Amex Serve Shutdown Data Point

Yesterday American Express conducted a second round of closures for Bluebird/Serve account holders who Amex feels aren’t using their accounts as intended. This second closure came exactly nine weeks after the first round in January. As Frequent Miler points out, this timing is something we should pay attention to in order to find a pattern.

From Two to One to None

Back in January my very old Serve card was one of the ones shutdown. Thankfully my wife’s was spared at the time. I wasn’t too surprised by this since it was a fairly new One VIP Serve that she opened after closing her REDcard following the end of debit card loads. In order to try and preserve her Serve and because we didn’t have much use for it, we stopped using it in January.

A Data Point from My Wife’s Shutdown

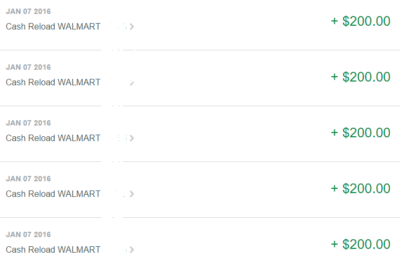

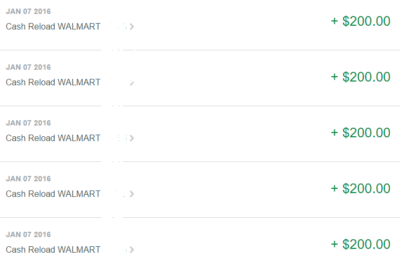

Unfortunately despite our best efforts, my wife’s card met its demise yesterday. After the sad news finally settled in, I looked at her account to see what activity it had in the past nine weeks. Other than the redemption of the Jet Amex Offer, she hadn’t loaded the card or paid a bill. There was even a few hundred dollars sitting in there. As a data point, here is her last load activity:

Does the date of those loads look familiar? It is the day before the first round of shutdowns. Her account was spared because it was too new, but this data eventually made it into their report.

Takeaways & Strategy Going Forward

Since my wife had not used her card other than for legitimate purchases since January 8, 2016, I think it is safe to say that curving your behavior won’t make a difference if you haven’t been shutdown. Shortly after the first round of shutdowns, Julian the Devil’s Advocate said that people should keep doing what their doing. He was right. My wife could have used her card in January, February and early March and didn’t. She was shut down anyway. If I was someone with a card that is still alive, I would keep using it.

Conclusion

A number of people wrote in the comments of yesterday’s post that they had limited activity since the first round of shutdowns and still saw their account closed yesterday. I do believe American Express is looking back at the entire account history and thus laying low most likely won’t work. As for what they are looking for, we still don’t know, but almost everyone at some point had loaded their Serve/Bluebird card with a debit card at Walmart.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

New Fee?

I received a new VIP One Serve card (my wifes was canceled in the first round) today. I activated it and headed to my favorite MW to add some VGC loads. I started to use Kate as normal but when I put in the $200 for the card load amount the screen came up with a “Serve Reload” of $3.74 creating a total of $203.74 needed. I canceled the transaction assuming I had done something wrong and tried again. Got the same result the second time. Has anyone else run into this? $3.74 fee to load $200 is just not worth it. Does someone have a possible explanation?

This happens sometimes and going back a different day or even to another register seems to fix it. Have you continued to run into this?

Shawn,

As it turns out it is somewhat my fault that I am getting a fee. It appears that AMEX no longer offers the Serve ONE VIP. I am pretty sure that when I applied several weeks ago it was still being offered and that this was the card I requested.. What they sent me is the Serve Cash Back card. Looks just like the ONE VIP except it does not say ONE VIP on it. I stopped at a couple WM (kate at one and register at the other) and a Rite Aid. WM was $3.74 and Rite Aid was $3.95 per load. I will have to see about getting the Serve Free Reloads card.

So you applied for the One VIP on this site: https://www.serve.com/onevip/ ? It seems they are saying it is still available which is strange. I would definitely get a different Serve card.

The theory of loading at Walmart being the trigger is not it. I only loaded at FD and RA and got shut down. I suspect they somehow know that it was loaded with a GC.

I work with someone who came over from AmEx. He worked in Product Development and worked on the Serve rollout. I spoke to him about Serve and BlueBird about 18 months ago and asked if he thought AmEx was looking to replace BlueBird with Serve. He told me absolutely not, AmEx has a long term contract with Walmart and will not/can’t get rid of BlueBird. Well now it’s 18 months later and AmEx has a different view of the prepaid business reflected in their laying off most of the staff in the prepaid headquarters down in Florida, yet they are still in a long term contract with Walmart to service these money losing cards. How do they reduce their losses? Very easy. Close any account with even slightly suspicious activity. Say it is not being used as intended (although within the rules) and offer no recourse. We hate it, but it is a smart business decision.

