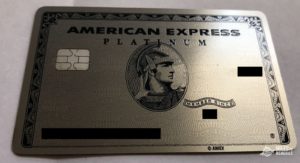

American Express Personal Platinum Retention Call Results

As an extremely loyal American Express Platinum Card holder, I’ve had a few strange platinum retention calls. I don’t know if this one takes the cake but it annoyed me nonetheless.Generally, the goal of any retention call is to get the annual fee reduced to a point where you’re getting enough value to keep the card open or get some other incentive to stick with the card. Here’s a great resource with Retention Tips and Retention Call Outcomes from several banks.

Personally, I will get at least the $550 of value from my Platinum Card but I’d still like to see some additional retention offer since it’s a lot of money to outlay each year. For more information check out our Guide to Amex Personal Platinum Benefits, Guide to Membership Rewards and our American Express Program and Application Rules Guide.

The Call

I called the general number and informed the CSR that I was considering canceling because of the $550 annual fee and she said in no uncertain terms there is absolutely nothing they can do about the fee, it’s the only thing they’re not able to budge on. At this point, I’m wondering what the policy is? Are there new rules or are they instructed to essentially lie to customers at first? Because if I Google “AMEX platinum retention call” thousands of posts come up where people did get something off the fee or some other incentive to offset their annual fee. I let her know that I’ve heard a lot of stories about people who have gotten some kind of compensation for keeping the card and she said “again we simply cannot do that.”

At this point, I probably should have probably hung up and called back at this point but I thought this was pretty interesting so I wanted to follow it down. I asked her if they had a retention department that they could transfer me to and she obliged.

You can read about retention offers for the following Amex cards as well

- American Express Personal Platinum

- American Express Personal Platinum Delta card

- American Express Business Green

- My Strange Amex Platinum Retention Call. Was it a Success?

Retention Department

As per usual I was given a recitation on the AMEX perks, which you’d be surprised to know I pretty much always listen to in case I am able to find out something interesting that I didn’t know prior to the call.

The CSR informed me that they are generally only able to give one such offer per year and that the previous year I was given a $150 statement credit to help offset the annual fee. Well now this makes a ton more sense! I have had this situation before with Amex. They will basically only give me an incentive every other year. Has anyone been successful getting an offer in back to back years?

Verdict and Thoughts

I kept the account open, but not for the reasons you think. I actually left myself with no choice but to keep the card open since I waited till the last possible minute to make the call and hadn’t set myself up to cancel. I may not have been as inclined to keep the card open if I had set myself up properly as far as points and annual credits go.

So what’s the moral of the story?

**Politely** ask for the retention department right off the bat. Say something like “I was recently charged an Annual Fee and I would like to be transferred to the retention department to see if they can help me offset the fee rather than cancelling the card.” Also, make sure you don’t wait till the last minute so that you have some extra time to consider your options. A future post about keeping track of things and preparing yourself to cancel cards is in the works.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Just got a choice of $200 or 20k MR if I spend $3k in 90 days. Thank you so much for the suggestion

I just got 30k MR’s for 4k spend in 3 months… pretty good offer. I had no intentions of cancelling so it was a mega win for me!

I don’t spend a ton on the card, maybe 20k… Mostly just airfare and amex offers when something peaks my interest.

Wow! That’s an awesome deal, especially since you were keeping it either way. #winning

When I made the call I was offered to down grade the card to the gold card that costs $175 per year and gets $100 travel credit. Would that make sense?

Why not just call the retention department first?

Not a bad idea, though I’ve heard of some people’s accounts being accidentally cancelled because supposedly they need to hear the word in order to transfer you. Not sure how accurate that is

Last year I only got 10k MR points. I called again this year (regular agent – not retention department) straight to the point asking if there is any offer. She said $200 statement credit after spending $3000 or $300 credit after $4000 in 90 days.. I took the latter..

Wow that’s excellent

How much spend did you put on the card. Since getting the card, I put $3000 plus a few more dollars on my vanilla platinum when I cancelled it earlier this year (January). They also only offered $150. I only had the card a little under a year. Even though I said I would keep the card if it was $200, that was still the max they would offer. I would have kept it, but my future travels would give me $0 value on the card from January-December – all out of the country where uber credits are useless, airline credit are useless since it’s not one of the airlines Amex allows for the credit, no Centurion lounges in the airports where i’d be in, I already get Priority pass from another card, I already have Hilton gold status, I have no use for SPG gold. I told them all this, and still retention was only $150. The rep was very nice though. When I cancelled my business platinum in April, the rep was downright condescending.

I’d say about 10k…. nothing crazy to make them want to keep me over anyone else. Yes, the CSRs can be pretty hit or miss

I’m in the same boat as you, but I’ve pretty much used up the credits so far. I feel the $500 total of airline fee credits, Uber credits and Saks credits to me are worth about ~$375 to me, so the question is really whether the addition of the 5x points on airlines is worth $175. I’ve a Business Platinum as well (thanks to Mark’s deal earlier in April) so I can get all the other platinum benefits through that. So far Amex is not willing to offer me an incentive saying they offered 15k MR last year. Tough choice but I’m inclined to cancel given that I just opened Citi TYP with 3x on travel and I’ve the Amex PRG with 3x on airlines.

I wish I could let it go, but the 5x on flights combined with the 35% points rebate make both my favorite duo. Plus I actually use the Uber benefits

Hi Bethany, 5X I can understand, what 35% points rebate are you referring to? Thanks.

Hi Kyle :). Happens to be my favorite way to use Membership rewards. https://milestomemories.boardingarea.com/guide-american-express-business-platinum-35-point-rebate-airline-bonus/

Nothing in this world is free

I just made the same call the other day and got the 20k MR offer (5k instant/15k after 2k spend in 90 days) and I took it. Other offer was $75 credit. This was after only a $75 credit last year so maybe they split it up. I don’t put a ton of spend on it (about 5k).

That’s interesting…I’m generally happy with whatever they give me since I get decent value from the card

I was told the same thing and that “…this is the new policy. it may change moving forward but as of right now there are no discounts or retention deals.”

As long as next years is decent, I suppose I’ll be fine lol

Yes typically with AMEX you can get a retention offer every other year. Have you used all the Uber credits in the past year? That would really be your only argument in that you were charged $100 more and didn’t use $100 in Uber credits but I imagine you used more than that?

Yes, I use them and everything else lol