Chase Adds Helpful Tool to Marriott Credit Card Applications

With credit card issuers changing bonus eligibility rules continuously, it becomes difficult sometimes to keep track. American Express made that easier last year by introducing a tool that would let you know whether you would be eligible for a signup bonus during the application. That wasn’t all good news, since they also get to pick arbitrary reasons to deny you a bonus, but at least you know ahead of time and can choose not to go through with the application.

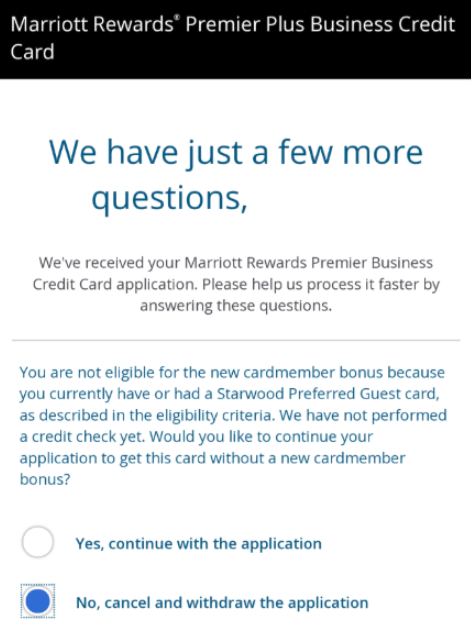

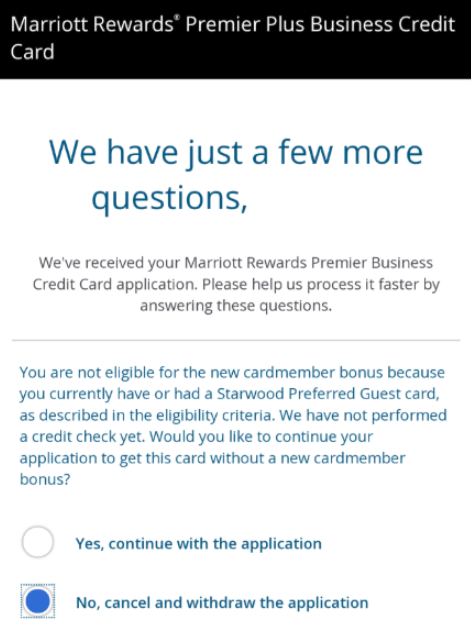

Now Chase is doing something similar for Marriott credit cards. While applying for one of their cards, you will get a pop-up letting you know if you are not eligible for the signup bonus. The notification was showing up recently for those who were applying for the Marriott Rewards Premier Plus Business Credit Card that is going away after February 12th, as part of the Bonvoy rebranding. The new pop-up will let you know if you’re ineligible due to previously having had specific American Express SPG cards.

Eligibility for Marriott Rewards Premier Plus Business Credit Card

You are ineligible for the welcome offer on the Marriott Rewards Premier Plus Business Card if:

- Currently have or have had any of the following Cards in the last 30 days

- Starwood Preferred Guest® Credit Card from American Express ($95)

- OR have acquired any of the following Cards from American Express in the last 90 days

- Starwood Preferred Guest® American Express Luxury Card ($450)

- Starwood Preferred Guest® Business Credit Card from American Express ($95)

- OR have received a welcome offer or upgrade bonus for any of the following Cards from American Express in the last 24 months

- Starwood Preferred Guest® American Express Luxury Card ($450)

- Starwood Preferred Guest® Business Credit Card from American Express ($95)”

Conclusion

That’s a lot of restrictions to keep track of, so it’s helpful that Chase will at least let you know if you will not get a bonus. That way you can cancel and withdraw your application.

HT: Doctor of Credit

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I agree with you for the transparency. Recently I applied for AMex SPG /Marriott Card. I called And asked if I would be eligible for the reward. The agent said YES. So after completing the $6000 spent I asked them for the reward. The reply was I have too many cards. It would have been better all around if they let me know upfront. Pisses off.

Amex has been playing dirty games like that lately.