Citi AAdvantage 60K Offer Ending

While American AAdvantage miles certainly don’t have the value they once did, the ability to grab 60K in one shot is definitely appealing. According to some sources, today will be the last day to grab this increased bonus before it drops back to 50K. Let’s take a look.

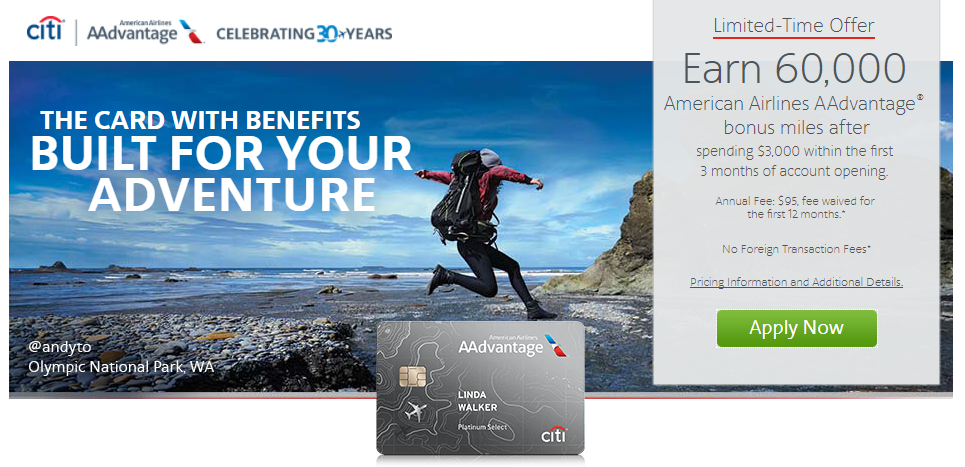

The Offer

Earn 60,000 American Airlines AAdvantage® bonus miles after making $3,000 in purchases within the first 3 months of account opening.

Card Features

- $95 annual fee waived the first year.

- No foreign transaction fees.

- First checked bag fee waived for you and up to 4 companions.

- Preferred boarding on AA flights.

- Earn 2X on AA purchases and 1X elsewhere.

- 10% of redeemed miles rebated back up to 10,000 miles per year.

24 Month Rule

American Airlines AAdvantage® bonus miles are not available if you have had any Citi® / AAdvantage® card (other than a CitiBusiness® / AAdvantage® card) opened or closed in the past 24 months.

As with most Citi cards, this application does have the 24 month language as stated above.

Analysis

If you haven’t opened or closed a Citi AAdvantage card in the past 24 months then this is certainly a bonus worth considering. 60K is the highest bonus I can remember in quite awhile for this card, so it might pay to grab it now. With that said, the normal bonus is 50K so if you feel the need to hold off you won’t be losing too much.

Do you plan to apply for this card before the bonus drops? Let us know your thoughts in the comments!

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Kind of a spur of the moment thing but decided yesterday to sign wife up for it. Had closed it right at 24 months. Approved quickly. Caught us at a good time I guess.