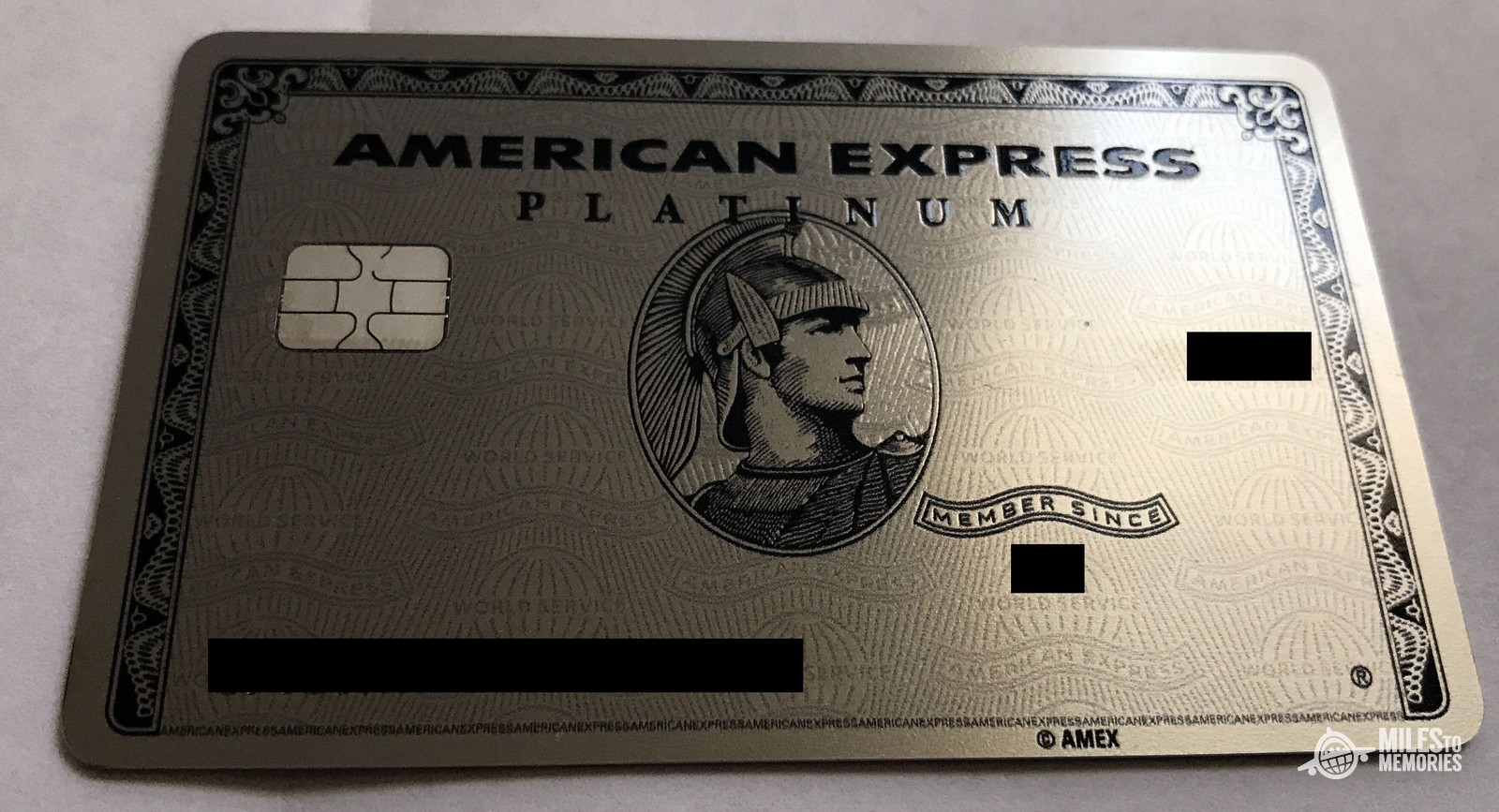

American Express Platinum Varieties Guide

The American Express Platinum Card is generally considered one of the top premium travel cards on the market thanks to it’s endless number of benefits, unique perks and ability to earn Membership Rewards Points. There are several variations of this awesome card issued by Amex. Each version of Platinum has the same baseline benefits but there are some considerable differences to consider when choosing which one is right for you.

