American Express Letter to Costco Cardholders

As I covered earlier this year, Costco decided to dump American Express as their co-branded credit card partner after a very fruitful 16 year relationship. Eventually we found out that Citi and Visa would be the new partners and that those companies would be buying the entire portfolio of Costco credit cards.

What does this mean for American Express? Well Costco customers represented 8% of the the company’s billed business last year, 20% of their worldwide loans and 10% of their overall cardholders. That is a huge chunk of business to be losing. (Source: CBS News)

The Pointless Letter – Sell Something!

Of course then you would think that the company would begin working hard to switch existing Costco cardholders into different products before their partnership ends on March 31, 2016. Indeed they have done that to some extent in the past. I reported on a very good offer my dad received for example.

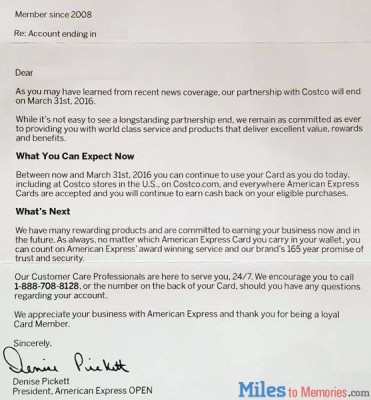

But today, friend of the site PDXDealsGuy sent over a copy of a letter he received from American Express. This letter (shown below) seems kind of pointless. It talks about how the Costco card will work until the end of March, 2016 and about how Amex is dedicated to earning and keeping his business. Nowhere does it push to convert him to other cards.

My guess is this letter is just the first of many methods of communication that Amex will use to contact cardholders. To me, the letter seems to be designed to butter up cardholders a little. It is more about branding than creating a call to action. I wouldn’t be surprised if every Amex Costco cardholder receives a great increased offer in the mail eventually, but Amex probably wants to create warm fuzzies first.

Does This Make Sense?

On the surface this letter seems pointless, but it is designed to make Amex look good to the consumer as they transition. Losing Costco is a huge hit for Amex and they will need to convert as many cardholders as possible in order to avoid a huge hit to revenue.

In other words, this transition is way too important to mess up. No one opens up a negotiation and goes right to selling. That will come later. I’m sure of it. For now, they just want you to like them before they try to start closing.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

When I moved to a “Non-costco” area I had to migrate my costco-amex to another since Once you loose your membership the AMEX is automatically cancelled . Actually the BLU card has the same benefits as the costco card and has no annual fee. I will say this about AMEX, they do stand behind their customers , I have not had any issues with warranty protection or disputes. I now have a Sams and a BJ’s in my area and I shop at BJ’s since they take all cards. Sams locks you into Mastercard or debit only and I am not going down that road again.

[…] The Pointless Letter that American Express is Sending to Costco Cardholders […]

They won’t stop sending me Blue Cash increased offers of $200 signup bonus. I signed up last month and they’re still sending them. I’m glad I got an increased offer, but not sure if it was targeted due to my Costco card. Hope they send more for different cards.

As long as they offer me something good (I got the $500 targeted SimplyCash business card offer and an instant approval for it as my first business card), I don’t care if they send out some meaningless letters at the same time. Hope they keep working on more offers before they ‘lose’ me.

Thanks for the link to me. I agree completely with your take on the situation. I’m looking forward to seeing what Amex’s pitch is going to be, as well as what Citi does with this new product.