Chase Ultimate Rewards Guide: How to Combine Points Between Accounts

As you may have heard by now, there’s a rumor going around that Chase may eliminate the ability to combine Ultimate Reward’s Points from one card with those of another. Why is this important? Currently, you can make purchases on whichever UR card earns you the most points and then transfer them to the account that gives you the best redemption value and/or flexibility. We covered the news and potential consequences for each type of Chase UR card in: What Would Chase Eliminating Ultimate Rewards Transfers Mean? I Take A Look at Each Card

Below I give you advice on which cards you should transfer your existing points to and a step by step illustration of how to complete the transfers.

Related: Chase Ultimate Rewards Points Guide: Earning, Redeeming and Sapphire, Freedom and Ink Brands

Best Card Transfer Options In Descending Order

Best: Chase Sapphire Reserve (Card Review)

If you hold the Chase Sapphire Reserve Card- transfer each and every one of your UR points into this account. Easy! If you’re still debating after I’ve told you what to do, fine, I’ll let you know why. First, your points when used to book travel through the Ultimate Rewards portal are worth 1.5 cents each (that’s .25 higher than the other premium UR cards.) Second, you have the ability to transfer those points to transfer partners which is only a feature available to premium card holders.

Good: Chase Sapphire Preferred and Chase Ink Business Preferred

If you have no Sapphire Reserve cards, either the Sapphire Preferred or Ink Business Preferred are your next best option to park your Ultimate Rewards points since they also allow transfers to loyalty programs and have increased value of 1.25 cents per point when booking through the portal. Check out our reviews of the Chase Sapphire Preferred and the Chase Ink Business Preferred.

Chase Freedom, Chase Freedom Unlimited and Chase Ink Business Cash

These cards are all excellent earners and fee free but not as great on the redemption side. You should transfer any Ultimate Rewards Points in the Freedom, Freedom Unlimited and Ink Business Cash to one of the premium cards listed above if possible.

Related: Chase Ultimate Rewards Points: Should I Transfer Points to Travel Partners or Book Through Portal

How to Transfer

Login to Chase and navigate to the Ultimate Rewards Site page. Or just click here.