Thanks for the insight.

Unfortunately, I didn’t escape the second round. Should I just close my Serve account since this card is literally useless now? What do you think?

Credit card load still working.

I would think that there are a number of indicators for Amex to track. One that may not be thought of, is the gift card numbers themselves. The debit card numbers starting and ending the number set on the card, signal the card type, bank, route, etc. It would be pretty easy to tell that someone had loaded from several “debit cards” (gift cards), all with separate one use card numbers and associated with banking and routing codes assigned to gift card sponsor banks.

This would be a huge red flag for AMEX.

99% sure Amex doesn’t even see that. To them, it’s a “cash reload”. Walmart (or RA, etc), handles the debiting of the card.

They definitely have access to that info, and it definitely doesnt show up as cash. There is an interchange associated with gift cards and AMEX absolutely would be responsible for that. Even if the cards number was tokenized, AMEX would be privy to the bank and route of card.

I pay my utility bills with serve, also use it at Costo, and other places,

Wife has one also

So far no problem…

Load about 2,000 a month. Both cards..,

I hope you continue to be spared!

I bought tires for my 04 Saturn at Costco and put it on Serve in January. The cost was 500 dollars. So I had a one time hit of roughly 20 bucks in reward points i gave up. To me it is worth keeping Serve going.

Rampant speculation is all one encounters reading about these shutdowns, but I think it’s a fair guess Amex will return to the field once they figure out how to do it profitably. But please, let’s stop dressing up campfire stories and calling them “data points”.

I’ve had a Serve card since summer 2015 and have never used it. It’s been spared, probably for obvious reasons. MS has always been something to get around to but haven’t as of yet. I just got the SPG personal card and will probably use Serve to satisfy the min spend. Might as well finally use it right? FT says direct loads still work to satisfy minimum spends. Any data points as to whether this still works or not? Many thanks

I used it for meeting minimum spend on my Amex Business Gold.

As a data point, my Serve card was only ever loaded online via my Platinum card and used for normal spend a few times a month with the random $1-4 transactions and $200 ATM withdrawals to MS roughly $1000 per month. Terminated on the 4th.

I wonder if an open account->load->bill pay->close account->repeat cycle would spare someone from closure/banning?

I wondered the same thing. Nearly tried it with my wife’s account (I got caught in the first round) but I pushed a little too far since I wanted to do a March load first After my week of business travel. She’s out now too.

Somebody above mentioned churning Serve cards. I have to imagine the answer is no, but for what it’s worth – can I just open another Serve Card? Or switch to Bluebird?

They only allow one Serve or Bluebird card per SSN.

Do you know if Amex can tell if you are loading Serve at Walmart with cash, pin enabled gift cards or actual debit card?

I suspect they might not since the account says cash reload. But I think they can figure out it is MS when there are multiple loads in one day. If you were loading with cash you would do it all in one load.

Who knows, may be there is some number the dept has to meet. If the resulting number is still too large after the 1st round, they will continue to axe. That’s how how cost cutting works.

Just a wild ass guess here, but it seems to me that multiple debit loads in the same amounts, and especially on the same day, will trigger the red alert. A person loading the card legitimately would most likely only need to load it once. Going forward, for our purposes, I don’t think there’s anything we can do to prevent the shutdowns. With this new data, we may just have to churn serve cards now.

This is a very good point and I suspect you are probably correct.

Disagree.

I expected my main MS cards to get the axe in 1st round. They were both maxed out beginning of month in a few days, and I’d often send money from one card to the other, to enhance balance for billpay direct to CC.

I also had a BB opened in November that I used sparingly. It was a card I opened for an aging relative so I could billpay for them in the event they “forgot” an important bill. I ran a little MS through it but at the time it was just overflow from my main MS cards, ~$1-2k a month. I NEVER loaded more than one VGC per day. There was spend on it at WM and other locations. Wrote some physical checks, did billpay to utilities.

And yet it was shutdown in this second round. At this point, I think MS as a long-term avenue is effectively dead. You might be able to use it tactically, open a new BB/Serve and max it out end of one month start of next. You might even be able to get start of another month, but count on being shutdown eventually. IMO no amount of “well THIS activity pattern ought to look legit” will matter.

Furthermore, I don’t think American Express CARES if they sweep up some legit customers in this dragnet. Notice they don’t give any phone number to call at shutdown. Normal users who get a shutdown, will just close it rather than write a letter to appeal. IMO this is a step toward closing Bluebird/Serve in the long run.

Churning the Serve/BB won’t work. I tried applying for a new Serve and was denied. A friend also got denied.

My OneVIP was shut down yesterday as well. I’d never loaded or used it at Walmart. Did load several $500 VGC at RiteAid and Family Dollar though. Don’t think Walmart specifically has anything to do with it–any pattern resembling MS will get shut down.