Check Your Southwest Account For A Credit Card Spending Offer

I was booking some flights for my parents in my dad’s account, like I always do, when I noticed a promotion he was targeted for. It was for a 25% bonus on points for spending on his credit card over the next 3 months. But the spend requirement was no small amount, 20,000 points need to be posted to his account from his credit card to earn a 25% bonus.

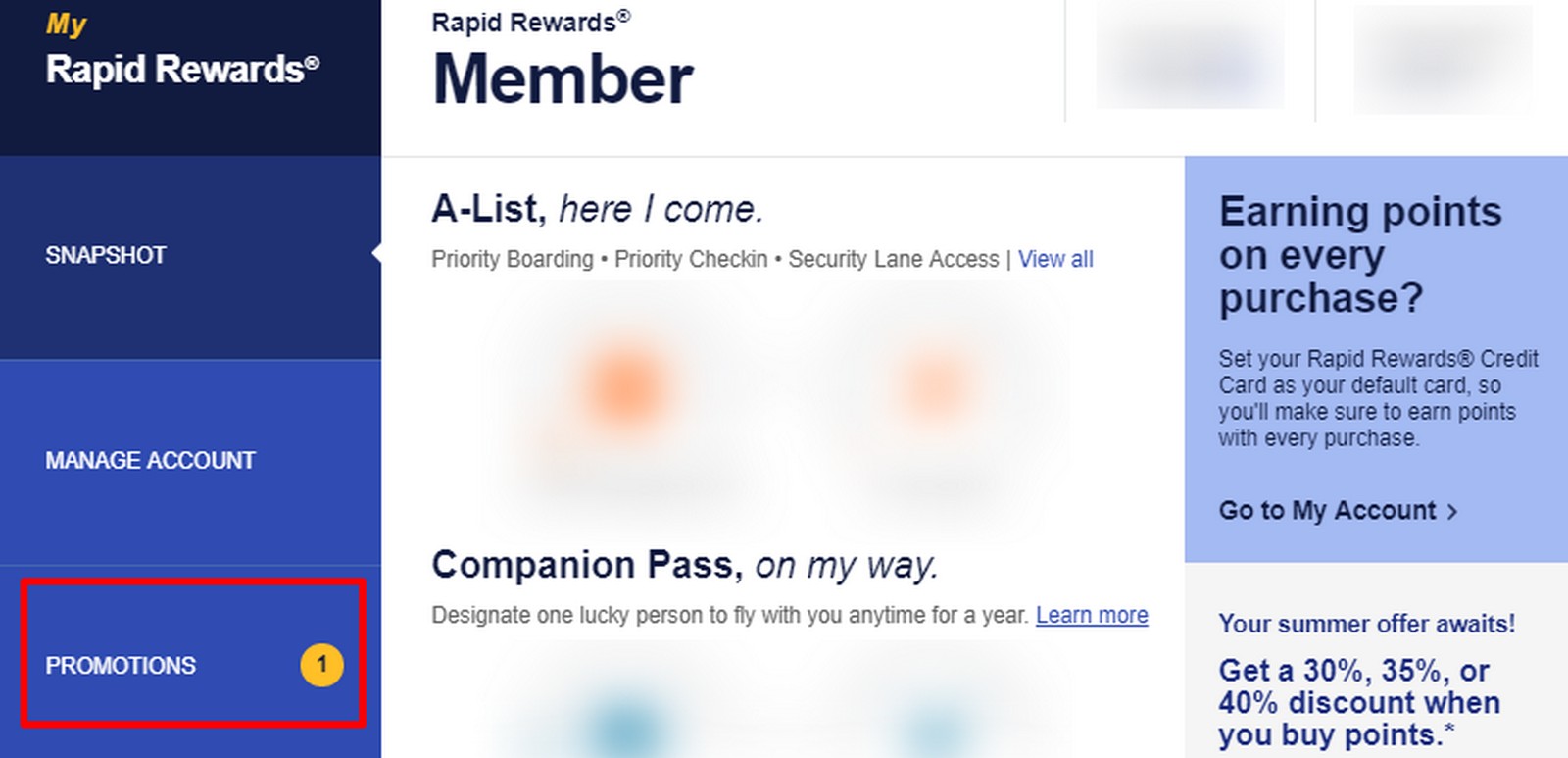

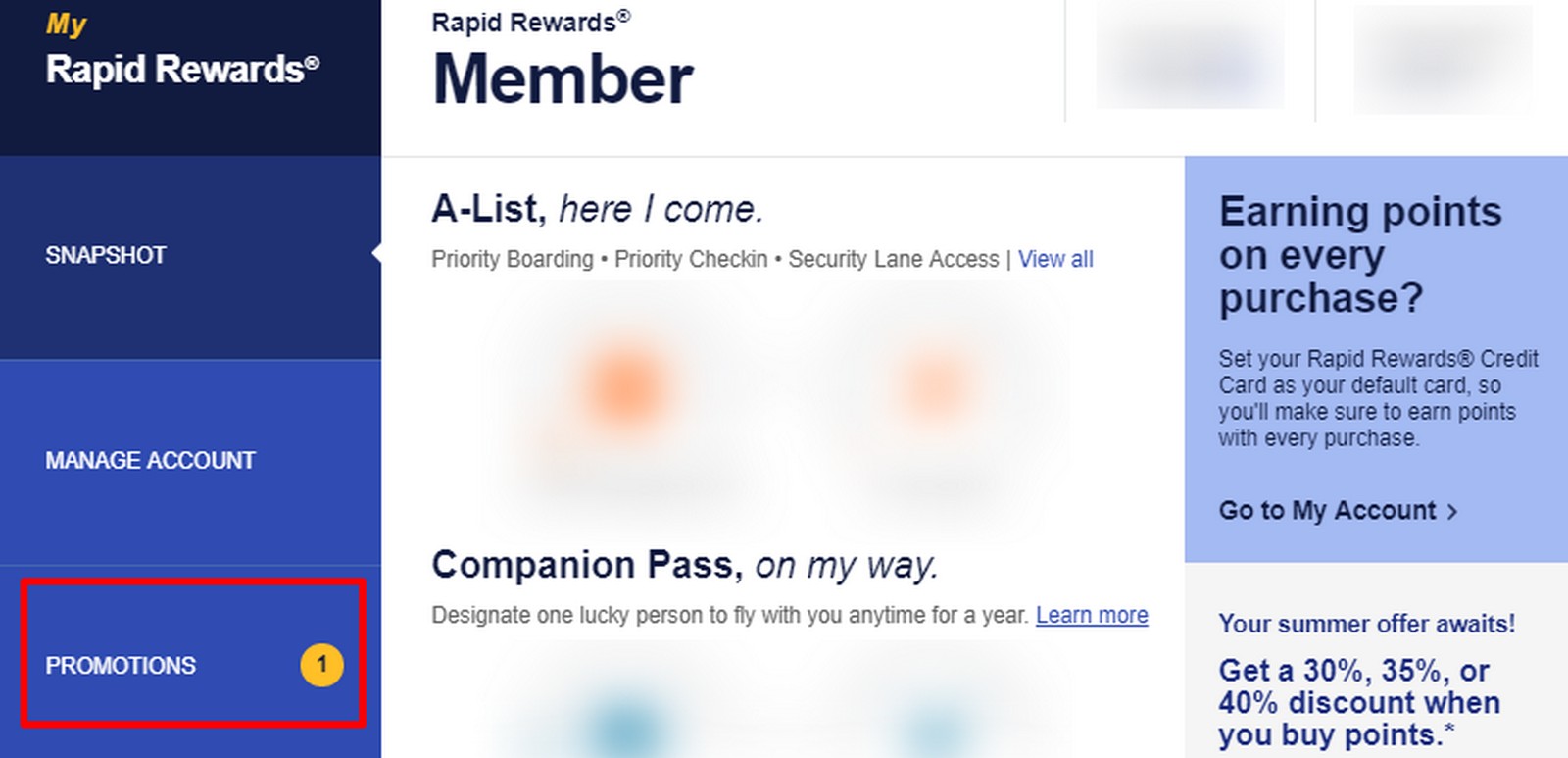

Where Do You Locate the Offer?

Once you log into your Southwest account look on the left hand side for your promotions. This will only be targeted for Southwest cardholders but it is worth checking from time to time for other promotions, like status challenges etc.

