How to Close Citi Credit Cards Online

Last year during the AAdvantage Executive 100,000 mile deal, I picked up a total of four of those cards. Now that the hefty $450 annual fee is due, I am needing to cancel a few of them. While I could also convert them to another product, at this time I feel like I have too many Citi cards and thus would like to scale back the total number.

Keep in mind that Citi does often have generous retention offers on their cards. In fact, I called retention a couple of months ago for one of my previous AAdvantage Executive cards. For those who don’t care about offers and just want to close their card, thankfully there is a simple and easy way to do it online in about a minute. Here is how:

The Simple Process

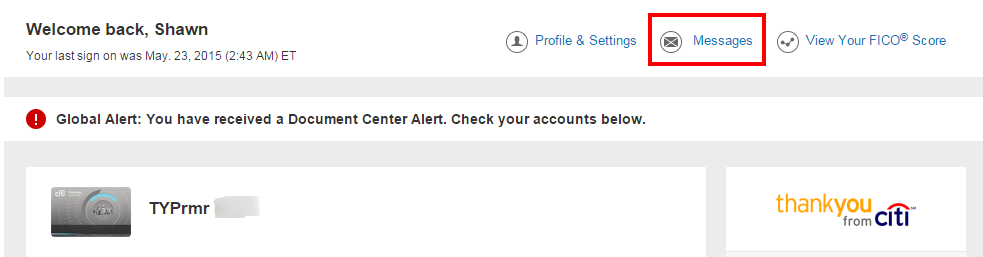

- Login to your Citi credit card account and click “Messages” towards the top.

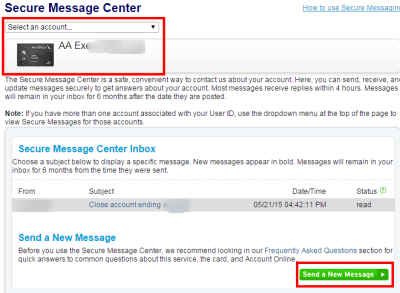

- Select the appropriate credit card account from the drop down. Once the correct account is selected, click “Send a New Message”

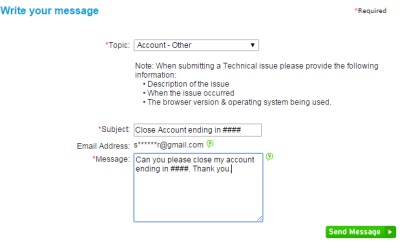

- In the Topic dropdown select “Account – Other” and in the Subject field write: “Close account ending in ####.“

- In the Message area write, “Can you please close my account ending in ####? Thank you.“

- You can elaborate more if you want, but it is not required. Once your message is written click “Send Message”.

Normally within 24 hours you should receive a written response from Citi. On my recent Executive card closure here was their response:

Dear Shawn,

We have closed your account at your request. If you would like to consider reopening your account, please contact Customer Service at 1-800-950-5114. If you are outside the United States, please call us collect at 1-605-335-2222. Our telecommunication number for our hearing impaired customers is CS TDD 1-800-325-2865.

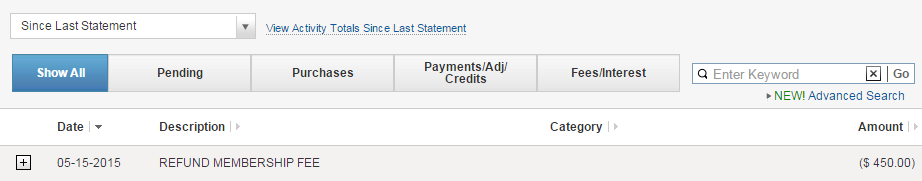

The $450.00 Annual Membership Fee will be credited. Our adjustment will appear on your account within the next five business days.

It normally takes between 24-48 hours for the annual fee credit to show. With my recent closure the credit showed up within 24 hours.

Conclusion

While it may be beneficial to call in to Citi to see what retention offers they have, you don’t have to. if you are simply looking to close a credit card account, it can be done in about a minute online without any fuss. Simple and easy.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I called in to cancel as I had a large credit line on my Citi Executive that I asked to transfer to one of my other open cards. I remember reading it’s better for your credit score to keep the credit line. True?

Well it can be. If you have a large line that you close, then your overall available credit goes down. If you have balances on cards then that means your utilization rate goes up which can be bad, but can also have no effect. In my case, I was closing a card with a $5k line, but I also just recently was approved from Citi for the Prestige with a $5k line, so it is basically a wash.

Fist Card they offered me 10k, I said no, have now canceled 4 cards, and one more to go…

Thank you Citi…

Hi Shawn,

I am very new to your site- thank you for all of the great deals and information!! I am only posting here because I recently came across some information about a Citi Simplicity card with 21 months 0% interest on both purchases and balance transfers. I am in the process of moving balances over from interest credit cards but haven’t seen information on credit worthiness to qualify for this card. Mine’s good, not great (yet)- and getting better. Can you please comment or link me to your post about this card before I apply? Thank you!

Credit Karma has some good information on credit score ranges. https://www.creditkarma.com/creditcard/CCCitiBank1859 It appears the low is 645 and average is in the 700s.

Thanks Shawn!

I just did this exact thing about a week ago for my 2nd exec card. I got the card cuz it still has a 50K bonus. I used Redbird for spend (before redbird died), got the miles and closed it, all in less than a month before the annual fee came due. So nice to be able to do via SM and not call in.

Yes that does make it convenient.

Good to know. Always good to avoid human interaction when possible. 🙂

Have you tried (or seen reports of) downgrading or retention offers via Citi secure mail?

I have not and I don’t think it is possible. When they convert there is quite a lot of language they read to you and get you to accept, so there probably is a regulatory reason. As for retention, the reps on SM aren’t usually the most empowered. Generally they are only able to do basic things.