American Express Account Manager – How To Set One Up

If you are in our Miles to Memories Facebook group then you saw my wife giving me crap about the hoops she has to jump through to fill up with gas. I don’t think this is anything new for people in “the hobby”. It made me think of all those things we make our significant others do in the name of miles and points. Chat can take of a lot of things, well if you get a decent rep, but sometimes you actually need to call in. And there it is, that is when the sinking feeling rises in your stomach, the point where you know you have to ask them to call into the bank. You steady yourself and prepare for the eye rolls and the huffs and puffs but you don’t have to with Amex. Because the American Express account manager option is here to save the day!

American Express Account Manager

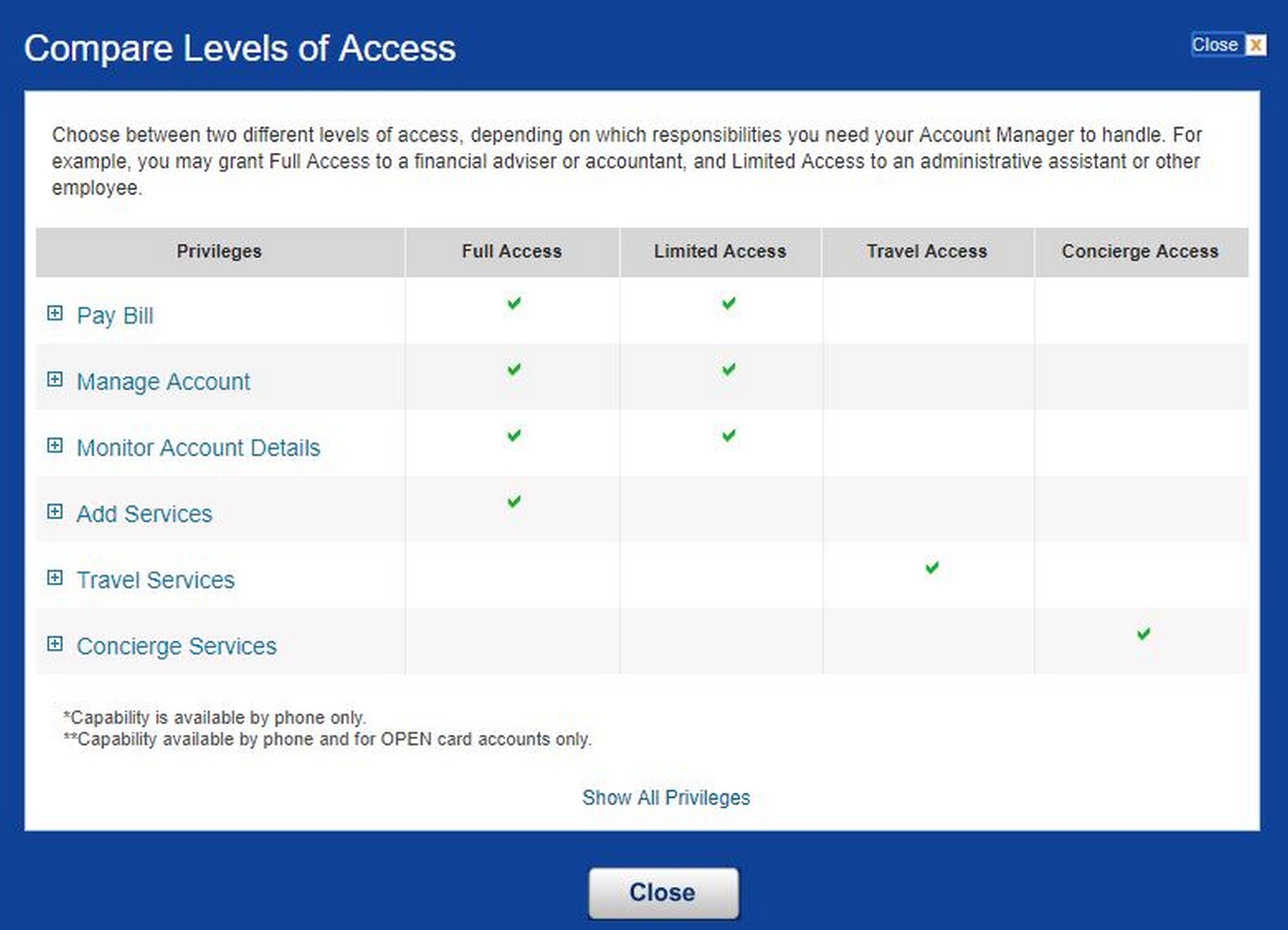

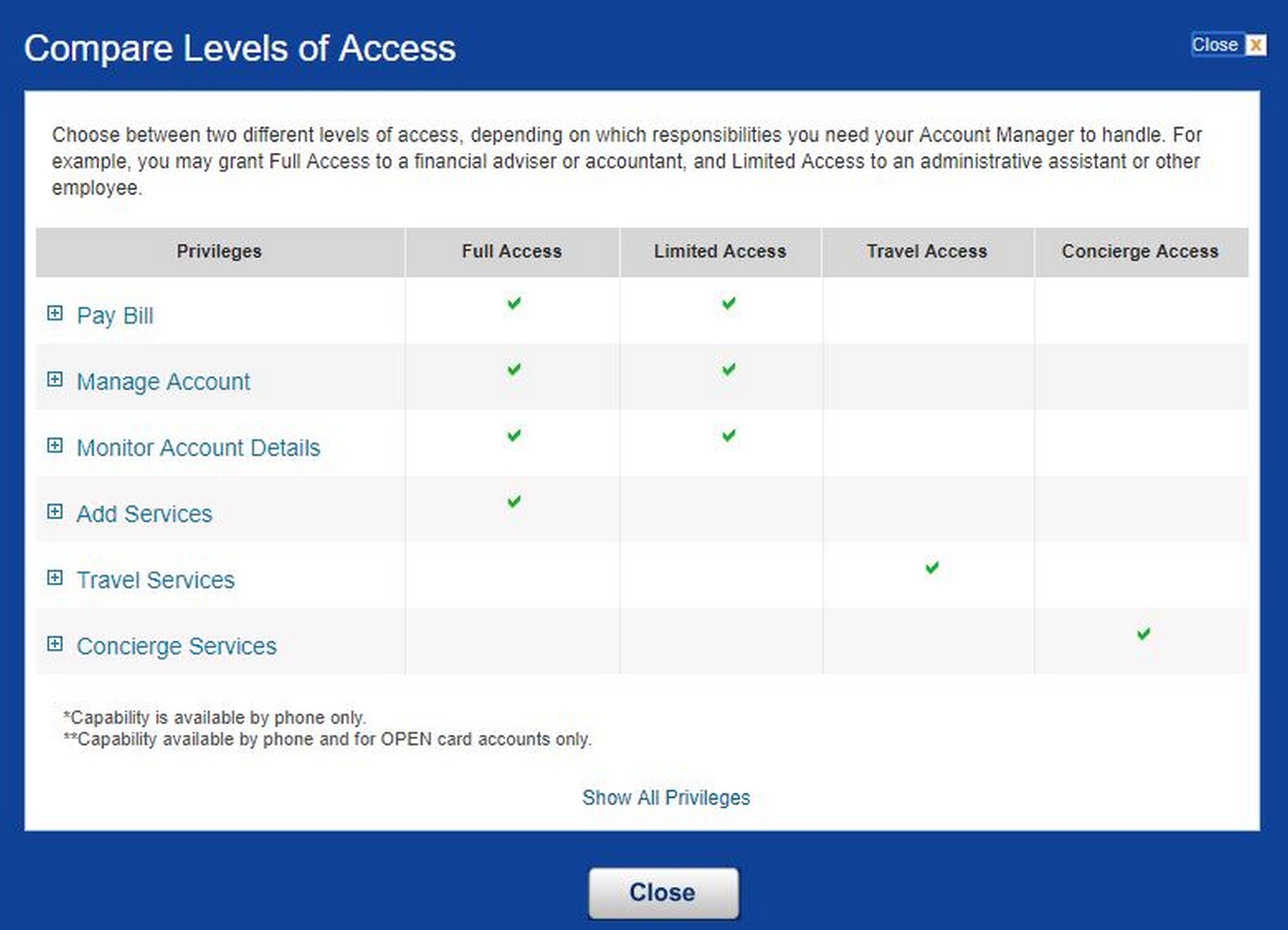

American Express allows you to set up an account manager online in your account. You can give this person varying levels of access.

This is great for relationships like ours where one person does all the work and the other one reaps the rewards where one person isn’t into the hobby and hates making the necessary phone calls. No more sitting in on the phone call while they mouth you questions! No more having them call and then ask if you can talk on their behalf! Because you know dialing a number and asking a question is the end of the world to some…