Details of the Offer

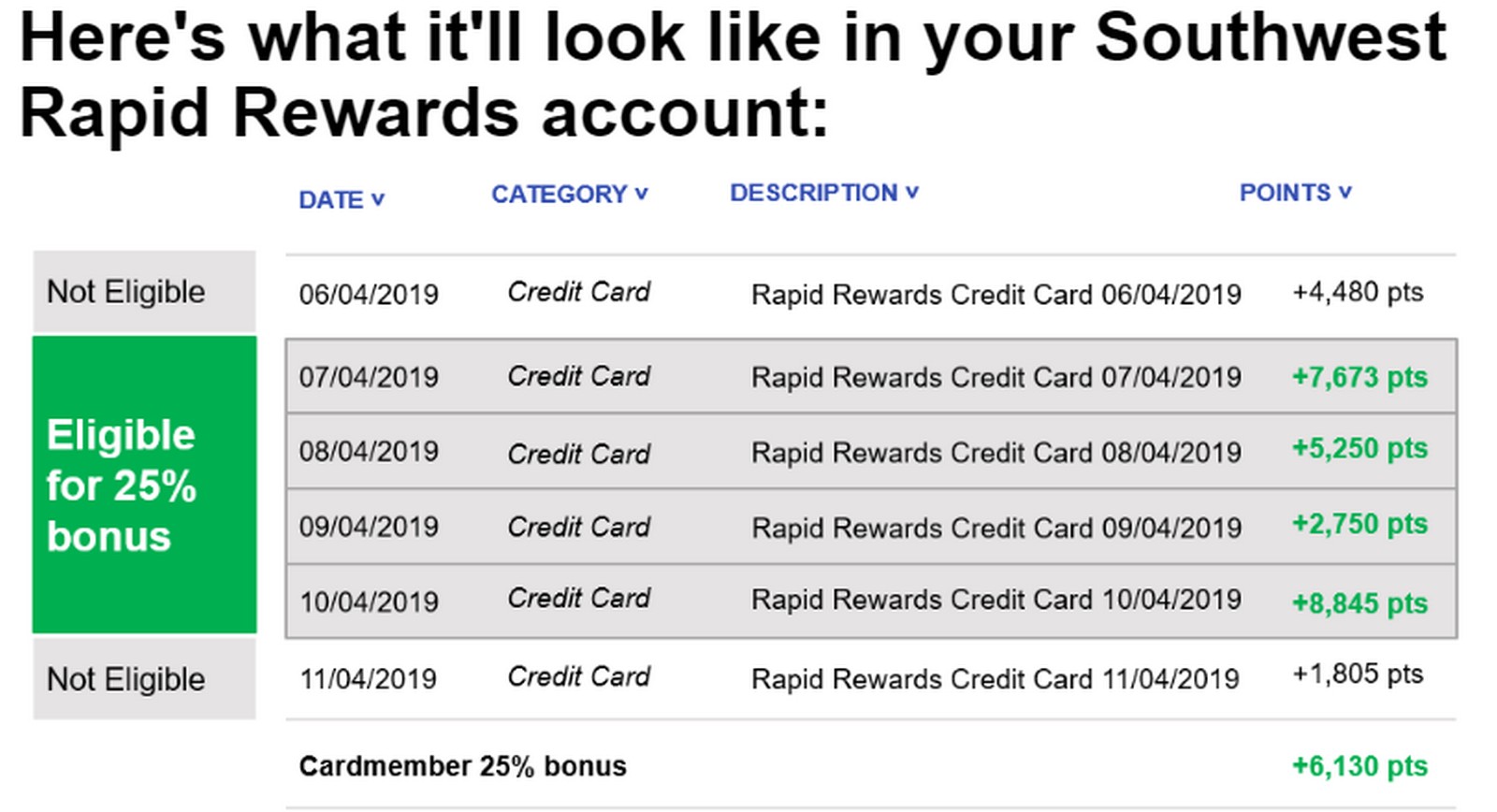

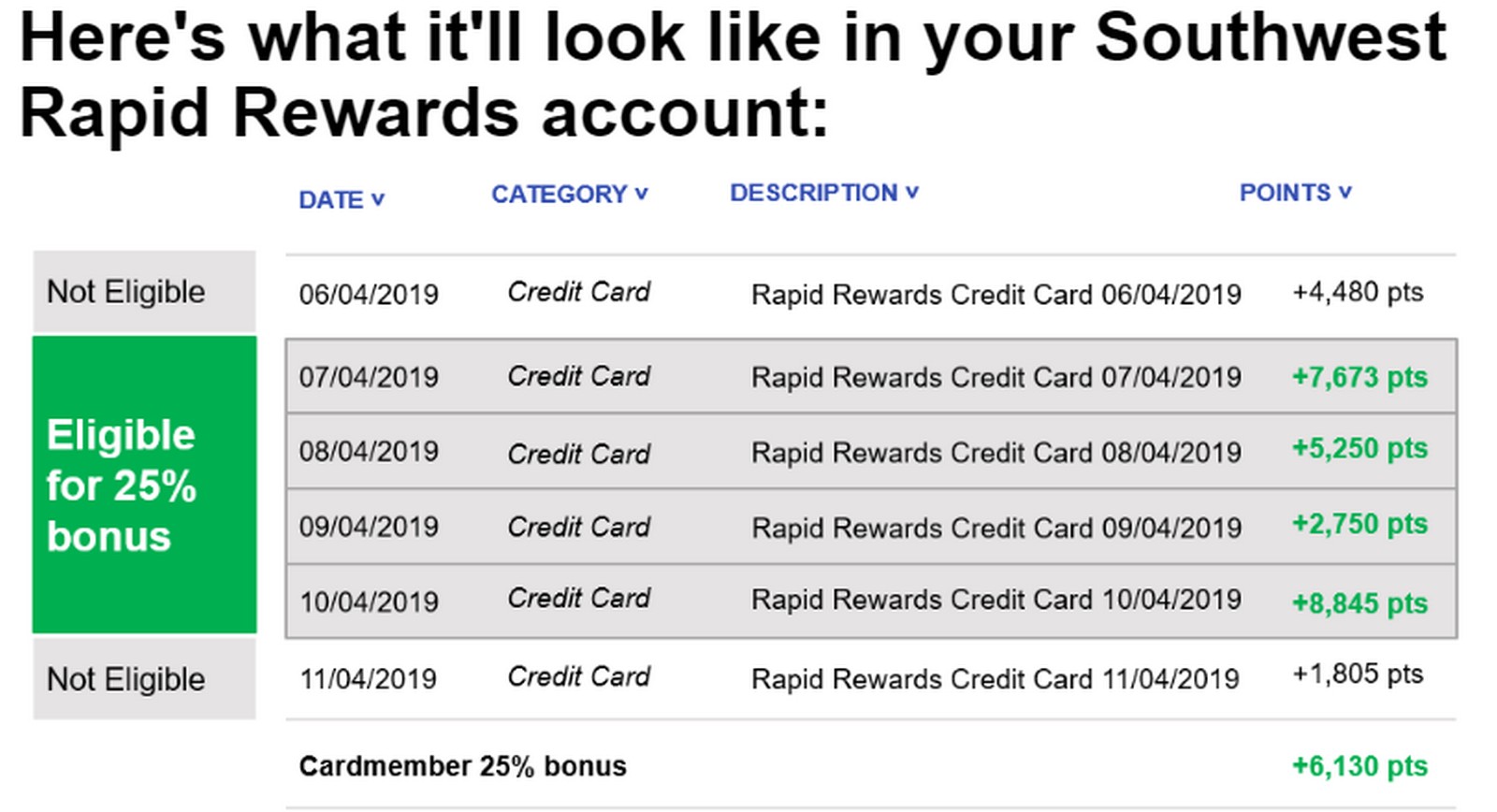

The details of the offer are as follows:

- You must register between 6/7/2019 and 10/31/2019 11:59 p.m. ET

- You must have a minimum of 20,000 points earned from Rapid Rewards Credit Card post to your Rapid Rewards account during the promotion period of 7/1/2019 and 10/31/2019.

- Only points posted from your Rapid Rewards credit card will earn the bonus, not flight earnings etc.

- The 25% bonus points will count toward Companion Pass qualification, but will not count toward A-List or A-List Preferred qualification.

- Please allow up to 8 weeks after the end of the promotional period for the 25% bonus points to post to your Southwest Rapid Rewards account.

- Maximum bonus point accumulation during the promotional period is 10,000 bonus points per Rapid Rewards account.

- Bonus points earned from Chase on a new credit card promotion will not be eligible for the 25% bonus.

- Points transferred from Chase Ultimate Rewards to Southwest Rapid Rewards will not be eligible for the 25% bonus.

For example, if you have 5,000 points from your Rapid Rewards Credit Card post to your account each month during July, August, September, and October, you’ll earn 5,000 bonus points from Southwest.

Those 5,000 bonus points will count toward Companion Pass, too!

My Thoughts

That is a massive amount of spend and I only see this being a good option for 3 types of people:

- Someone who is chasing Companion Pass status through spend because they can not get a new card bonus or are over 5/24.

- People who only use one card for all of their spending and it happens to be a Southwest card. That would be my parents, trust me I have TRIED!

- Someone who flies Southwest for work and gets to put the spend on their Southwest card. Assuming they don’t have a card that earns better than 2.5 Southwest Rapid Rewards points per dollar on travel.

Otherwise even with the 25% bonus the return on spend is below 2% so it doesn’t make sense for anyone else. It is still nice to see them trying to offer something to card members though. I just wish the amount of spending needed wasn’t so steep.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Mine is saying 10,000 points, which is a lot more doable!

That is a much better offer

Just 10 of those gift cards at Simon Mall at minimum.. hmm..

Yup – not too bad!