Proceed with Caution! American Express’ New Policy is Dangerous

American Express has been getting more restrictive with signup bonuses lately. Now they have taken one more step in that direction, and this one gives them even more power to deny bonuses. Here’s everything you need to know about the existing American Express rules and conditions: Guide: Amex Program Rules: Application Strategy, Card Limits and Difference Between Credit and Charge Cards

RELATED: Is American Express On a Shutdown Spree?

Updated Terms

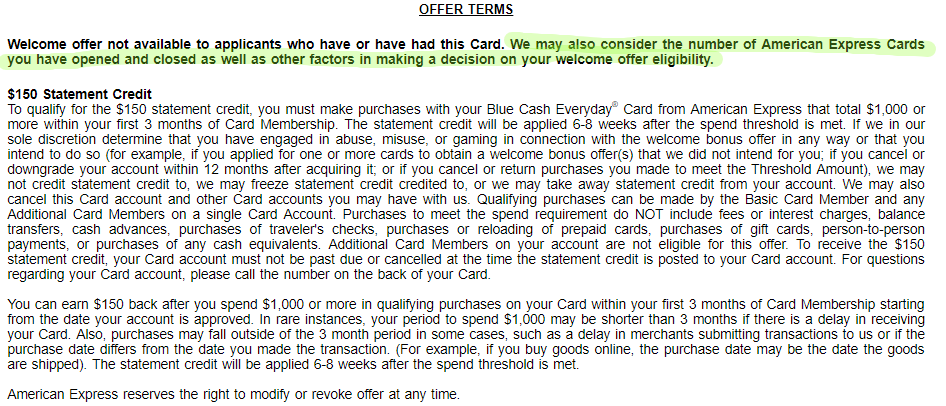

Previously Amex only had the following language in the terms of the application:

- Welcome offer not available to applicants who have or have had this Card.

- Purchases to meet the spend requirement do NOT include fees or interest charges, balance transfers, cash advances, purchases of traveler’s checks, purchases or reloading of prepaid cards, purchases of gift cards, person-to-person payments, or purchases of any cash equivalents.

It prevented you from getting the bonus twice on the same and also from purchasing gift cards and other cash equivalents for the spending requirement.

Now there’s a new limitation for signup bonuses. It’s very vague and it gives Amex full power to withhold signup bonuses for a variety of reasons.

We may also consider the number of American Express Cards you have opened and closed as well as other factors in making a decision on your welcome offer eligibility.

Analysis

There’s no real rule here. Your bonus can be denied if you have too many Amex cards. There’s no set number, so you do not really know what “too many”. Besides that, the bonus can also be denied because of “other factors”.

On top of that it’s not clear how they will enforce or implement this new language. Will they approve you for a new card and then tell you that you do not qualify for the bonus? Will they wait for you to complete the spending requirement and then look at your account to decide whether you should get the bonus? We’ll have to wait and see.

Conclusion

These new Amex credit card rules are bad news for many and the uncertainty of it is even worse. There’s no set rules for what disqualifies you for a bonus with Amex. If you start getting denied for bonuses I guess you need to wait a long while before trying again. How long? Again, no one knows.

Hat Tip US Credit Card Guide

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

#THIS ALL DAY LONG

Unfortunately, I’m having to learn this hard way, and will lose money rather than saving by choosing to do business with Amex (again). This change is ABSOLUTELY dangerous! How in the heck are they getting away with this btw? There are SO FRIGGIN MANY complaints/poor reviews out there about this exact issue, and to be honest, it surprises me that this consumer deception tactic is even legal. What kind of a company purposefully PUNNISHES return customers? If anything, they are just chasing us all AWAY! Outrageous!

I just got denied the bonus on the relaunched Amex Gold card. The good news is that they informed me of this BEFORE I completed my application and let me exit without the credit pull. The bad news is – I don’t obviously violate any of their rules unless 6 cards in 7 years is “too many.” I have never had the PRG or any other variant of the Gold Card. The last Amex card I applied for (Delta) was almost 2 years ago and that card is still open. Since 2011 I have opened 6 cards and closed 3 of them, and none of them were closed within a year of opening. I am disappointed, as this card looked like one I would really use. But without the bonus offers, it is just too expensive. Any other data points on this one? Would it make any difference if I waited until a full 24 months since my last Amex application?

I have the Amex everyday and Hilton card. I use the everyday but do not use Hilton. Same thing denied points bonus on gold card. We also have a business card we use. Never canceled anything. Still no bonus. Been a member since 14′

I was randomly ding on 75,000 mr points on new plat card – I’m currently requesting $550 card fee – I have ready recooped $200 airline and $100 Tsa – but I’m annoyed cause sign up was the reason I got the card – and they never informed me about not giving me points – until I reached after 3 months of making my spend

Thoughts

Have you ever had the Plat card before?