How to Designate an American Express Account Manager

Here come the red arrows! Not really…but kinda 🙂

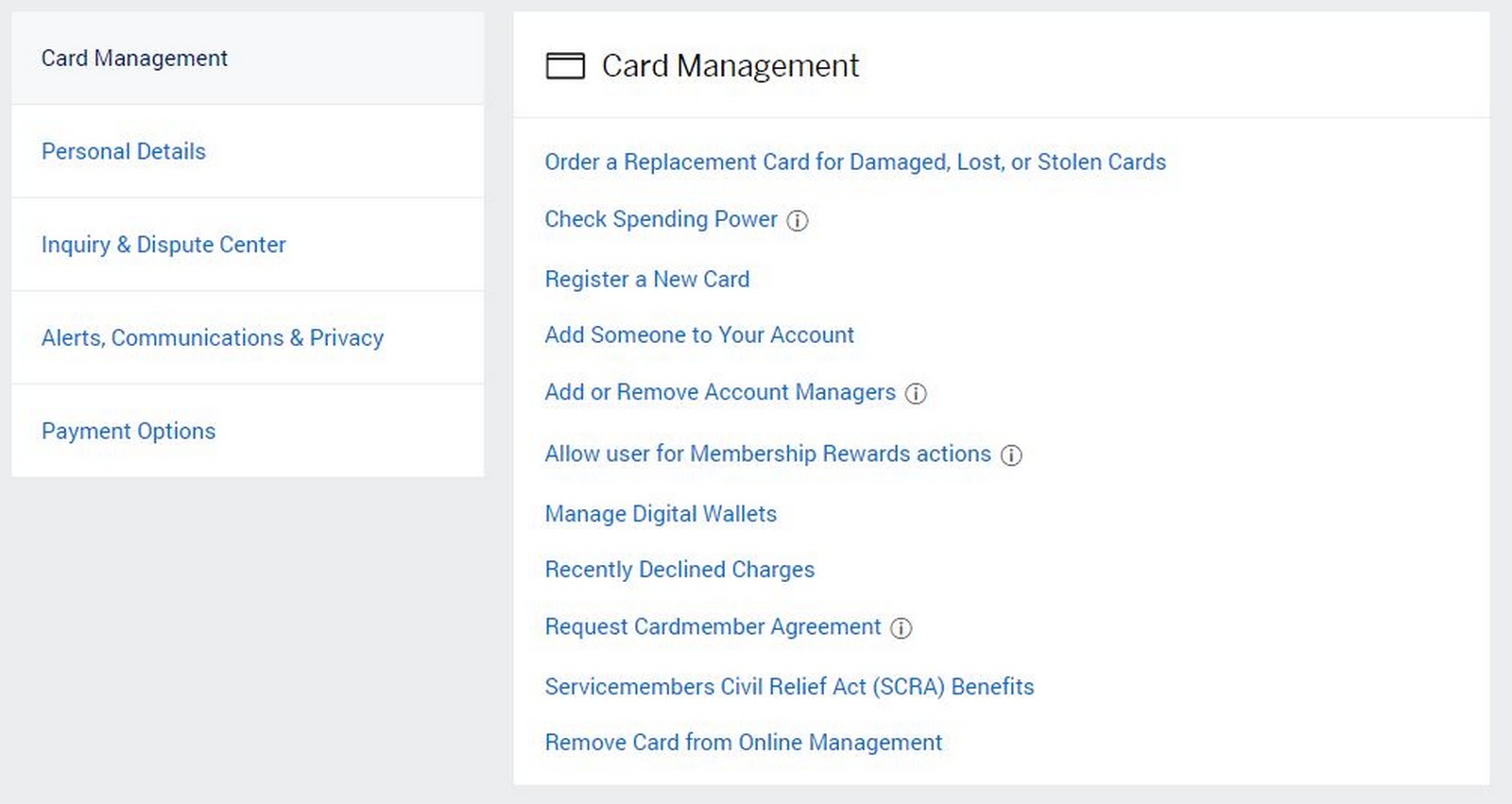

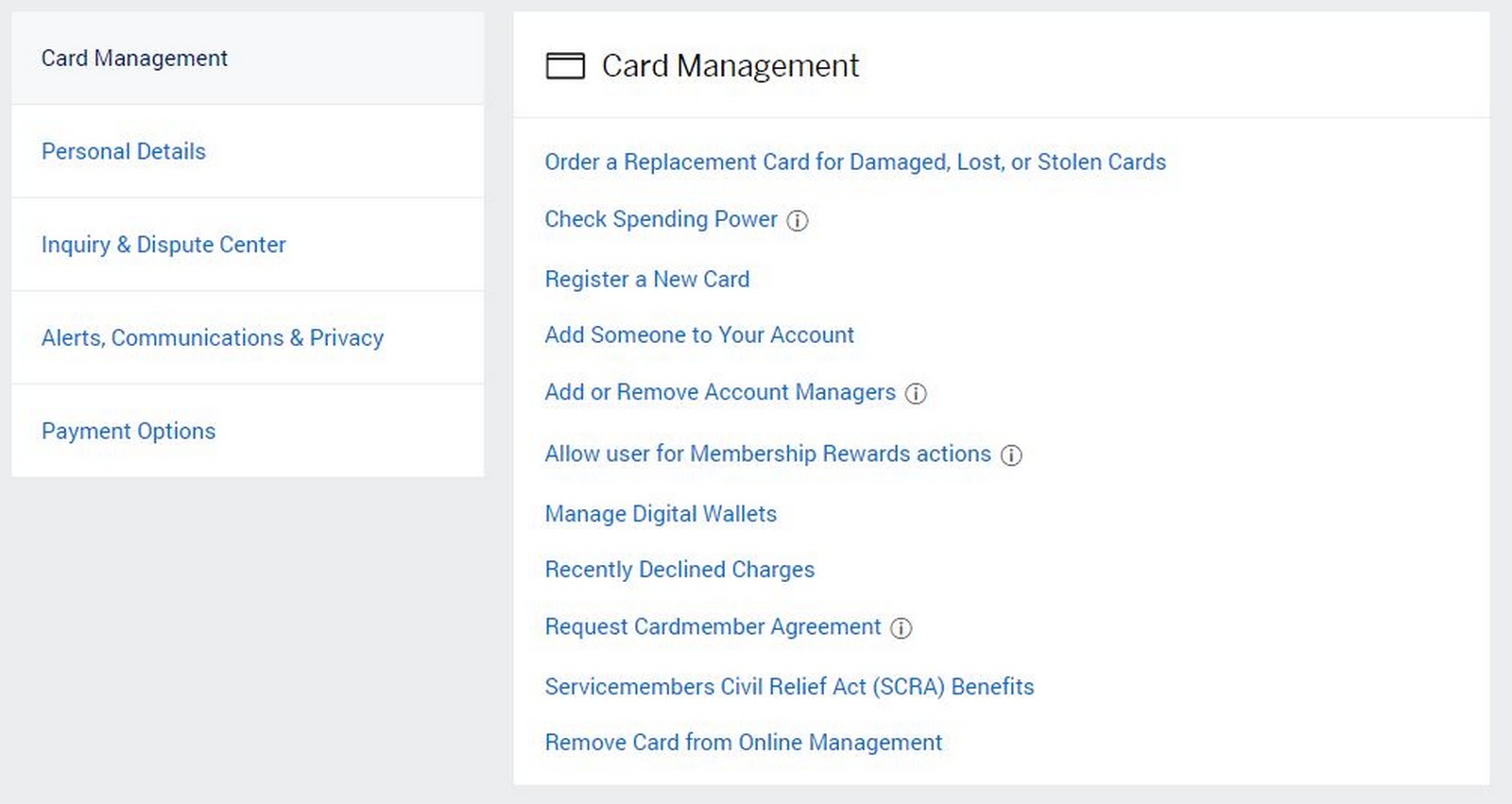

Go to account services after logging into your American Express account. It is at the very top of the page right under the card art.

Once you click through your Card Management page will be open. Halfway down the list is Add or Remove Account Managers.

Once you click that a list of all of your cards will be listed here. You have the option to add the account manager from existing users. If the desired account manager is not a current authorized user on one of your cards then I assume you will need to call in to add them.

Once you click add account manager they will ask for your personal security key. If you have this set up it should give you a hint as to what it is. If it isn’t set up nothing will be shown. Don’t just take a stab in the dark – after 3 tries the account will be locked (I know from experience 😁). You will need to call in to get it set up.

Once you enter the security key it will ask who you want to designate and which level of access you want to grant them (see graphic above). Once you do it for one card the other cards on your account will pop up and you can add a manager to all your accounts, if desired.

