Economics of an Award Hawaii Edition

Back in February I wrote about my last minute trip to Kauai. In a post titled “Why I Love Miles/Points – $4,000 Worth of Travel for $23” I talked about the retail cost of my trip and what my out of pocket cost was.

We all know that talking about those two things exclusively doesn’t tell the whole story. Today I thought I would follow up with a little more of an in depth look at the actual costs of the trip including how I acquired the points used to book it.

Hotel

During my time in Kauai I stayed at the fantastic Grand Hyatt Kauai for 4 nights. The original reservation was for only 3 nights, but I loved it there so much that I decided to extend my stay by a day. The room rate for all four nights was $519 plus taxes and resort fees. All in, the retail cost of the stay was $2,458.76.

Since I am a Diamond Gold Passport member, during my stay I was upgraded to an oceanview room and received access to the club lounge for breakfast and evening hors d’oeuvres. I was also given a free one-day cabana rental worth $50. I see these benefits as icing on the cake and don’t calculate them into the retail value, although they do have monetary value.

Hotel Points Cost:

The Grand Hyatt Kauai is a category 6 property, meaning it costs 25,000 points per night or a total of 100,000 points for my 4 nights stay. Fortunately the stay came during Hyatt’s 20% rebate promotion, meaning my actual cost was 80,000 points.

About 95% of my Hyatt points come from Chase Ultimate Rewards. While I can’t break down my actual cost of those points, I can share with you a few facts about how I acquired them.

- Last year my wife and I acquired 180,000 Ultimate Rewards points through sign-up bonuses.

- We acquired hundreds of thousands of more points from actual spending.

- Our monetary cost for those points was negative thanks to deals from Officemax, Staples and others.

In other words, our actual monetary cost of acquiring those points was less than $0. Of course there was a time factor as well. I don’t have calculations for that, but I average over a $100 return per hour of time spent. Since I value Ultimate Rewards points at 1.7 cents each when making calculations, THE MOST time I spent to acquire those points was 13.6 hours.

Airfare

To book airfare, we used British Airways Avios, since I have an abundance of them from the recent American Express Membership Rewards transfer bonus.

Since there are no direct flights from LAS-LIH on British Airways partners, we flew on American Airlines from LAS-LAX-LIH on the way there and US Airways LIH-PHX-LAS on the way back.

Airfare Points Cost:

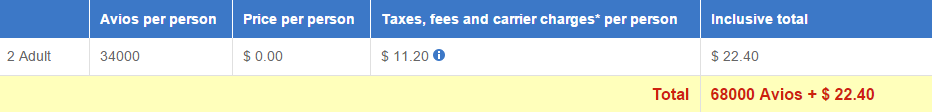

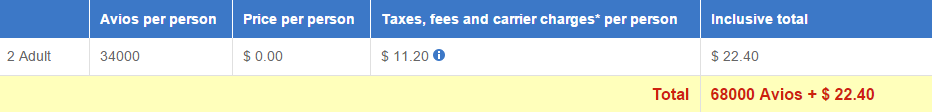

British Airways charges by segment, so the LAS-LAX & PHX-LAS segments were 4,500 Avios each and the LAX-LIH & LIH-PHX segments were 12,500 Avios each for a total of 68,000 Avios roundtrip. Calculating in the transfer bonus, my cost was thus 48,571 American Express Membership Rewards points.

I acquired my Membership Rewards points from last years 75,000 bonus on the Premier Rewards Gold card which required $10,000 in spend to get the bonus. My cost of that spend was $4 per $500 or $80 to achieve the bonus. The portion of that cost that applies to this reward is $51.81.

Since the $10,000 in spend was all done via the same method, I can honestly say my time cost for this one was just under 5 hours total, so I will call it 5 hours.

