| Miles to Memories does not have a direct relationship with the card issuing bank(s) and this post does not include any affiliate links. If you wish to support the site by applying for credit cards or using other referral links, you can do so here. Before applying I highly suggest reading the following posts: Slow & Steady Doesn't Make You A Loser and A Mandatory Waiting Period to Apply for Credit Cards?. You can find all of our credit card reviews here. |

Delta Skymiles Credit Card Statement Credit

As I previously reported, I picked up a Gold Delta Skymiles American Express as part of my last application round. I had already applied for the Business Platinum 150K offer and figured it couldn’t hurt to get another Amex card since they merge credit inquiries.

Currently the offer on the Gold Skymiles card is 50K miles + $50 statement credit after $2k spend in 3 months. There is also an offer on the Platinum card which comes with 60K miles and a $100 statement credit. Since these offers are expiring in a few days, I thought it would be a good idea to share with you how easy it was to get the statement credit.

The Statement Credit

Here is how American Express explains the statement credit on the Gold card (The Platinum card works the same way):

One statement credit for $50 will be issued to your Card account after a Delta purchase is charged to your Gold Delta SkyMiles® Credit Card within your first 3 months of Card Membership.

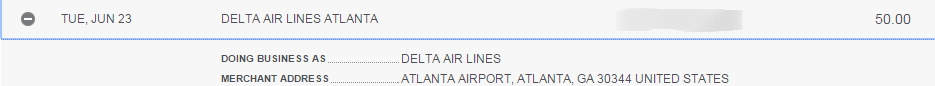

That seems pretty straightforward. There aren’t any restrictions such as having to use the card for incidental fees. Any Delta purchase should work. To test this out, I purchased a $50 eGift card from the Delta website. Sometimes gift card purchases are through third parties or code differently, so this wasn’t guaranteed to work.

Here is how the Delta eGift card transaction is coded:

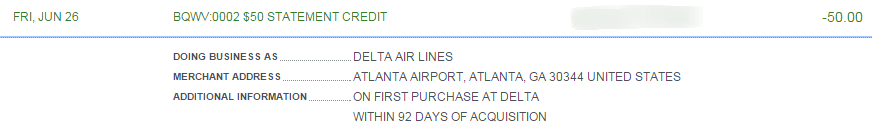

Then three days after purchasing the cards, this showed up:

Success! Everything worked exactly as it should have and the entire process took about 2 minutes to complete!

Delta Gift Card Terms

While not too restrictive, there are a few things you should know about Delta gift cards. The first thing is that eGift cards cannot be used until 72 hours after purchase. Also, gift cards cannot be used for ancillary fees such as bag charges, etc. Make sure to read the full terms on their website before purchasing.

Conclusion

Since I don’t have upcoming paid Delta flights, I was glad to be able to put this $50 in the “bank” so to speak to use later. While Skymiles are definitely not worth what they used to be, being able to get 50K + $50 from one application made sense to me and may make sense to others. I am just glad that Amex makes it so easy to get the credit.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Quick q: Does the $50 gift card you buy (with the $50 statement credit) count towards the minimum spend?

No any credits will not count.

You can buy on deltas website something that is called (i think) miles booster its like $20 to $30 and then you get $50 back as a statement credit. I Did that a few years ago.

Any updates on the question above? If you bought SkyMiles will that purchase count toward the credit?

Hello,

I was also interested in the $50 statement credit.

I was wondering if a purchase done through their shopping portal was seen as a valid transaction ?

And is a Delta gift card/E-certificate valid to cover the fees of an award ticket ?

Thank you.

Just about to try this. From how I read the offer, there’s no min purchase, and the min gift card through Delta is $5, so you could also use this as a $5 Delta + $45 cashback.

My mistake. $50 minimum purchase, and $5 increments after that. Still went for the $50…thanks.

here are some really good Amex offers right now I’d like to take advantage of, but I already have 5 Amex cards. At one point I was told I could only have 4 and had to cancel one to get another, but a few months later, I got a 5th card without any discussion of this. What is your experience on this? Do you have more than 4 Amex cards?

The limit of 4 actually only applies to credit cards. (Cards in which you can carry a balance.) You can also have a number of charge cards as well. I currently only have 2 Amex credit cards and 3 charge cards, however I know of people with many more. Also, each authorized user card is eligible for Amex Offers as well.

Good evening Shawn, does the eGift card have an expiration date—and can I send it to myself?

There is no expiration and you can definitely send one to yourself.

I know Amex has an (active) card limit, but is there also a limit of how many cards one can apply for in a given period? Something like Citi’s 8/65 rule?

No, not that I know of. I wouldn’t push it, but many people get 2 cards in one day.

Can that $50 e-cert be resold?

I don’t see why it couldn’t, although I don’t know of any websites buying them. It is just a code and certificate number, so it shouldn’t be tied to any one name.