It will then say it is processing and can take up to a week to be added into the system. If you add someone over the phone it is added immediately.

Final Thoughts

This is useful for all types of people. Most relationships have one person who pays the bills and this makes it easier to gain access if an issue occurs. Or, if the cardholder is traveling overseas and has an issue with their card they can have their account manager call. Assuming they are unable to easily call in without spending a ton of money etc. This could also be very useful for kids that take care of their elderly parent’s accounts.

It is a very useful setup that I wish more banks would offer. It should score you some “spouse points” for sure in the long run!

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

My experience has been account manager is useful for many things though not two key areas where we need them. (1) retention offers, if calling in as account manager it does not load the same system for agents, our last effort at this was last fall where an agent explicitly told us this, so we called back in with her as primary and immediately got the offers. (2) credit reallocation department will only provide details to the primary, such a reasons for denial of a reallocation.

This is great for relationships like ours (where one person does all the work and the other one reaps the rewards) LOL!

I handled all the points and miles for our family. We separated 10+ years ago, my ex-husband never took over his accounts. Except for Amex, he doesn’t care. I receive emails each time he checks into a Marriott. 🙂

Nice!

Can confirm the other comments saying that you need to create a new account for every card you want to be a manager. What a hassle. I’m only gonna do it as needed.

It is annoying that you can’t do a blanket change over. It does make sense to do it as needed – good point.

Mark,

Thank you, thank you, thank you! And thank you to the commentators.

I actually had tears streaming down as I read this.

The advice and pointers are amazing and useful.

You made my week!

Haha glad I could help Doc!

“If you are in our Miles to Memories Facebook group then you saw my wife giving me crap about the hoops she has to jump through to fill up with gas.”

Where is this? I wanna read it.

