annual fee is not waived the first year.

- The bonus is not available if you have opened or closed a ThankYou Premier, ThankYou Preferred or Prestige card within the past 24 months.

- If you don’t have a Prestige, this is a good card to get to open up points transfers for ThankYou points earned with other cards such as the AT&T Access More.

Analysis

When deciding whether or not to apply for Citi products, it can be tough because of their new restrictions on getting the bonus. On one hand if you are eligible for this card now, applying could start the 24 month clock so you can get another one, while on the other hand we may see better bonuses including a waived annual fee down the line.

Keep in mind that Citi has also been fairly generous with retention offers on this card. While that isn’t guaranteed, it may help you to keep this card past the first year so you don’t close it and restart that bonus clock. If I was in the market for a ThankYou card and didn’t need any of the benefits of the Prestige, I would probably jump on this since there is no guarantee that we will see anything better soon.

Conclusion

It is nice to see Citi bring back the bonus on what was once considered their Sapphire Preferred competitor. With 3X on travel and 2X on dining it earns at a great rate, although the Sapphire Reserve has definitely eclipsed that. Either way, this is a decent card with a good, but not great bonus. Let’s hope for something better and more importantly hope the bonus doesn’t disappear again!

What are your thoughts on the new Citi ThankYou Premier 40K bonus?

HT: Doctor of Credit

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.