U.S. Bank Altitude Reserve Application Experience

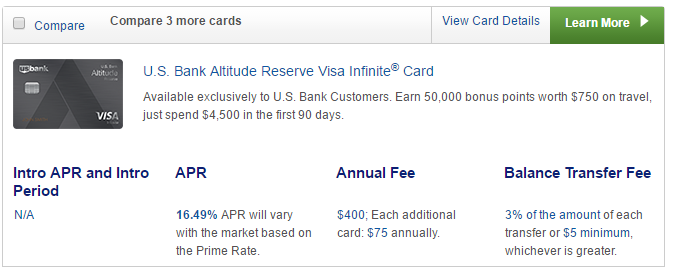

The U.S. Bank Altitude Reserve card launched this morning. This new card is U.S. Bank’s entry into the premium card market. This metal card comes with $325 in travel credits, 12 free Gogo passes, a 50,000 point bonus, a $400 annual fee and more. You can find out more about the card here.

One of the other great features of the card is that it earns 3X points on travel and all Mobile Wallet purchases. Since I spend a lot of money on merchandise and other “stuff”, I find the bonus categories to be quite valuable. Thus I (actually my wife) applied this morning.

The Application Process

To apply my wife headed to the U.S. Bank website and logged into her account. She has both a credit card and a checking account with U.S. Bank. After logging in she clicked “Apply for Products” under the “Products and Services” menu.

From there she clicked through to the credit cards and found the Altitude Reserve at the top of the page!

The application itself is fairly straightforward, although they do ask if you have dual citizenship for some strange reason. Other than that the typical info like name, address, income and social security number is all that you require.

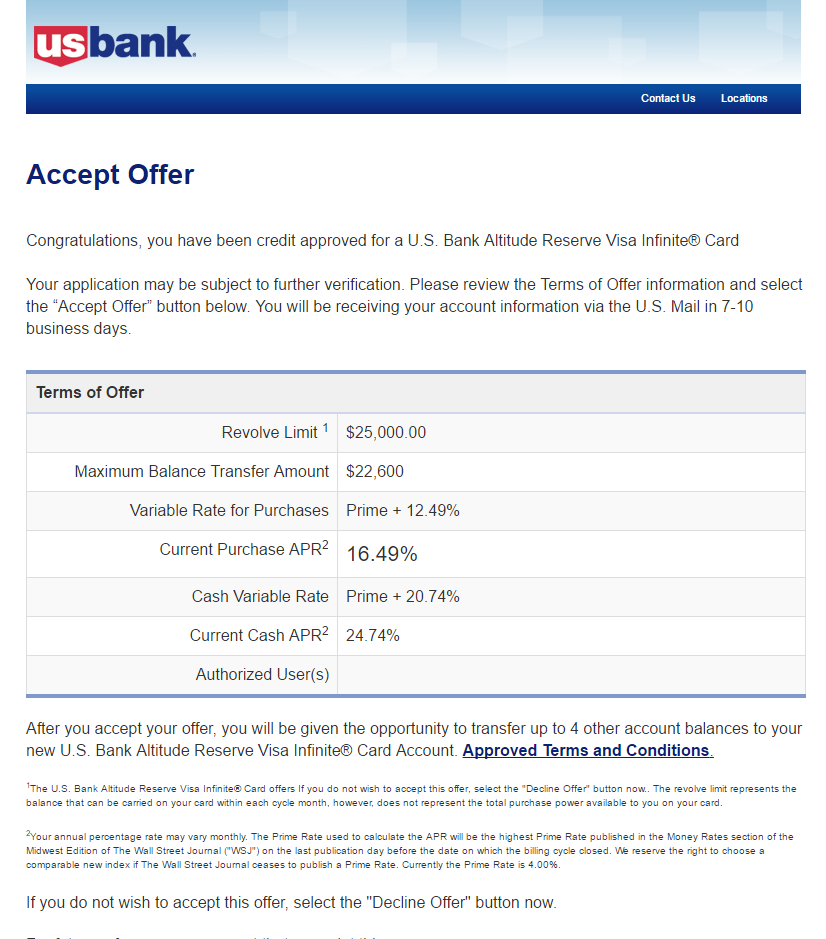

After filling in all of the information my wife submitted the application and then something strange happened. Instead of just saying she was approved, they presented an offer to her. She then had to accept the offer to get the card.