Rep: Hello. My name is Steve. How can I assist you today?

Wife: Hi. I want to cancel my card.

Me, whispering: No, not cancel! Downgrade!

Wife to rep: Hold on.

Wife to me: What?

Me: Not cancel. Downgrade.

Wife to rep: I mean I want to downgrade.

Me, whispering: Ask for a retention offer.

Wife to rep: Can you hold on again?

Wife to me: What?

Me: Ask if they have a retention offer.

Wife to rep: Do you a retainer?

Me, waving: Just ask him to talk to me.

Haha – exactly

John, you have not included the iceberg melting looks from our spouses as we try to “help”…

My screen shot was different, FYI. Account services then “manage other users”.

This kind of tip is exactly why I spend all that time plowing through endless emails and postings about airline trivia and gift card arbitrage. Thanks! As for all the snarky remarks in the comment thread about freeloading spouses: I don’t blame my husband at all for resisting making phone calls to banks about credit cards he doesn’t care about. He does the yard work and most of the cooking and I handle the financials, and we’re both fine with that. I’ll bet you guys would not want to take on all the tasks your “lazy” spouse handles for your household on a daily basis, so kwitcherbitchin (as Ann Landers used to say).

Glad that you found the article helpful 🙂

I think most of the comments were in good fun.

“This is great for relationships like ours where one person does all the work and the other one reaps the rewards …” 😀

My day is made — thank you 😀

🙂

Awesome!! Always wanted something like this. Thanks a lot. No option for any other banks?

Not that I know of. Although you can do most everything via secure message with Chase.

Good to know, thanks! Could you imagine how difficult this hobby would be without secure messaging and we had to call in for everything?

It would make life tough

I don’t share my spouse’s love of golf, and he doesn’t share my love of all things miles/points. So, on behalf of my marriage, I thank you.

Sounds perfect:)

Yup, already an authorized user. I was sent an email for each card with a special code and directions for finalizing my status as an account manager. While completing the final steps on my end I was prompted to create a new ID and password. Did not appear to be any way to utilize my existing login. I stopped there for now.

I would log into her account and see if you are already added. That may be just so you can pay the bills etc. and not needed.

Thanks, Mark. I think what happened was I didn’t properly select myself as an authorized user on the initial step of adding an account manager. This led me to walk through the process as if I were a 3rd party. Ultimately, I checked my wife’s account and I was officially added as an account manager even though I skipped the final step of creating a new login. Thanks!

Excellent…glad it worked!

I am experiencing the same issue and after using the AmEx chat functionality they are telling me that I cannot merge account manager cards with my personal amex account. I really don’t want two logins, how were you able to add it? I am looking to manage my wifes cards, enroll and manage the benefits mostly, from my existing account.

You can’t add someone else’s card under your own account. My wife had her own online set up but she added me so I could call in and chat on her behalf.

Thanks for the heads up. I’m going through the process and its forcing me to create a new Amex login and password for each card that I am becoming an account manager. Is that your experience?

No that wasn’t my experience at all – that is strange. Were you already an Authorized User?

Although mine are still pending except for the one my wife did over the phone when we called in to unlock her card (after guessing at password)

To qualify as an account manager, do you have to be an authorized user on each other’s account? We have purposefully not placed each other as authorized users as we want to stay as low 5/24 as possible.

To do it online I believe you do but I think you can call in and have them add it without being an Authorized User but I am not 100% on that.

Love the post. Very amusing. My wife hates that I’m opening new credit cards, buying gift cards, or having her change her auto pay bills to a different card/payment processor. “Another new credit card? Isn’t that going to hurt your credit?”, “No more gift cards!”, or “I am trying to simplify my life and you’re complicating it” are my favorite comments. You’re welcome for getting 5% back on the groceries or finding coupons/portals that help pay for your online shopping habits.

Haha same story here. After 5-6 years she has complained less but this sure does make life easier!