Recently, American Express decided to do way with the Mercedes Benz version of the Platinum Card a move which we discussed in detail. I didn’t include the Business Platinum Card because we’ll be doing a separate comparison for Personal v. Business.

Platinum Card Varieties

- Amex Platinum (Regular)

- Charles Schwab Amex Platinum

- Morgan Stanley Amex Platinum

- Goldman Sachs Amex Platinum

- Ameriprise Financial Amex Platinum

American Express Platinum Card Benefits

For complete details on the innumerable benefits, check out my American Express Platinum Card Benefits: Ultimate Guide Including Details of Each Perk and How to Maximize Each version of the Personal Platinum Card comes with the same central benefits including:

- 5X points on airfare and prepaid hotel bookings at Amextravel.com

- $200 a year in statement credits for airline incidental fees

- $200 a year in Uber credits

- $100 in Saks Fifth Avenue credits ($50 every 6 months)

- $100 Global Entry fee reimbursement every 5 years.

- Airport lounge access (Centurion and Priority Pass)

- Rental car elite status

- Elite hotel status

- And so much more

Related: A Way to get Free Changes & Cancellations on American Airlines Without Status

Key Differences

Annual Fee

The cards come with a $550 annual fee except the Ameriprise Platinum version has no annual fee the first year.

Current Welcome Bonus

I’m unable to find the bonus for the Goldman version and the Ameriprise doesn’t have a bonus because the annual fee is waived the first year. The publicly available bonus for all versions is 60k after $5,000 in spend. This happens to be a great time to sign up for the card because occasionally CardMatch and American Express team up to provide targeted offers. Right now some people are reporting that they are being offered 100,000 Membership Rewards points for signing up for the Amex Platinum card. Click here for details and instructions on how to see if you’re one of the lucky ones.

Related: Caution: You Should Be Careful with Amex Bonuses, Clawbacks Could Happen Even If you Don’t MS

Relationship Requirement

Goldman, Morgan Stanley (MS) and Schwab require a relationship but Ameriprise is available to the public.

Authorized Users

See Chart for additional platinum fees. Gold cards are free for authorized users.

Unique Benefits

- MS allows one free authorized user and Ameriprise waives the $175 fee for the first year

- Spending Bonuses

- Morgan Stanley: $500 Credit for every 100k in spend

- Ameriprise: 5,000 Membership Rewards for every $20k in spend (limit 30K MR’s)

- $550 Credit for those with $1M in assets at MS

- Membership Rewards

- Schwab allows Membership Rewards (MR) points to be transferred to your account at a rate of 1 : 1.25

- Morgan Stanley allows a 1 : 1 transfer

- $100 or $200 credit depending on funds with Schwab

American Express Platinum Versions Compared

| Card Features | Amex Version | Charles Schwab | Morgan Stanley | Ameriprise Financial | Goldman Sachs |

|---|---|---|---|---|---|

| Annual Fee | $550 | $550 | $550 | $550 (Waived First Year) | Unsure |

| Current Bonus | 60K after 5K Spend | 60K after 5K Spend | 60K after 5k Spend | 0 | 10K after First Purchase |

| Authorized User Fee | $175 Up to 3, $175 for additional | $175 Up to 3, $175 for additional | 1 Free, $175 for additional | No fee first year then $175 Up to 3 + $175 for additional | $175 each |

| Additional Benefits | *Transfer MR's to Schwab Account at a rate of 1 : 1.25 *$100 or $200 Statement Credit for 250 or 1M in Schwab Accounts | $500 after $100,000 spend within card member year | Earn 5k MR's for every $20K in spend (up to 30k MR's) | Anniversary Spend Bonus of 40k MR after $100,000 in spend in cardmember year | |

| Relationship Requirement | None | Customer | Customer | Encouraged but not required | Customer |

Conclusion

As you can see, each version of the American Express Platinum Card has a ton of benefits and unique variables that factor into the right choice for you. If you’re only interested in keeping it for a year and not paying a fee, the Ameriprise version is the way to go. If you have a financial relationship with any of the financial institutions, you may factor those in as well. You are allowed to get a bonus on each since they are considered different cards.

Before applying make sure you check to see if you’re eligible for 100k Welcome offer. Platinum also happens to be my favorite premium card because of the elite status at Hilton and Marriott and the Membership Rewards program. Here’s our American Express Membership Rewards Points Guide: Including Best Ways to Earn and Redeem Rewards Points.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.