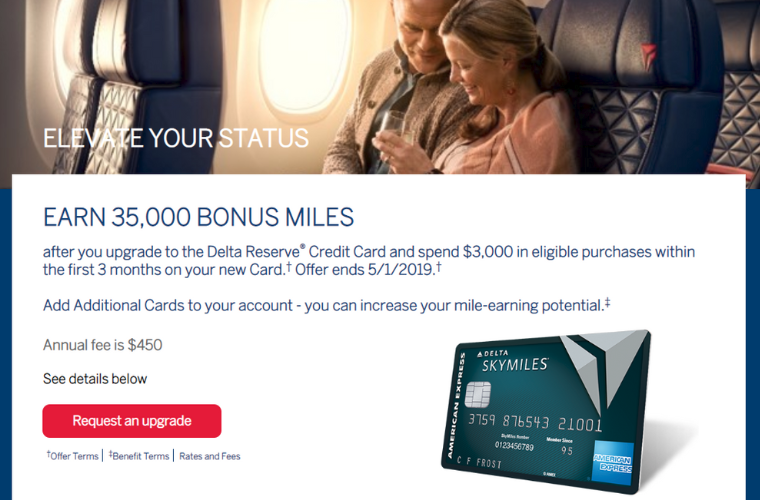

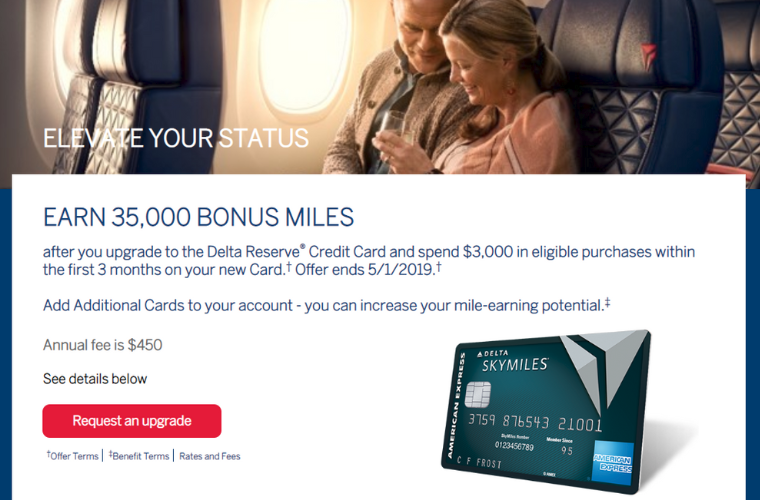

35,000 Mile Upgrade Offer for Amex Delta Reserve

American Express has an upgrade offer available for the Delta Reserve credit card. This is probably the highest upgrade offer we have seen on the card, but comes with limitations. You can read our review of Delta Reserve cards here. We found the link and offer in the myFICO forums and it could come with some risk.

The Offer

The offer is as follows:

- Earn 35,000 bonus miles after you spend $3,000 within the first 3 months.

- Annual fee $450.

- Offer expires on 5/1/2019.

Analysis

This is a good bonus for an upgrade, but the offer clearly states that you are not eligible if you have had the Delta Reserve card in the past. If you’ve never had the card, then it makes sense to just apply through the public bonus which gives you 75,000 SkyMiles and 5,000 MQMs. This upgrade offer doesn’t have any MQMs at all.

On top of that, sometimes Amex denies these bonuses, as they might be targeted to certain customers. I don’t see any targeted language in the terms, but keep that in mind if you decide to apply since the link was found on a forum.

With American Express making up the rules as they go along it is hard for us to say if this is a good idea or not. I would tend to say it is a pass but that all depends on your risk/reward calculations.

Conclusion

A decent upgrade offer, but with the lifetime language in it doesn’t make much sense for most people as the public welcome offer is much better. I do find it strange that the lifetime terms are in an upgrade offer. These have not been enforced in the past but I can’t remember if they have been included in other offers or not. I would give this a pass overall since it comes with risk but the decision is a personal one.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I received this e-mail this morning, and what’s odd is that it calls the 35k “our highest bonus yet!” :-/ Granted, the spend is lower ($3,000 vs. $5,000 on the public offer), but it’s still less than HALF of the public offer.