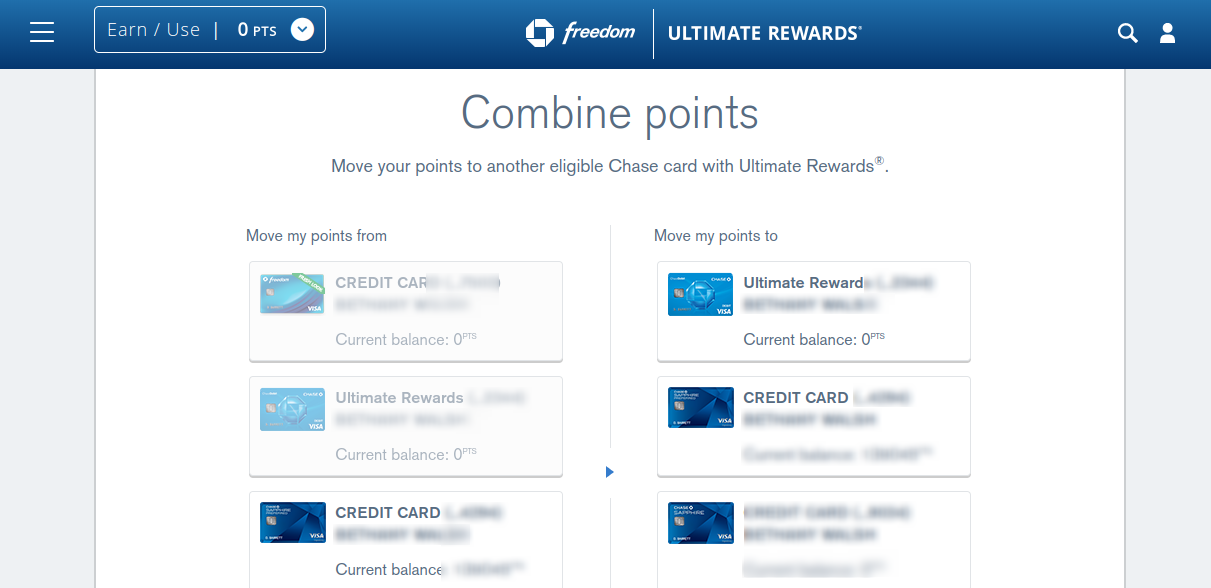

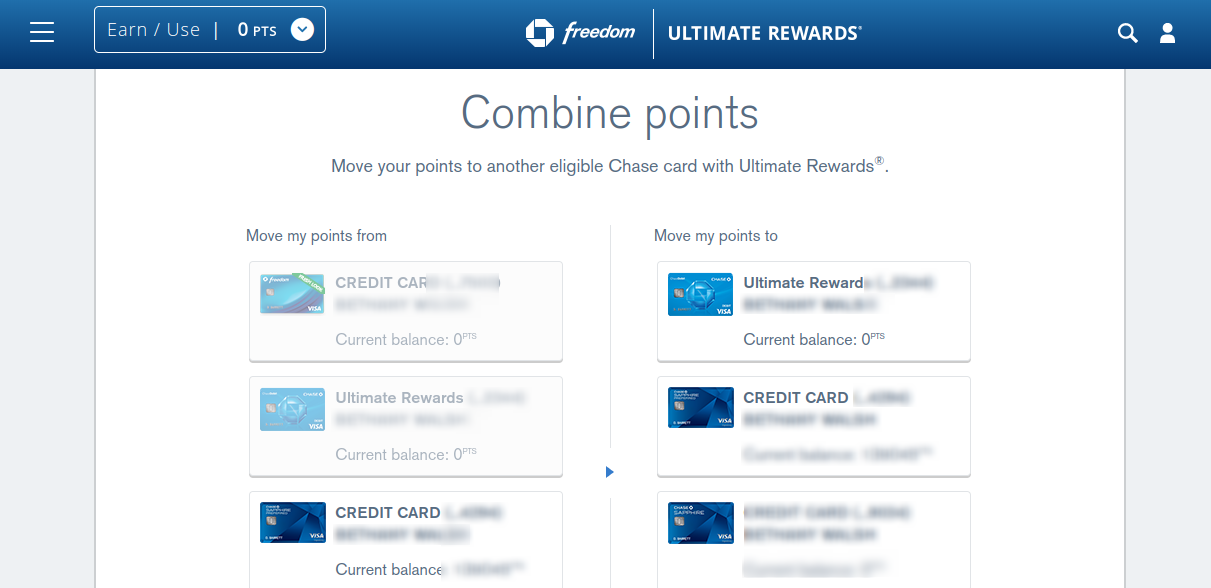

After you click “Combine Points” you will be given a list of your Ultimate Rewards Cards and the balance totals for each card account. On the left side, you select the account for the points you want to transfer from and on the right side you select the account you’re transferring to.

A box will appear asking you to confirm that you would like to proceed with the transfer and once you do so, the points will instantly transfer and that’s it, you’re good to go.