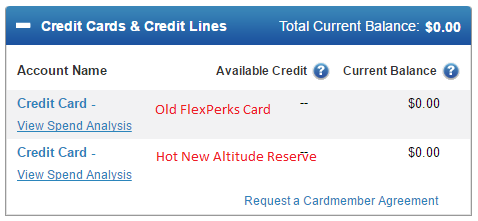

As you can see, the limit of $25,000 is quite generous. My wife of course clicked to Accept the Offer. The new credit card showed up in her online account instantly!

Data Points

I have been reading through many data points today and it seems some people are having success getting approved while others are getting denied and/or pending messages. My wife hasn’t applied for many cards lately due to an upcoming mortgage we are getting so that played to her advantage. We also have been U.S. Bank customers for quite a few years.

Some of the people getting denied and/or processing messages are:

- People who have opened a lot of accounts recently.

- People with only a credit card relationship with U.S. Bank.

For some reason according to data points, U.S. Bank’s systems aren’t properly seeing credit card only customers as customers and are sometimes denying apps on that basis. (You must be a current customer to get this card.) Many people who were denied by this error have had success getting themselves in a manual processing queue by calling.

Conclusion

While it has been painful to hold off on applications for awhile, it paid off in this case with an instant approval. We plan to use this card quite a bit, so the generous limit will come in handy. The $750 worth of travel, Gogo passes and other benefits are nice icing on the cake as well! 🙂

Were you approved for the Altitude Reserve or did your app go to pending? Share your U.S. Bank Altitude Reserve application experiences in the comments!

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Applied online on Monday showed as pending. Card arrived on Wednesday, so I’m off an running working on the $4500 to get the 50K in points. Could we get an article on how to effectively use the mobile wallet? I have an iPhone.

You have to call in to active the card. When I called in the guy was able to activate it, and, he asked about if I had any questions regarding the benefits. When i asked one though, he didn’t know the answer. Not a surprise in a call center. For this type of a card though, you’d think they would have dedicated customer service?

[…] Approved! My U.S. Bank Altitude Reserve Application Experience Including Their Strange Process […]

What is your valuation of the 50,000 point bonus?

The value is $500-$750 depending on how you are going to use the points. For me, even at a $500 value the card is worth it given the travel credit and 3X Mobile Wallet.

[…] I admit that I have definitely been keeping up with it. Plenty people have already applied – including Mrs. Miles to Memories – and been approved for this […]

I have a ClubCarlson card but initially had my application rejected. I called the reconsideration line and they said they have a glitch and didn’t recognize me as an existing customer. My application is now pending.

If I do get the card, is there a quick tutorial out there about using a “mobile wallet”? I’ve never really bothered, but this might motivate me to do so.

That’s a good idea. I think it would be good to know as well.

I applied about 9 AM Central today and was given pending. I have both checking and savings at US Bank. I talked with a bank official last week, so if I’m declined I’m going to talk with him more about this.

How to meet spend req is the problem. Hardly any technique left

I got a similar (maybe the same) message when I applied for the US Bank Business Flexperks card during last year’s Olympic Promo. But I was busy and saw the congrats message, and walked away from my computer for half an hour. Long story short, my application was never actually processed, and there was no way to get it processed. Keep clicking if you apply, and screenshot everything!

Shawn did you freeze your ARS or SageStream for your wife prior to the approval?

No I didn’t because she isn’t applying for any other cards today nor has she opened others recently.