Roundup of 5% Bonus Categories: Freedom, Dividend, Discover it and ABOC Platinum

Chase Freedom, Discover It, Citi Dividend and the new ABOC Platinum Mastercard are the major 5X rewards points or cash back credit cards with rotating bonus categories. Let’s look at the 2019 categories for each card.

Discover it 2019 Bonus Categories

- Q1: Grocery Stores

- Q2: Gas, Uber and Lyft

- Q3: Restaurants

- Q4: Amazon

Discover offers 5% cash back bonuses on the first $1500 in spend each quarter (much like the Chase Freedom card). Although the categories are similar each year, Uber and Lyft is a nice addition for 2019. Grocery stores is always a favorite category of many as well as Amazon to finish off the year.

CLICK HERE to compare cash back credit cards.

Chase Freedom Bonus Categories

Q1: Drugstores, Tolls and Gas Stations

Chase Freedom is one of the more popular rewards credit cards. With no annual fee, 5X rotating bonus categories and points that convert to Ultimate Rewards when paired with a premium card. Unlike Discover who released their categories all at once, Chase likes to drip the Freedom’s bonus categories out by quarter.

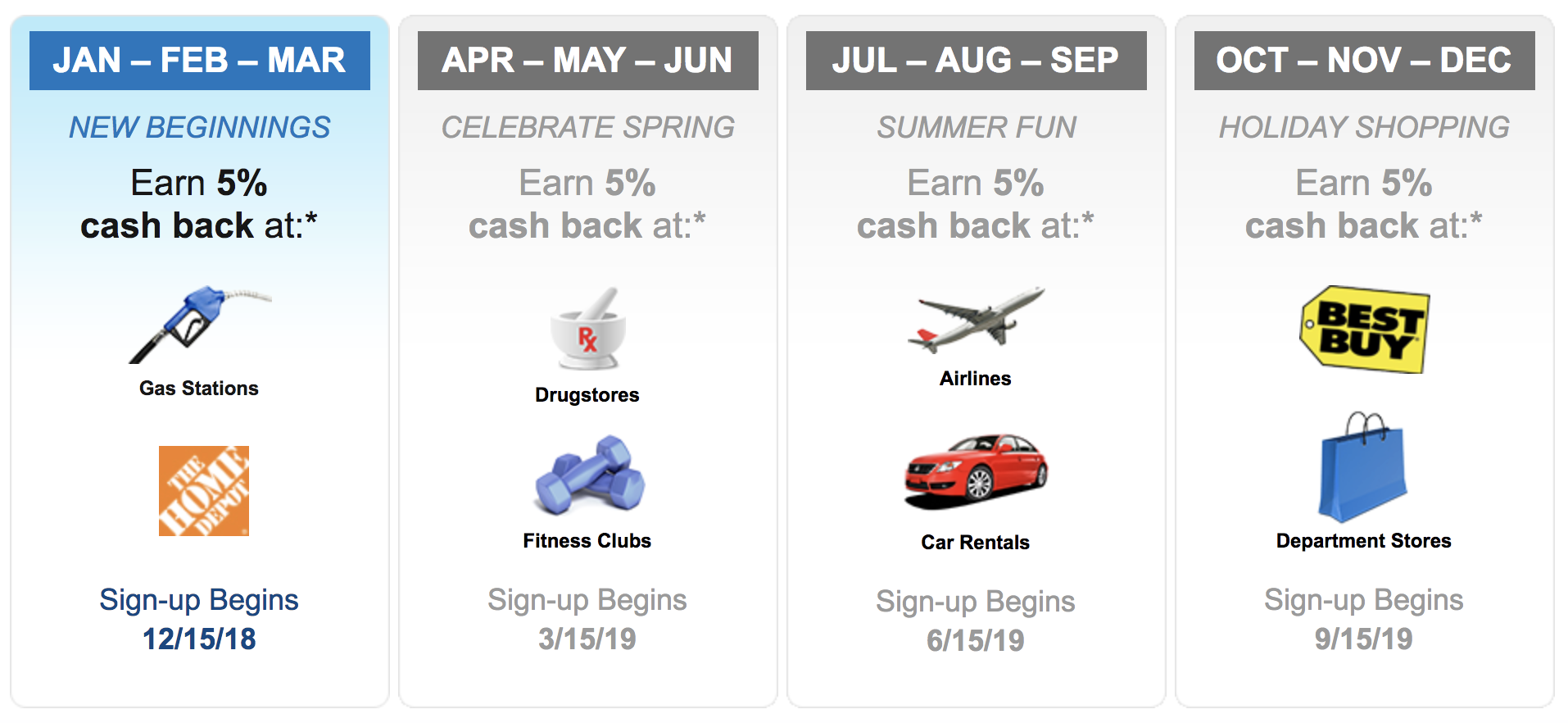

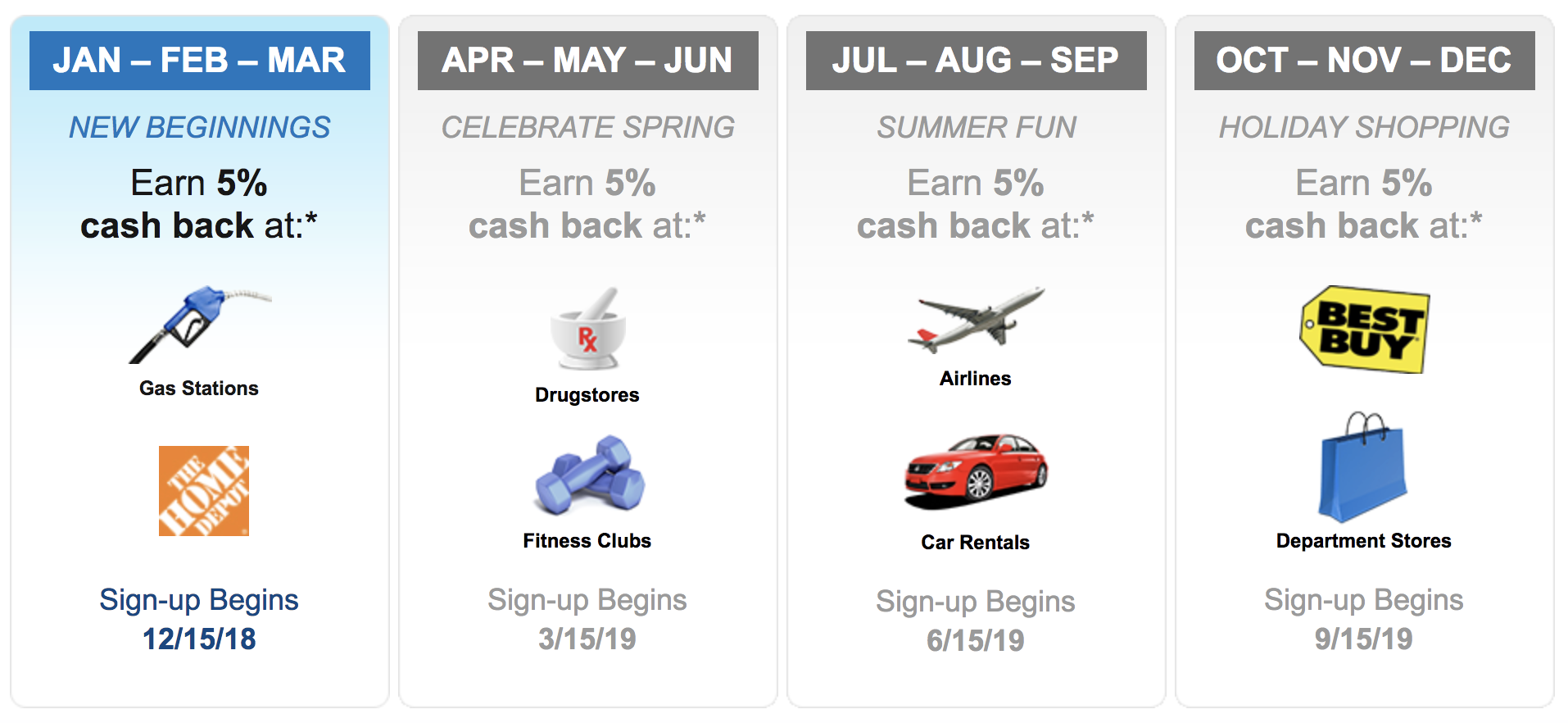

Citi Dividend Bonus Categories

- Q1: Gas and Home Depot

- Q2: Drugstores and Fitness Clubs

- Q3: Airlines and Car rentals

- Q4: Best Buy and Department stores

Citi Dividend is unique to either the Discover it or Chase Freedom cards since you can earn all of your cash back ($300) total any time during the year in whichever category you choose. Home Depot is a mega store where you can get almost anything you need for your home, they also sell third party gift cards. If you’re unable to max out spending this quarter, there are some great categories opportunities in the back end of the year including airfare, Best Buy and Department Stores. You can sign up for this quarter here and make sure you sign up prior to making a qualifying purchase.

The Dividend card isn’t available to the public anymore, but you may be able to product change over another card to it. You can find the calendar here.

ABOC Platinum Mastercard

- Q1: Dining and Grocery Stores

- Q2: Home Improvement

- Q3: Travel

- Q4: Automotive

Click Here to apply

The ABOC Card recently introduced rotating 5x Categories and it’s another good no fee option in this card category. Check out our write-up for card earnings and bonus details.

Conclusion

You can bookmark this post and use it throughout the year to strategize. We love our 5X cards from the Chase Freedom, Discover It to the Citi Dividend and it’s great to see a new rotating 5X cashback card, the ABOC Platinum Rewards Mastercard.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Chase Freedon added Grocery stores to their Q2