Plastc – The New Credit Card Replacement

Late last year a new product called Coin was announced and went immediately viral. There was a lot of buzz and everyone was talking about it. The product which was available to preorder for $50, promises to replace all of your credit cards by storing the information digitally. A kind of all in one credit card if you will. It was supposed to launch in August, however it has been postponed until next year.

To me, Coin seems like a product before its time since it lacks any of the latest payment technologies – mainly NFC & chip & pin. Plastc is a new competitor which has been recently announced. At $155 it is more expensive than Coin, but it has all of the features the other card is lacking.

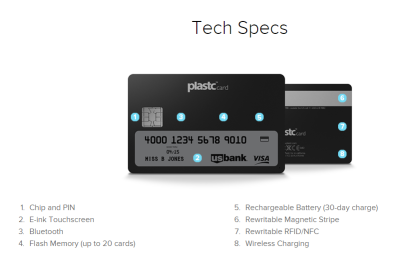

It Is All in the Features

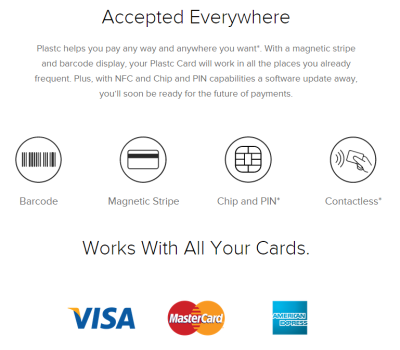

Like Coin, Plastc replaces all of your cards, but it goes so much further. In addition to having a much larger and more useful display, Plastc has chip & pin functionality, NFC & barcodes. The addition of NFC means that Plastc will be compatible with systems like Apple Pay & Google Wallet. It also holds up to 20 cards while Coin only stores 8.

Both of the cards seem to have similar security features like passwords and proximity sensors. If the card isn’t within a certain distance from a synced smartphone, it won’t work. Plastc also has a remote wipe function if you happen to lose it.

Plastc also will have the availability to receive software updates. In theory this means that it should be able to keep up with the latest developments in the credit card space, since new firmware can be uploaded. In reality, we will see just how often that actually happens.

Will it Work?

As someone who has a lot of credit cards, I think this is definitely the temporary direction that things will go. Eventually credit cards will be replaced completely, but the full implementation of that technology is a ways off. In the same way that Blu-rays continue to exist, so will physical credit cards. When Coin was announced, I wasn’t really excited since it was limited only to a magnetic stripe and 8 cards. Plastc has all of the features needed to ensure it will be a device that lasts at least a few years.

For $155 there is no doubt that Plastc is an investment. I do think that we will see prices drop dramatically as the technology improves. My only issue with Plastc is that it still isn’t going to launch until Q3 2015, meaning it may be delayed much in the same was as Coin. Perhaps they too are biting off more than they can chew or this is just another proof of concept product.

It also remains to be seen if a small company such as Coin or Plastc will be able to bring a product like this to market without significant backers. The credit card issuers and payment processors must be on board with the product. Even companies like Google have had issues getting everyone to agree in the past.

Conclusion

I want to end by saying I think Plastc is a cool looking product. Since it is about a year from launch, I have no intention of giving them my money, however I do hope it suceeds. As someone who has used products like Softcard and Google Wallet, I still prefer using a physical card. I do think this technology will be successful if they can maneuver the security issues and get banks on board to back them.

What do you think? Are you going to preorder one? Let me know!

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

[…] first covered Plastc back in October, 2014. At the time of its announcement, Plastc seemed like a credit card replacement product that could […]

Hopefully this one stays working:

https://share.plastc.com/x/9yVvVh

$20 OFF PRE-ORDER FROM $155 TO $135

USE THIS LINK

https://share.plastc.com/x/DCQtKo

Feel free to use this promo code by clicking the link Plastc gave me: https://share.plastc.com/x/s9zhiF

Get $20 off Plastc using code rpzw0503 or clicking the link below.

https://share.plastc.com/x/vnh8p1

By the way the promo code for $20 is ‘save20’. Follow this link to their site. https://share.plastc.com/x/ws6aoF

The best part about plastc is that it gives you the option of how to pay and secure your payments regardless of what the marketplace will look like in the next couple of years. Swipe, NFC, Chip& PIN will all be around for the foreseeable future but plastc is a good way to hedge your bet.

$20 promo code!!!! https://share.plastc.com/x/FLGYhl

Just got my refund from COIN , and immediately pre-ordered PLASTC :))

This is going to be AWESOME!