How to Transfer to Family Member or Account Associated with a Different Login

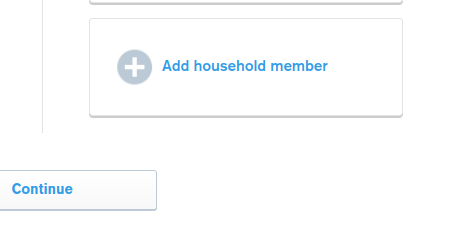

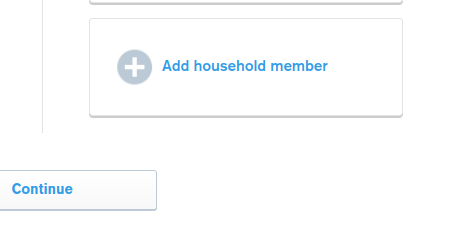

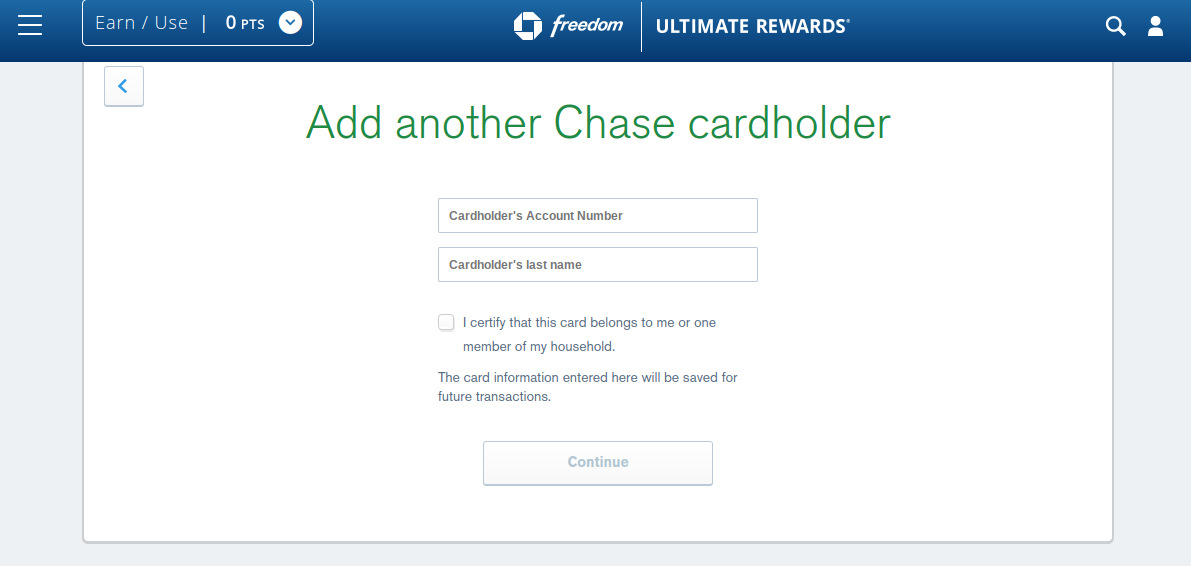

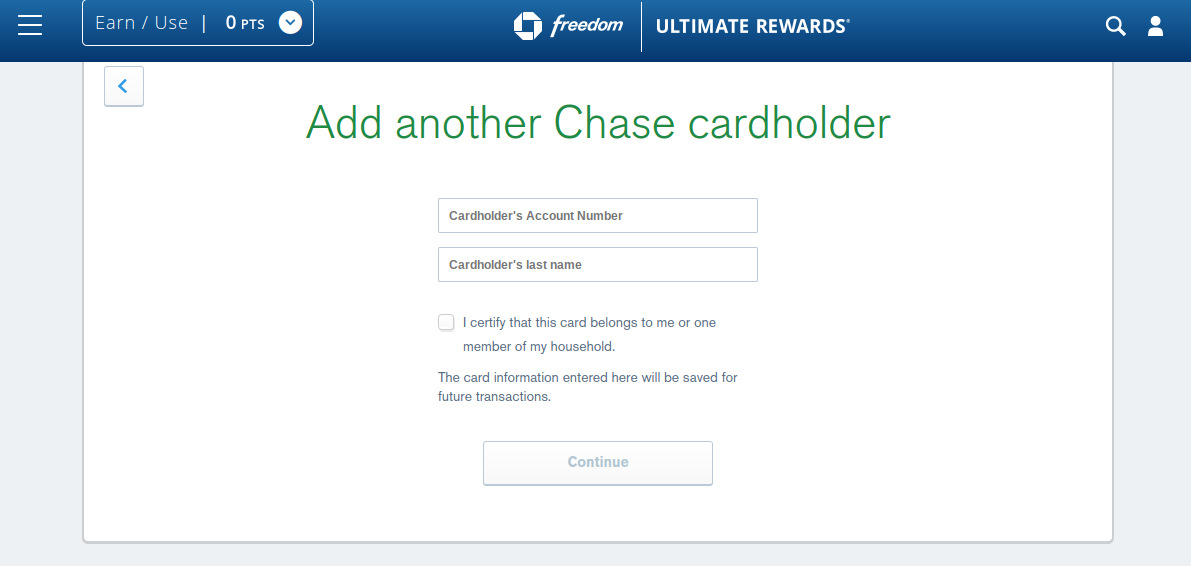

Follow Steps 1 and 2 above but instead of choosing one of your card accounts at the bottom of the right hand side, click “Add Household Member”. You can then add a member of your household with an Ultimate Rewards account by entering their account number, which is their card number and their name.

If you have UR cards in different logins because you have both personal or business accounts, you can transfer them to the most beneficial account by adding your account on the combine points stage. The steps are almost the same except it will ask you to link an account. Keep in mind, you can only move your points to another Chase card with Ultimate Rewards belonging to you, or one member of your household or owner of the company, as applicable.

Conclusion

Currently, this is a rumor and unfortunately I cannot look into my crystal ball to tell you what the future holds, but there’s no downside to transferring your points to the most beneficial account. (Unless you transfer them to a spouse and they run away in the middle of the night, in which case, my apologies for giving you poor advice.) And since there’s no downside, you should be transferring your points each month each month as they are earned in the manner discussed above. I find it unlikely that Chase would eliminate the ability to combine points without a bit of notice, but it’s still a good idea to be ahead of the game.

HT: Frequent Miler

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

When I go to combine points and try to add my ink plus onto the login for my freedom, it tells me an unexpected error occurred. Anyone else have this?

Hi Jason. I’ve had the same thing happen to me in the past. If your Ink Plus or Freedom is linked to another card you should remove the link with your other card. After you remove the links, it takes about 24 hours for the error to disappear. I have a few different Ultimate Rewards points between me and my wife and I always unlink them after transferring the points. If that doesn’t work, you can call Chase and they can move the points over the phone.

Hi Nikki. If you transfer your points to an airline or hotel partner, then you don’t lose any of the value of the points by going with Chase Ink Instead of Chase Sapphire. But if you spend the points using the Chase travel portal, and I think your analysis makea sense.

i plan to cancel my CSR since i got amex biz platinum (Thanks to Mark). However is it worth keeping csr for the 1.5 redemption if i have about 400k? Or move it to Ink Preferred for 1.25? Is it fair to compare the following:

CSR @ 400k points = $6000 travel

Ink @ 400k points = $5000 travel

loss $1000 if moving to Ink but save $450 (prorated to $300) CSR AF = Net $700 travel credits which isn’t much. $300 cash with more.

i know i lose CSR perks but Platinum will make up of it. this lead me to think I should cancel the CSR unless you think otherwise.