Car Rental

Car Rentals in Hawaii are not cheap. While I wrote about one way to save money on them, my five day rental still came to $253 total. I had originally booked a car for $151 for 3 days and then I got a second rental for $72 for 2 days when I extended my trip. All of this will be covered by points on my Arrival Plus card. (My review)

So the question then comes to the cost of those points. I actually achieve some spend on the Arrival Plus card for free thanks to Serve online credit card loads (which are ending this month) and other methods, but the normal cost for me is $4 per $500 in spending.

Lets say I purchase a $500 gift card for $504. That ultimately earns $11.09 worth of points on my Arrival Plus card. So I am spending $4 to get $11.09. The way I look at this is I am getting a 63.9% discount on my travel expenses. In this case the $253 redemption cost me $91.25 plus my time.

To generate $253 worth of points (including the 10% rebate) I would need to purchase 23 $500 cards. It takes me on average 5 minutes to purchase and 5 minutes to liquidate each of those cards. That comes to approximately 3.83 hours worth of time. (A very conservative estimation. It was probably less time.)

Final Calculations

- Hotel: No monetary cost + 13.6 hours time. (Retail cost: $2,458.76)

- Airfare: $51.81 + $23 fees + 5 hours time. (Retail cost: $1,800)

- Car Rental: $91.25 + 3.83 hours time (Retail cost: $253)

- Total: $166.06 & 22.43 hours. (Retail cost: $4,511.76)

So I achieved $4,511.76 in retail travel for $166.06 & ~22.43 hours of time. If I subtract out the cash, I saved a retail amount of $4,345.70 or a total of $193.74 per hour.

Analysis

I am not a believer in analyzing this any more then I have. There are many other factors that can come into play like staying in cheaper hotels, booking flights ahead of time and using discount services like Priceline to bid on hotels. Going any further in calculating cost and value is a time suck in my opinion.

You should also note that I tried to be conservative whenever possible to give realistic numbers here. I probably actually spent significantly less time & slightly less money than I described. This is especially true for the Arrival Plus where I achieve at least $1,500 a month in fee-free spend that isn’t accounted for.

Conclusion

The reason I wrote this post up is to show you that traveling for free monetarily is an achievable goal. I was able to book a last minute 5 day trip to Hawaii and only spend $166 out of my pocket. Thanks to this hobby I also have Diamond status so I had food and drinks free at the hotel which provided even more value.

This hobby is fantastic in the value it provides for traveling the world, but this travel does come at a cost. While it is fun to say that I traveled for free, the truth doesn’t quite match up with that narrative. With that said, I certainly traveled for pennies on the dollar and these calculations just reaffirmed why I love this hobby!

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

[…] Grand Hyatt Kauai – Among my favorite hotels in the world! […]

[…] of their co-branded Chase card. That deal got me to sign up for the card and I enjoyed stays in Kauai among other places for 20% less than normal. Today Hyatt has sent me a similar deal, although the […]

Arrived to this page from your 5X Ebay hyperlink, theres nothing on here about 5X Ebay.

Sorry Steve. The link must have gotten mixed up. Here is the link and I have fixed it in the other post.

https://milestomemories.boardingarea.com/ebay-5x/

I love this hobby! Here is a savings angle that you had not mentioned that is huge for people in high income brackets: pre-income tax cost.

Here is what I am talking about: Unless your vacation/trip is a legitimate tax deduction, you are paying for it with after tax dollars! So hypothetically if you paid $6,000 for a business class ticket, for 2 people that would cost $12,000. But if you were in the 50% tax bracket then you would have to earn $24,000 in order to pay for these seats! This is why I will never be willing to pay for anything more than the lowest economy seats to fly.

So for people who are in high income tax brackets, the savings from this hobby are huge!

I will be staying for free at the Park Hyatt Vendome for 2 nights thanks to the Hyatt CC.

The rooms are about $1,000 each, so if I was paying for them with my after tax dollars, I would need to earn $4,000 in order to stay for 2 nights in a standard room at that hotel! Absolutely no way I would do that.

Now if someone were filthy rich and overflowing with massive amounts of money then of course this would not matter. But for those of us who have to earn our money, that is why this hobby is so great.

