How to Check Your Chase Credit Card Application Status

Wondering how to check your Chase credit card application status after applying? Assuming you weren’t instantly approved, you should follow the status to know what’s happening. In this article, we’ll look at how to check the status of your application and also why this might matter.

Why You Should Check Your Application Status

Before we discuss how to check your Chase credit card application status, the question is why this matters. There are a few reasons why it matters.

First, welcome offers have conditions. These start from the date the card is approved. If you aren’t checking the application status, it might be hard to nail down what date the account was opened. (Note: you still can get this later)

Second, your records matter. In this hobby, you need to be organized. Chase, as with all banks, has application rules and welcome offer dates. You need to know when you opened a card to make sure you’re following these. The most prominent of why this matters would be watching your 5/24 status.

Lastly, applications aren’t valid forever. If it just sits as “pending” for too long, the application will be discarded by the bank. This usually happens at 30 days. Check the status to keep up to date with what’s happening and prevent this.

Now that we know some important reasons for why you want to check your status, here’s how you can check it.

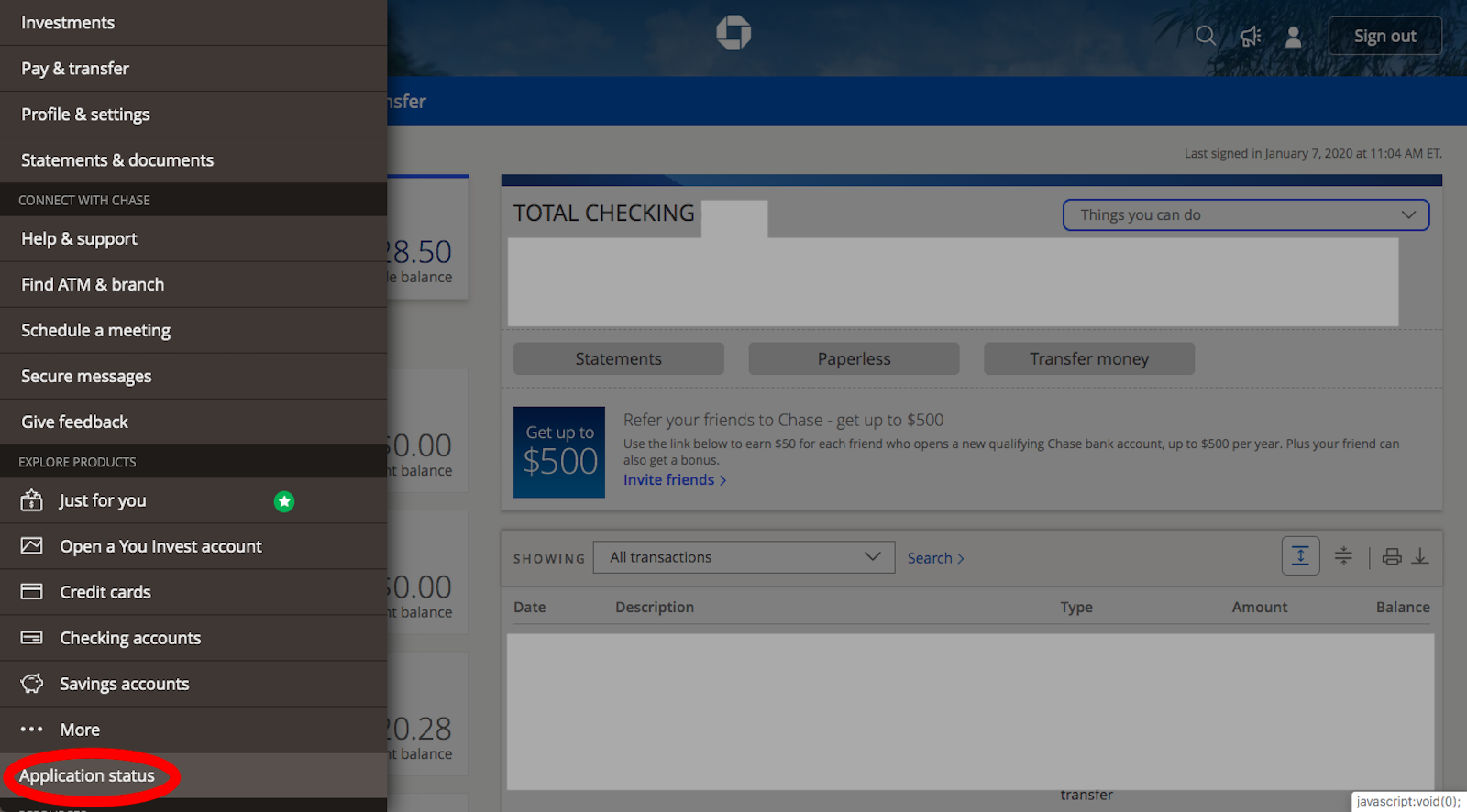

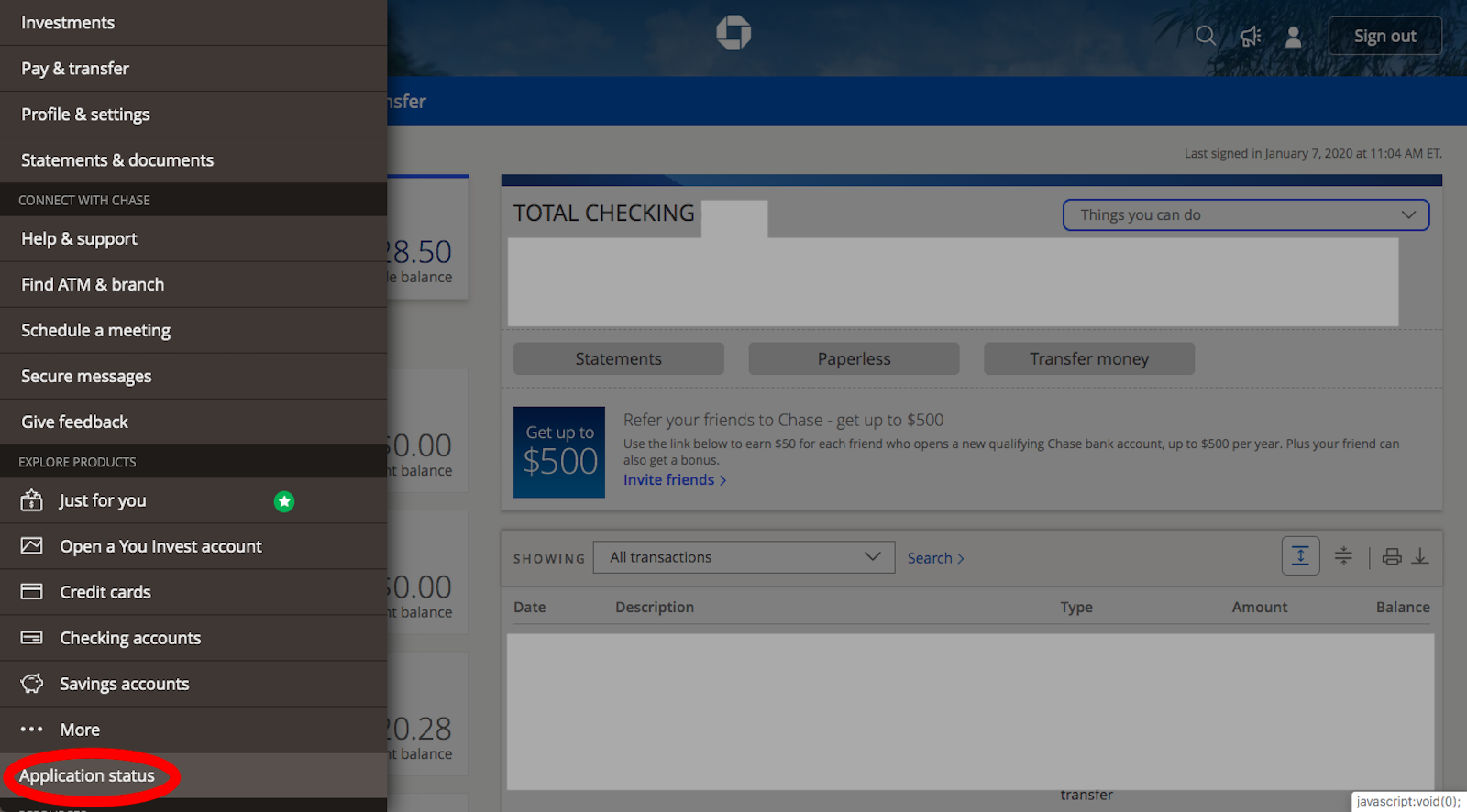

Check Your Chase Credit Card Application Status – Online

If you’re already a Chase customer, you can check your status online. Log into your account and click on the 3 lines in the top left corner. This will open the menu. Scroll down to “application status”. You will see your application there and the status of it.

Check Your Chase Credit Card Application Status – By Phone

You can call Chase’s automated information system to check your status. It’s easy and doesn’t require talking to anyone. Call 800-432-3117 and put in your Social Security Number. You’ll hear the status of your application.

