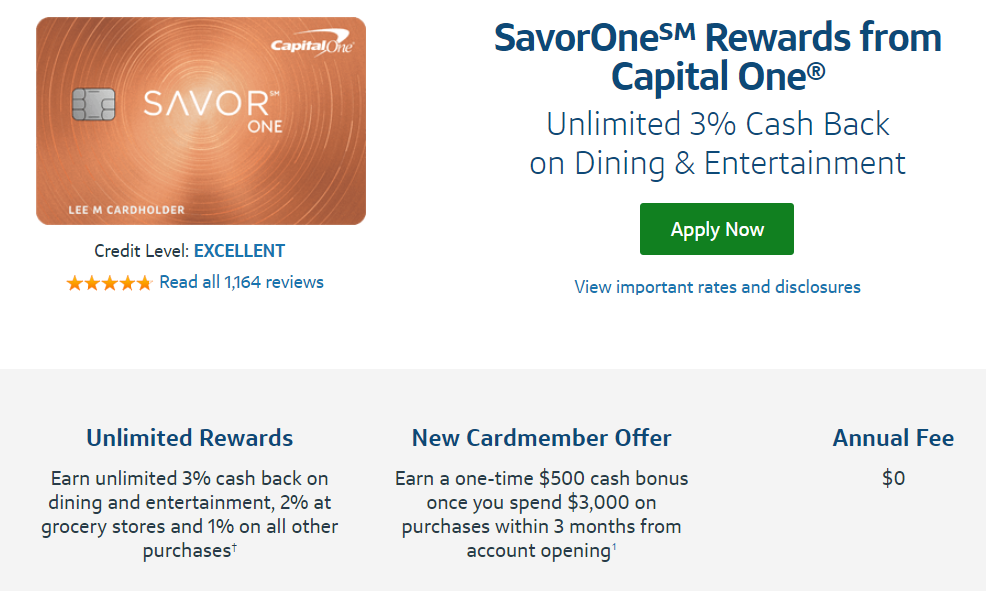

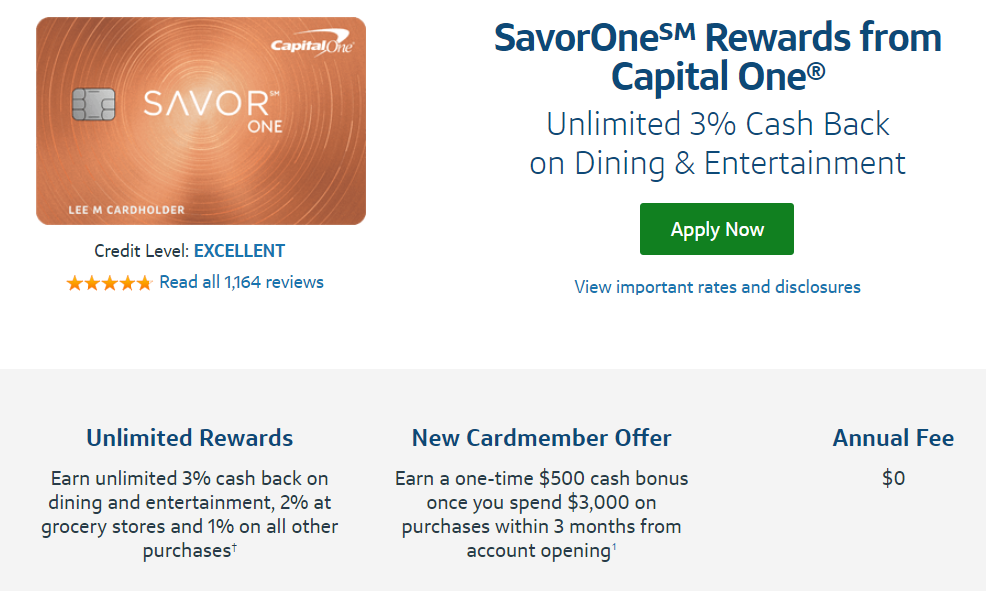

Capital One SavorOne Bonus Gets Supersized From $150 to $500!

Update: Capital One has sent out emails telling those who applied and were approved that the $500 bonus will be honored. They confirm that it was indeed a system error and the actual bonus should have been $150, not $500.

But it gets even better. Looks like you only need to spend $500 (which was the spending requirement for the $150 bonus) to get the $500 bonus, not $3,000 as it was stated in the offer. Congrats to those who got in on time. (HT: Doctor of Credit)

The Capital One SavorOne card was released last year, as the Capital One Savor card was upgraded with more benefits. Unlike the Savor card, the SavorOne card has no annual fee. It was first released with a $150 bonus, but now it has a huge $500 offer that’s pretty rare for a no fee card. But there’s one issue, in terms it still shows a $150 bonus, so make sure to take screenshots.

Some Of These Offers May Have Ended Or Changed

The Offer

Earn a one-time $500 cash bonus once you spend $3,000 on purchases within 3 months from account opening.

No Annual Fee.

Card Details

- 3% cashback on dining and entertainment

- 2% cashback on groceries

- 1% cashback on all other purchases

- No Foreign Transaction Fees

- Price Protection – Find a lower price within 120 days and you could be reimbursed for the price difference.

- Additional warranty protection at no charge on eligible items that are purchased with your credit card.

Conclusion

This is not a card that has been on many people’s list. It has some decent earning categories, no foreign transaction fees and no annual fee. Clearly that’s not worth getting excited about. But now the signup bonus has jumped from $150 to $500. That’s not something we see on a no fee credit card. On top of that, you also get 0% APR for 15 months.

As I mentioned above, there’s still a mention of a $150 bonus in the terms, so take screenshots of your application. Email and T&C after application is approved do show the $500 bonus, so everything should be OK.

Do you think it’s worth it? Let us know in the comments.

Increased Offer! - Chase Sapphire Preferred® Card 75K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

So is the bonus now $150 or $500? I would really like to apply for the card now but only if it is a $500 bonus.

$150 now unfortunately.

I see 150 after 500 when i click link

I am guessing it was a mistake then that they caught and have now fixed. Thanks John – updated the post