Yes, there is a learning curve to this hobby – just like there is a learning curve to ANY hobby. No one becomes an expert surfer, skier, cook etc overnight – it takes time and money to acquire the skills for any hobby that a person chooses.

Very good point. Thanks Jason!

But isn’t the actual cost also made up of the opportunity cost that you have when you generate UR or MR points instead of 2% cash back? As such, you could have had 155,000 points as you did, or $3100.00 in cash.

Where do you get the $3100 in cash? Most of the points used came from sign-up bonuses and thus would not have earned the cash back. I only spent about $22,000 to acquire the points used which would amount to about $440 in cash back. Even if I redeemed the 80,000 UR and ~50,000 MR for cash, they would only come to $1,300 plus the $440.

This all sounds great and easy. But you neglect the learning curve to figure it all out, despite bloggers who (like greedy children) attempt to spell out everything with circles and arrows type posts (what a great way to ensure the few remaining methods die a fast death).

And even with the absurd hand holding bloggers who infest this hobby, it takes time to set up the necessary programs and learn how to execute them – a beginner is going to spend dozens of hours spinning their wheels making mistakes, finding friendly stores and banking institutions, and stressing out when the inevitable snafus and shutdowns occur because they don’t have the experience how to solve them other than “complaining” and “demanding” refunds NOW!!!!!!

Of course, when you’re actually a credit card shill pretending to be a “travel expert”, the downsides of the hobby are rarely discussed. Instead the focus is on the “exciting, free travel to exotic places where only millionaires stay”.

As big a lie as it gets.

In my opinion the learning curve cannot be quantified with time since it varies for everyone. Anyone who gets into this hobby quickly learns that it takes time and I certainly am not trying to tell everyone it is easy. If anything, this post says the exact opposite of that.

You have come to this blog several times and made accusatory comments under different names. I am as transparent as possible in this blog and I have published many articles about pitfalls of this hobby and practices to avoid. In the end people must do the research for themselves.

Also, I love how you call me a “credit card shill pretending to be a travel expert”, because I don’t have direct affiliate links and don’t push particular credit cards. To your second point, I AM a travel expert. I have been on the road for 3 of the past 7 years and have visited over 70 countries. (50 countries with my wife & son.) If that doesn’t make me somewhat of an expert, then I don’t know what does.

There are no lies in this post. In fact, it is designed to debunk the “travel is free” myth, although it still shows that travel hacking or whatever you want to call it is worth it. Have a great day and feel free to comment any time!

Thanks for this breakdown, I’m getting ready to do something similar after a free weekend of travel this weekend. I like the process you outlined!

Quick question, I purchase tons of $200 visa gift cards from Staples with my Ink card as I haven’t been able to find $500 visa gift cards anywhere. Where do you find them with only $4 in fees? If I order online I find options to pay the fees and pay for shipping. Help would be appreciated, thanks!

They are sold at various malls.

Thanks for that analysis!

Can you briefly explain how you spent negative money to get hundreds of thousands of points?

Officemax and Staples often have negative cost deals where they offer either instant or mail in rebates on gift cards. I earn 5X Ultimate Rewards points with my Ink card. By taking advantage of those deals I am able to earn points at a negative cost.

How do you liquidate gift cards?

I have a Serve and Bluebird card that I use at Walmart to liquidate them. You could also load them to REDbird as well. There are many ways to liquidate them. Here is a resource: https://milestomemories.boardingarea.com/visa-gift-card-prepaid-mastercard/

It’s nice to see an analysis of time as well as cash vs. points. I take it you got diamond status from a diamond challenge?

Yes I completed the Diamond Challenge before it went away last year.

Great analysis. As you say, to analyze it in any more depth would be pointless. But you are fair in presenting alternative ways people might view the cost, especially the time factor. You did not, however, attempt to quantify the value of giving your wife a nice trip before childbirth! It sounds like a great spur-of-the-moment trip, and I’m sure worth every penny and hour.

You are right, no matter how you analyze the trip, it was definitely worth it on so many levels!