Chase Discontinuing the Ink Bold In November

I have been pretty consistent on this site over the years about my feelings about certain things. People should never take on debt and should always be careful before jumping on that next great deal. This week we saw Chase widely release a pretty stellar 70,000 bonus point offer for the Chase Ink Plus (personal referral link) credit card. If you have the card then you may have your own personal referral link. (Details.)

This same offer has been available in branches for a short while and many wondered why the Ink Bold, isn’t getting any love. The Ink Bold & Ink Plus are essentially the same cards with the same benefits. The only difference between the two is that the Bold is a charge card meaning it has to be paid in full each month, while the Plus is a credit card. (Meaning Chase gets to charge intere$t!)

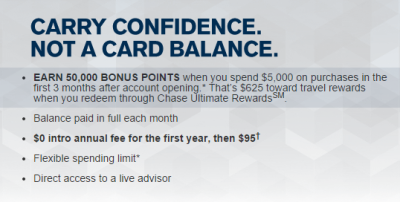

There have been numerous substantiated claims over the past couple of days that Chase is discontinuing the Ink Bold card in the middle of November. I have been told both November 16 & 17. Currently the best offer for the Bold gives 50,000 bonus points after $5,000 in spending during the first three months which is less than the current offer for the Plus.

Why I Applied For The Bold & Not The Plus

Before I go any further I want to say I love the Ink cards. My wife and I have had at least one version of the Ink cards for several years. Currently neither of us has a Visa version of the Ink Bold. We used to have Mastercard versions, however they switched them to Visa last year which means they are now considered a new product and thus we are eligible for the bonus.

Earlier this week before we knew an exact end date, I decided to apply for the Bold. (Non-affiliate link.) I carefully considered the decision for a couple of days and then filled out the application. It went to pending status and I have yet to make the reconsideration call due to time constraints. I may just let it sit there without calling to see if they approve it without the need for reconsideration.

Discontinuing the Ink Bold – Should You Apply

Some bloggers and people in the miles/points space advocate applying for as many cards as possible every 3 months. Grant at Travel with Grant wrote yesterday urging readers not to ruin their App-O-Ramas by applying for the latest great deal. I personally don’t do app-o-ramas anymore and have slowed down my pace of applying. If I see a deal that I want, I apply. Sometimes several good deals present themselves at once and I make a spree of applications the same day. It varies for me and that is ok. There is no wrong answer in my opinion.

Personally I would rather apply for a card with a lesser (but still good) bonus that will no longer be available in a month than one with a bonus that will most likely return. Most people are unlikely to get approved for two Chase Ink cards within 45 days, meaning if you get an Ink Plus right now, the odds of getting a Bold before it goes away are pretty slim.

Conclusion

This is not a call to action at all, but simply me sharing an opinion and my thought process. Applying for a credit card is a personal decision and one which shouldn’t be done lightly. Just because Chase is discontinuing the Ink Bold does not mean you should or need to apply for it.

Some people will not feel the need to apply for anything, while some will want the 70,000 Ultimate Rewards points from the Ink Plus. In my opinion the only wrong answer here is the one that jeapordizes your financial security and leads to debt. Otherwise we are all winning.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

[…] wrote a few weeks back that the Chase Ink Bold was going away. Many people reported that it would be around until the middle of November, however I just noticed […]

[…] most recent case of success for both me and my wife was our recent application for Chase Ink Bold cards. Since it has been widely reported that the Ink Bold will be going away, […]

[…] back is earned in the form of points which can be transferred to premium card accounts such as the Chase Ink Bold or Plus & the Sapphire Preferred. This means that you can potentially get a lot more than $.01 value […]