Brand New Amex SimplyCash Plus Credit Card

It isn’t everyday that a card issuer releases a new product, so it can be kind of exciting. This week American Express released their new SimplyCash Plus credit card which is a replacement for the normal SimplyCash card. How does it stack up?

SimplyCash Plus Credit Card Overview

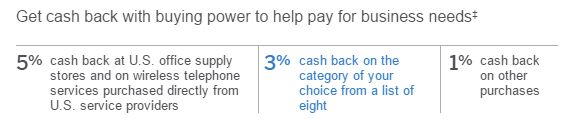

The SimplyCash Plus credit card has no annual fee and earns cashback in the following ways:

- 5% on Wireless telephone services purchased directly from U.S. service providers and U.S. office supply stores.

- 3% in the cashback category of your choice. (Choose from: airfare, hotels, car rentals, gas, restaurants, media, shipping or computer hardware.)

- 1% on all other purchases.

Note: The 3% and 5% categories are capped at $50,000 in spend per year.

Enhancements from the Old SimplyCash Card

As far as I can tell, the Plus card carries two enhancements from the previous version of this card. One of the changes is minor and the other is significant.

- The first change is the addition of computer hardware as a choice for the 3% categories. Not a huge addition in my opinion.

- The second change is major. With the old SimplyCash card the 3%/5% categories were limited to $25,000 in spend. Now that number has doubled. That is significant.

Two Bonus Offers

As part of the launch of this card, American Express has two different bonus offers. Both expire 8/3/16.

- Offer 1: Earn a $250 statement credit after $5,000 in spend within the first six months. $250 Credit Offer Link

- Offer 2: Get an additional 2% cash back in statement credits on up to $25,000 in purchases made on the Card within the first 6 months. (Total $500.) Extra 2% Offer Link

Offer Analysis

There is no right or wrong answer in my opinion about either offer. Which one to choose will be determined by how you plan to use the card:

- For big spenders, the extra 2% will be the right choice, since it means a total of $500 in credits.

- If you don’t plan to spend at least $12,500 in purchases on the card within the first six months, then the $250 bonus is the better choice.

Worth It?

For those who are struggling to get a Chase Ink card, the SimplyCash could be a great alternative. Not only does it earn 5% at office supply stores, but it has a generous selection of 3% categories (you choose one), it comes with no annual fee and it is also eligible for Amex Offers. Overall this is a winner of a card in my opinion, especially since the bonus category limits have been raised.

Conclusion

It is nice to see American Express enhancing their products in a way that doesn’t take anything away. The addition of a 3% category is nice, but the real news is the new $50K limit on bonused spend. Combine that with the two very good sign-up offers and Amex Offers and I think this is a card that could be on a lot of people’s radar. What do you think? Is the new Amex SimplyCash Plus credit card something you are considering? Let us know in the comments.

Miles to Memories has partnered with CardRatings for our coverage of credit card products. Miles to Memories and CardRatings may receive a commission from card issuers.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

[…] New Amex SimplyCash Plus Credit Card with 5%/3% Categories, No Annual Fee & 2 Great Bonus Offers… […]

Anybody tried changing product from old to new Amex SimplyCash Plus?

Yeah, I thought about that as well. For me though right now the $25k cap on office supply is sufficient. If you try to do the product chance you’d miss out on the sign up bonus though, unless they allow you to have two of these cards, at which point you could try to downgrade one of these cards at that time to maintain your AAOA since you’re capped at 4 Amex non-charge cc (although I now have 5 myself).

Unless you’re spending over $25k in bonus category I don’t see any reason to upgrade to the plus.

Is offer # 2 the wrong link or the wrong card? When I go to it, I don’t see this card, only gold, silver, Platinum, and Plum.

Yup looks that way. I’m not sure it’s really worth it though, considering the opportunity cost is using a 2% cc.

Given that this card earns 1% on non-bonus category spending it’s really only a 1% bump above and beyond using a 2% cc. Thus from what I can tell it’s really just a 3% cc on up to $25k in spend and you only have 6 months. In contrast if you go with Option#1 its 5% on the first $5k.

So what you’re gaining here is an extra $250 for $20k in spending, or 1.25% cb. Considering the card is 1% for non-bonus you’re really gaining a net .25% for $20k spend AND you’re forgoing using other credit cards (such as for minimum spending).

Unless I’m missing something here option#2 is by far an inferior deal, even if you are a big spender. The only situation where I could see it being worthwhile is if you’re spending that $25k on bonus categories (such as Staples). Depending on how you mix up your spend you could raise red flags here. However, if you’re a re-seller and source from office supply and/or a 3% category then it could be worthwhile.

Of course if they have any sign up bonus attached to offer#2 then everything goes out the window. I tried to google the link and I can’t find anything other than $250/$5k spend. Maybe they removed it since he posted the link.

I have the Amex Gold business card for the 3x on shipping. Our business’ UPS and FedEx bills are in the thousands. This is a great alternative when the annual fee posts on the Gold card.