The Status Options You Can Receive

Chase has multiple options for what status you might hear on your application. “Approved” is obvious. So is “denied”. Here are the other two options you’re likely to hear:

- You’ll receive a decision within 30 days. Traditional thinking on this is that your application hasn’t been looked at yet. Wait a few days and then check again. If it stays on this same status, auto approval isn’t likely. You’ll need to talk to someone. Maybe you misspelled something on your application. Perhaps they want more information. Maybe you’re getting denied. I’ve seen more data to support this line of thinking than against it, but of course there are outliers.

- You’ll receive a decision in approximately 2 weeks. If your application changed from the “30 days” status to this “two weeks” status, this usually means you’re getting approved. Wait a few days and check again. You should hear “approved” as your status soon.

Reconsideration Call

A reconsideration call works is like a second chance on your application. Maybe you were denied. Perhaps you need to provide more information. Maybe your application is taking too long or wasn’t approved. You can call Chase to discuss the application. Call 1-888-270-2127 (personal cards) or 1-800-453-9719 (business cards) to talk to a person. You can provide your Social Security Number or the application ID you received in the mail/email from your application.

We have a resource on reconsideration strategies, as well as what you’ll likely be asked. While phone calls are by far the most common reconsideration path, there are other options, as well.

Final Thoughts

It’s quite fast to check your Chase credit card application status. There are a few different results you might see when checking your status, so we looked at what they mean. If things aren’t moving forward the way you want, we covered how to use reconsideration. I hope you’re approved for your new Chase card at this point. Happy travels!

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

[…] you apply for a Chase credit card. And the you…wait. Here is How to Check Your Chase Credit Card Application Status. I remember the days when these apps were instant […]

The quickest way I’ve found to see if approved in both personal & biz is to login & see if shows up under my Accounts on the Dashboard.

Yes, that often works — assuming it matches previous accounts. If it’s for a new business, then it won’t.

If a biz checking acct was opened for the new business, the SS/TIN links to the info taken on the cc lending app. The new biz cc, if approved, then shows on the same login as the deposit acct. A rep told me as long as the ID numbers match, it will link & display, a new biz name (only) is not relevant.

Yes, if they match, then it should show up. My point was that if it’s a different business or is for a business but you only had personal accounts previously, then this doesn’t work. If it’s apples to apples, then yes this works. 🙂

I recently got approved for a CSR (before the AF increase was announced), then applied for a Freedom Unlimited which was then denied. This was back in November, so I’m looking for advice on what I can do to try from here. Should I just call the hotline and reference my past application? Is there a safe period to wait before trying the online application again?

I’m under 5/24 and only have the one Sapphire card currently.

Had you applied for any other Chase cards recently (they have a rule against more than 2 cards in 30 days)? You’re still under 5/24 even with this CSR (5/24 includes ALL cards on your credit report, not just Chase cards)?

You can apply again after 30 days and it will be a new application. You could’ve done a reconsideration call previously — did you not call?

Also, what was the denial reason?

No other Chase cards other than the approved CSR and denied Freedom.

I have 5 credit cards in my report, the CSR is #5 and earliest 2 are in 2008 and 2011 so it is well beyond the 24mo. period.

The letter didn’t show any contacts and I’ve only recently learned about the reconsideration line. (still new to points and miles)

They listed 4 reasons, Too many requests for credit or opened accounts, One or more credit cards have a high balance, Insufficient installment loan information, One or more recent requests for new credit

I assumed I hit 5/24 at the time of application but it turned out not to be the case when checking out the report afterwards. I’ll probably try again if I decide to keep a flavor of the Sapphire.

so basically they think you have too many recent requests for credit and a card with a high balance. Wait a bit, pay off your balances, and that should address the major issues.

Maybe it was the Amex Gold and BBP I got accepted earlier in the year in addition to the two Chase applications?

I don’t carry any balances on any of my current cards, so I’ll wait a bit and try again.

Yes, that can change things. They see a bunch of inquiries and new accounts in a short period. They will see the inquiry for the Amex Blue Business Plus but not the account. They’ll see the inquiry and then the new account for the Gold personal card. If those were several months ago at this point, your application will show more maturity on the accounts when you apply again. Should work this time.

Looks like a short wait was all I needed.

Approved for the Freedom Unlimited now.

Does not work for business cards. My wife is under 5/24, above 800, only 4 Chase cards and twice she has not gotten the Bus. Ink Cash. She has a real business.

What doesn’t work? I was confused by your comment.