Delta MQDs Waiver for Diamond Medallion Goes from $25K to $250K

Delta made an announcement yesterday that will effect lots of Diamond Medallion members. Starting January 1, you’ll have to spend a whopping $250,000 a year on Delta American Express credit card if you want to waive into the airline’s much sought after Diamond Medallion frequent-flyer status. It’s a drastic increase from the $25,000 in annual spending currently required to reach Diamond Medallion status and a change that will put the top tier out of reach for some.

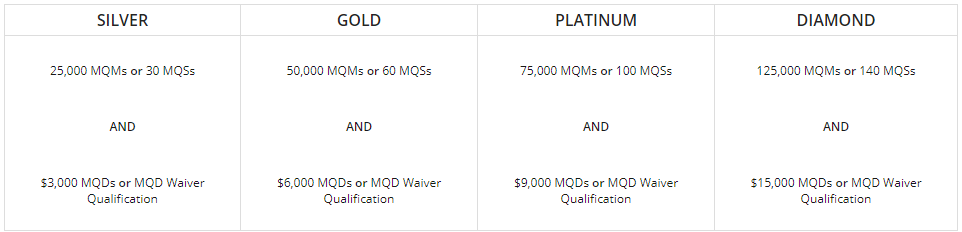

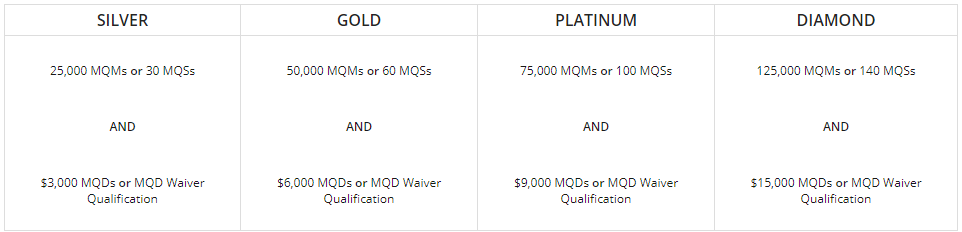

The requirement will remain unchanged for Silver, Gold, and Platinum members.

Delta MQD Waiver for Diamond Medallion

Here’s what the announcement says:

We are always looking for ways to improve the Medallion experience by listening to your feedback. Because we want to ensure our most well-traveled Members can take full advantage of all the benefits of Diamond Medallion Status, a change is being made to how Members qualify for 2019 Diamond Medallion Status.

Starting January 1, 2018, the Medallion Qualification Dollar (MQD) Waiver for Diamond Medallion Status is increasing. The MQD Waiver for Diamond Medallion Status is currently earned by spending $25,000 in eligible purchases in a calendar year on a SkyMiles Credit Card from American Express. It is being adjusted to $250,000 in a calendar year.

This qualification change will allow us to deliver on expectations for Diamond Medallion Status so Members can maximize elite benefits like Complimentary Upgrades and Delta Sky Club® access. This update will not change how Members earn 2018 Diamond Medallion Status.

We understand this is a significant increase, but keep in mind that the MQD Waiver to qualify for all of the best-in-class benefits of Platinum, Gold and Silver Medallion Statusopens in a new window will still remain at $25,000.

How To Qualify For Delta Elite Status

To qualify for Delta’s frequent-flyer perks, loyal customers have to achieve one of its four “medallions”. To do that, you need to fly a certain number of flights or miles and also spend a required amount of money with the airline.

Travel hackers though don’t like spending cash for flights. So a workaround to that spending requirement was that Delta AmEx cardholders can waive the spending requirement with the airline by putting a certain amount of spending on their Delta cards every year. And that’s what’s being increased, ten fold.

Since status for 2018 is determined by spending and travel in 2017, the new waiver requirement will take effect for those seeking Diamond Medallion status for 2019.

Conclusion

This 10 time increase will prohibit many from achieving Diamond Medallion through spending on Amex Delta cards. There will likely be a big drop on the number of Diamond elites and that’s probably exactly what Delta is trying to achieve through this change.

They’re prioritizing customers who are most loyal to Delta and making Diamond Medallion a super exclusive club for high spending frequent-flyers. $25,000 in spend annually was probably an achievable amount for many, but $250,000 will put the MQDs requirement for Diamond Medallion Status out of reach.

Chime in!

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Come on I think many of your readers also read a few other blogs and already read about this yesterday. At this point why write about it at all?