Here is 100 % WORKING ,FRESH (as of 01/28/2015) code for $20.00 off your pre-order:

http://share.plastc.com/x/kOtRgi

Thanks for using it 🙂

The other codes no longer work, this one still works as of 01/25/2015.

http://share.plastc.com/x/k9em6U

[…] few months ago I brought you a story about Plastc, an all in one credit card solution that is supposedly coming to market later this year. Plastc […]

That last code didn’t work either, but this one still does as of 01/22/15 if anyone wants it

http://share.plastc.com/x/rAxdMd

Here’s a new one called Cybergate on Indiegogo launched by Finis Conner, the co-founder of Seagate Technologies, that looks interesting. It’s a bit of a different approach … not so much focused specifically on credit cards but building an secure open platform that can adapted for many different uses.

https://www.indiegogo.com/projects/cybergate-an-open-mobile-cyber-security-platform/x/9638819

Thanks for pointing this out Mark. Interesting product, although it seems they are having trouble raising money.

That code didn’t work. But this did: http://share.plastc.com/x/tnl7ik

Get $20 off! Enjoy everyone!!!

http://share.plastc.com/x/7WAOKb

New Code as of Nov 20, 2014,

It’s a $20 promo, off the cost of the card.

Use and save, $20.

http://share.plastc.com/x/OcrWyI

New code on 19/11/2014 must work 🙂 Get $20 off right away!

http://share.plastc.com/x/fd7V3T

Here is $20 off promotion link.

http://share.plastc.com/x/J034qL

Here’s another $20 off Plastc promo code.

http://share.plastc.com/x/Lvq604

Just pre-ordered, with this $20 coupon, http://share.plastc.com/x/5uWSJM

Apple pay takes time, and Apple won’t rule the world.

As for the security problem, I can always start from the loyal cards of the stores, hotels, restaurants, miles, etc. 🙂

$20 off Platc card pre-order: http://share.plastc.com/x/7exZLY

[…] around the interweb: Success loading a(n Amex) Target RED card with a Onevanilla prepaid debit card Plastc is another take on loading all your credit cards into a single card, like Coin which went public a year ago but is still hard to get in beta. Personally I’m […]

I pre-ordered Coin only to be disappointed with slipping delivery dates and ageing technology. I have a LoopPay FOB and use Google Wallet but if this works out I think Plastc looks pretty awesome and worth the price. Since you didn’t throw out a link the referral gets you a $20 discount and me a $20 amazon card when Plastc ships. http://share.plastc.com/x/r8KzZD

Hopefully Plastc doesn’t disappoint like Coin. No referral link from me since it isn’t a product I am quite yet sure about. I just wrote the article because I think it looks interesting and promises to fix all of the shortcomings of Coin. Thanks!

I dont think you understand NFC and Apple Pay/Google Wallet correctly. NFC is a method whereby you can make a payment by touching a card to a NFC receiver rather than swiping the card. By supporting NFC the Plastc card can be touched rather than swiped. Having NFC doesnt make the Plastc card compatible with Apple Pay, it makes it a competitor to Apple Pay. In each instance you load your current credit cards to the device (either the Plastc card or an iPhone with Apple Pay) and then use the device to make a payments.

I really don’t see this product being successful. Anyone savvy enough to use such a product likely will already be utilizing Apple Pay or Google Wallet. I see no reason to pay $155 when I can make payments through my phone at no additional cost.

First off, Apple Pay is just one of the many NFC technologies. Google Wallet and Softcard are the other main ones. NFC is a way of communication and Apple Pay/Google Wallet are the front-end systems that use them. Apple has APIs available that will allow devices and apps to use their system. (Plastc has announced that they will use these to support Apple Pay.) In other words, a device such as Plastc can use your already existing Apple Pay account to pay at merchants. It can also use Google Wallet or another system. (Or so they say it will as this product hasn’t yet reached market.) It is not the NFC wallet, but just another tool or device such as your phone that can use it.

Since it also has chip & pin, this is a device that can be used anywhere unlike your phone. Remember that NFC technology is limited and the roll out has been slow due to costs. Plastc can theoretically be used all over the world. I completely agree that this is a product of convenience and don’t think $155 is a price worth paying for it, but as the technology develops, I can see this as being a great bridge technology. Will it be the future of payments in 10-20 years? No it won’t, but it doesn’t have to be.

Thanks for another great comment!

I agree with Jay. I don’t think Coin or Plastic have the know-how or backing to make these concepts feasible. With Apple Pay, I won’t need to carry any credit cards with me. With Apple’s technology and billions of dollars in backing, they have the capability to do great things. I’m still waiting to make my first Apple Pay payment with my iPhone 6. Hurry up Apple!

Apple Pay will be big. No doubt. Apple doesn’t only want the business of people who own iPhones though. That is why it will work on other devices like this. This is not an Apple Pay competitor, it is just another device which uses Apple Pay like your iPhone.

I am not defending this device, it is too expensive and may not even make it to market. The concept is interesting though, especially in a world where we will still need physical plastic in some form for awhile.