New IHG Card Offer – 50,000 Points & $150 Statement Credit

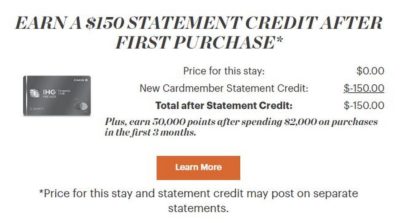

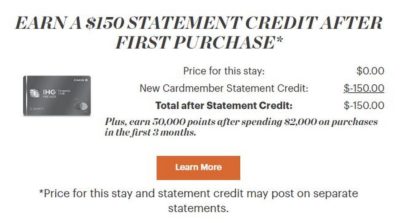

I was booking a hotel for an upcoming stay and during the checkout stage a new IHG card offer popped up. It was for 50,000 points and a $150 statement credit. The question is whether or not this offer is better than the standard offer.

Breaking Down the Numbers

The current standard welcome offer for the Chase IHG Premier Card is for 80,000 points after spending $2000 within the first 3 months.

With this new offer you are giving up 30,000 points for $150, a valuation of $0.005 per point. That is the price you can usually purchase IHG points for with sales or through the cancellation trick. Their redemption value is usually slightly higher, averaging around the $0.006-$0.007 per point. This new offer has less overall value than the current 80,000 point offer for most people. Don’t forget that 100,000 point offers come around for the card from time to time as well.

UPDATE – There Is Still A 100K Offer Available With A $50 Statement Credit – Hat Tip DoC

If you are points rich and cash poor this may still entice you though. Especially if you want the IHG Premier card for it’s 4th night free perk. The 4th night free perk pairs with the old IHG card’s 10% back in points perk. That is something I confirmed with Chase a few months back.

If you have the old IHG card you can still get the new Chase IHG Premier card since they are considered different products. Which offer you feel is better depends on your personal situation. They are pretty close to equal in value.

Conclusion

When people have options it is a good thing. This new offer may be slightly less valuable than the 80,000 point offer ($30 less in my valuation) but it gives you cash instead. Most of the time cash gets a premium since cash is king. Some people would rather have the points and others would take the money.

The nice thing is that this card has been treated as a separate product from Chase so you can carry both versions of the card. You can also stack the perks of the two cards and get 32.5% off all 4 night award stays. That may be the best deal out there that no one talks about.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Was approved for Premier. Sadly they wont expedite the card and said it take 2 weeks for it to arrive. I missed the 100K bonus though but 80K is fine as long as i can get my upcoming 4-night stay rebated. I now have 7 personal Chase cards! Not sure about pressing my luck on an 8th for United next year.

Congrats! Haha if you end up getting 8 let me know 🙂

[…] Hat tip to MtM […]

[…] Hat tip to MtM […]

If i am at 4/24 with 6 chase cards in good spending rotation can i still get approved for this card?

IHG card is not a 5/24 card so that shouldn’t be an issue. At 6 Chase cards I think that would be a problem unless half are business etc. Even then you may need to move around credit lines.

I was thinking that, i had previously lowered 4 to 5K but then they gave me 32K for CSR two months ago. All personal and have 4 to 10 years history except CSR.

A better question would be am I risking a shutdown? I dont think i am since my history is long and still under 5/24 but newest card is 2 months and from Chase.

It is hard to say at this point and no one really knows what triggers it from Chase. I would probably wait until 3 months or more from the CSR application but that is me.

Also I just updated the article there is a 100K offer plus $50 credit still available…added the link in the article. So be sure to use it when you end up applying 😉

The previous offer that came up during the booking process was 80,000 points + $50 statement credit.

So this offer trades 30,000 points for $100 statement credit, so definitely much worse of an offer.

Thanks Klanfa – yeah that is even better. Hopefully that one comes back via booking then.