SPG Amex New Bonus

There has been so much news this week regarding the SPG and Marriott merger. From new credit cards to a combined loyalty program coming in August, there is a lot to digest. One of the things we have been wondering about is the future of the SPG Amex credit cards.

We had already learned that beginning in August those cards would earn 2 points in the new loyalty program instead of the equivalent of 3 which they earn today. They also will come with the program’s low tier Silver elite status and an award night each year on their account anniversary. It’s an overall loss in my opinion since the everyday earning is being cut by 1/3.

To make things worse, rumors started swirling that the bonus on the personal & business SPG cards was going to be cut as of today. According to the rumors the 25K Starpoint bonus which is worth around $500 was going to be cut to just a $200 statement credit. Unfortunately that has happened on both the personal and business cards, however it isn’t even as good as it sounds.

SPG Amex New Bonus – $200

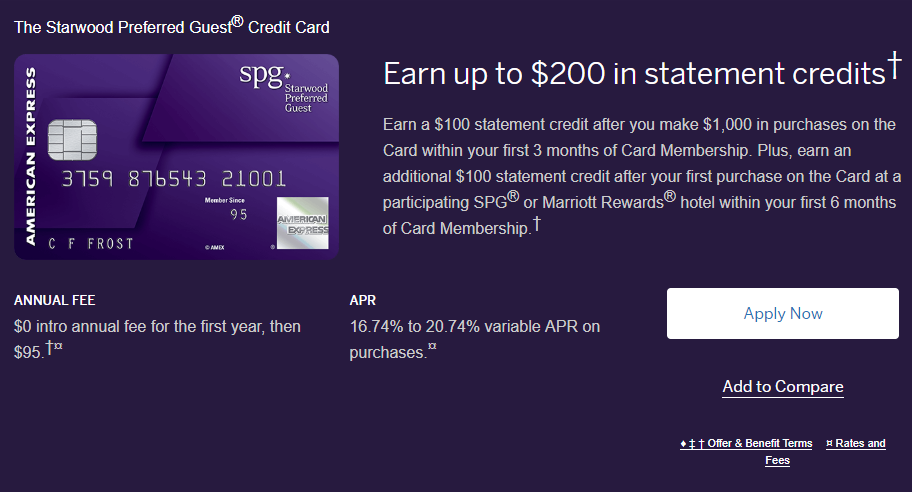

As you can see, the bonus has indeed been reduced to a $200 statement credit, but it is actually split into 2 parts.

- $100 statement credit after $1K spend in 3 months

- $100 statement credit after your first purchase at an SPG or Marriott hotel within your first 6 months

While the wording on the $100 SPG/Marriott part of the credit seems to indicate you could make a small purchase and still get the $100, I’m not 100% certain that is the case, but it should be. The terms only say:

To qualify for the additional $100 statement credit (the “First Purchase Bonus”), you must use your Card to make a purchase directly with a participating SPG® or Marriott Rewards® hotel, or a Marriott-branded retail establishment or SPG- or Marriott-branded online store that, in each case, is wholly owned by Marriott International, Inc. and its affiliates within your first 6 months of Card Membership, starting from the date your account is approved.

Either way we went from a nice 25K bonus to a $200 statement credit bonus which at the very least makes you jump through hoops and spend at one of their properties in the next 6 months. Hopefully all you need is a small purchase (and worst case Marriott sells gift cards), but we will see.

Will It Get Better?

I believe at some point in the next couple of months American Express is going to have to stop offering the personal card to new cardholders and will only be able to offer their new premium card along with the business card. If that’s the case it would make sense for them to try to attract new cardmembers with a big bonus, but given this severe cut, I wouldn’t count on it coming back. Hopefully we will see something better return to the business version.

Conclusion

As predicted by rumors, the SPG Amex bonus was cut from 25K Starpoints to a tiered $200 statement credit bonus. At this point we don’t know if it will go back up again, but for now this represents a huge value loss for new cardmembers, especially considering the reduced earning potential come August.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

What about the Ritz Carlton card? Is that remaining as is, as far as anyone knows?

Mark – what would you define as “a lot” of hard pulls.

Do you think the Marriott Business card might go away ? I don’t want to lose the sign up bonus for that if there is a real possibility that could vanish.

Yes it goes away at some point for sure because Amex is taking over all of the business card portfolio. No one is sure when though. I would consider getting it sooner rather than later but remember that Chase has been shutting people down if they have a lot of hard pulls after applying for a new card. So something to be aware of.

Id say an even bigger loss to the bloggers who relied on the referrals from this card, for some it was the bulk of their biz.

Besides the mega blogs that get a lot of newbies I don’t think these were big money makers for most since most people have already had them.