Travel Freely & Miles to Memories have partnered up. We may receive compensation from Travel Freely. The words and thoughts in this post are ours alone.

Travel Freely – Credit Card Organization Tool

One of the greatest challenges of being in this hobby is credit card organization and keeping track of the best offers available to maximize your applications. We have partnered with an awesome new tool called Travel Freely that sets out to solve those issues. It works great for both beginners and more advanced miles/points aficionados. Let’s take a look!

Sign-Up

To start, Travel Freely doesn’t cost anything. You can sign-up to use their service without paying anything.

Beginner or Advanced?

Travel Freely’s goal is to help their users become more informed. They have dedicated a great deal of time to developing resources to help users out, but of course if you are already pretty advanced you may want less of that. For that reason you can select whether you are a beginner user or an advanced one. Travel Freely will tweak the process based on your experience level which is great!

If you do choose “Beginner” then you can expect to be treated to a bunch of useful guides, resources and even webinars to take you through the steps of getting started. This is a great tool to recommend to friends who are looking to get their feet wet. Travel Freely makes it very easy to learn.

Credit Card Organization – Adding Cards

The true meat of the Travel Freely service is in tracking your credit cards. When you sign-up and then later on in the Card Dashboard you can add in all of the credit cards currently in your portfolio. Travel Freely tracks all of the following information:

- Product Name/Type

- Open Date

- Bonus Amount

- Bonus Spend

- Account Status

- Notes

What I really love is that Travel Freely already has a database of all of the most popular card products. This means if I choose the American Express Personal Platinum from the list it already knows it comes with a $550 annual fee. The service also uses my open date to remind me of when that annual fee is coming due.

As with any flexible service you can choose to include as much or as little information as you want. Accuracy is helpful here though since Travel Freely is tracking a lot to help you out.

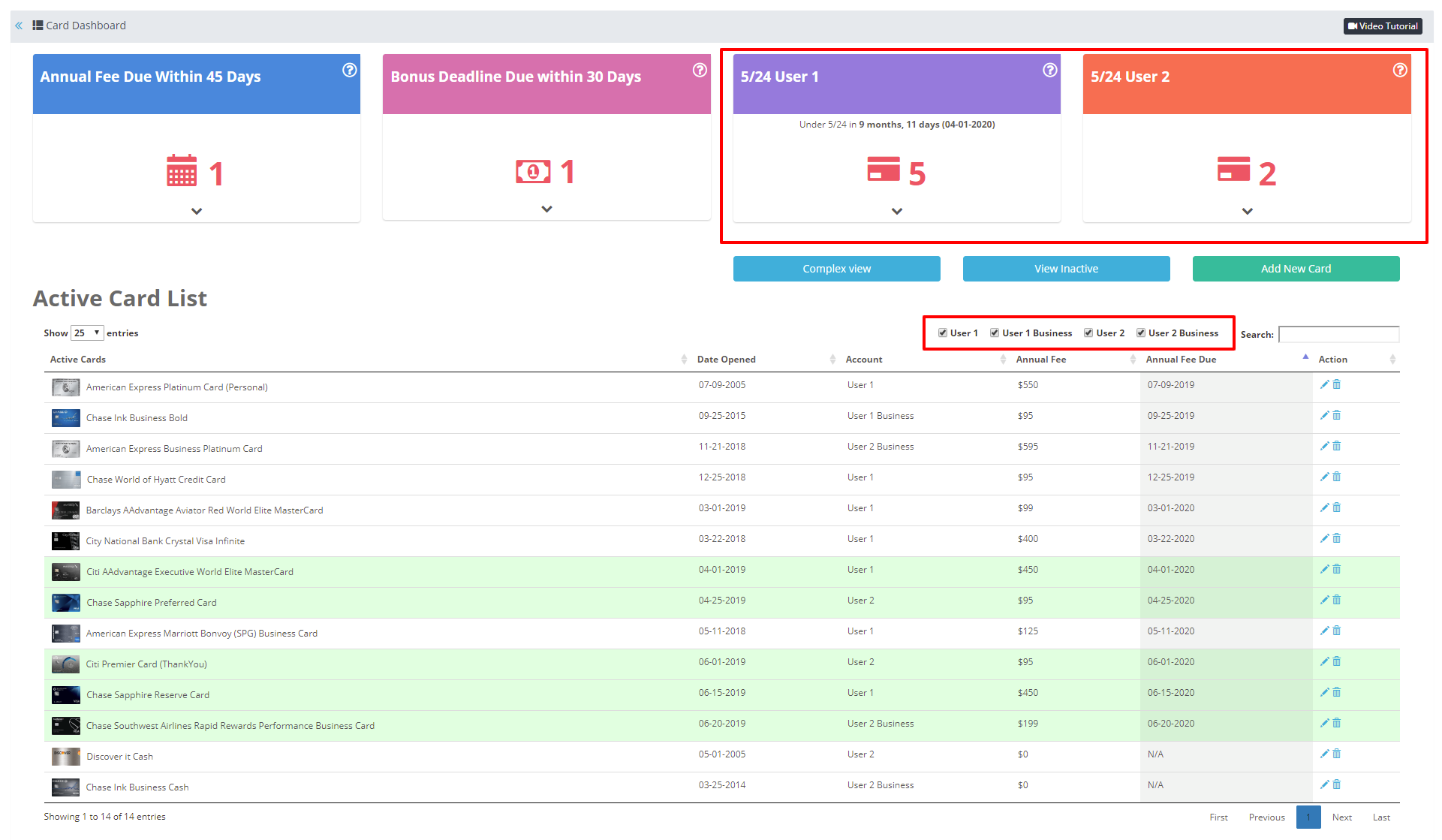

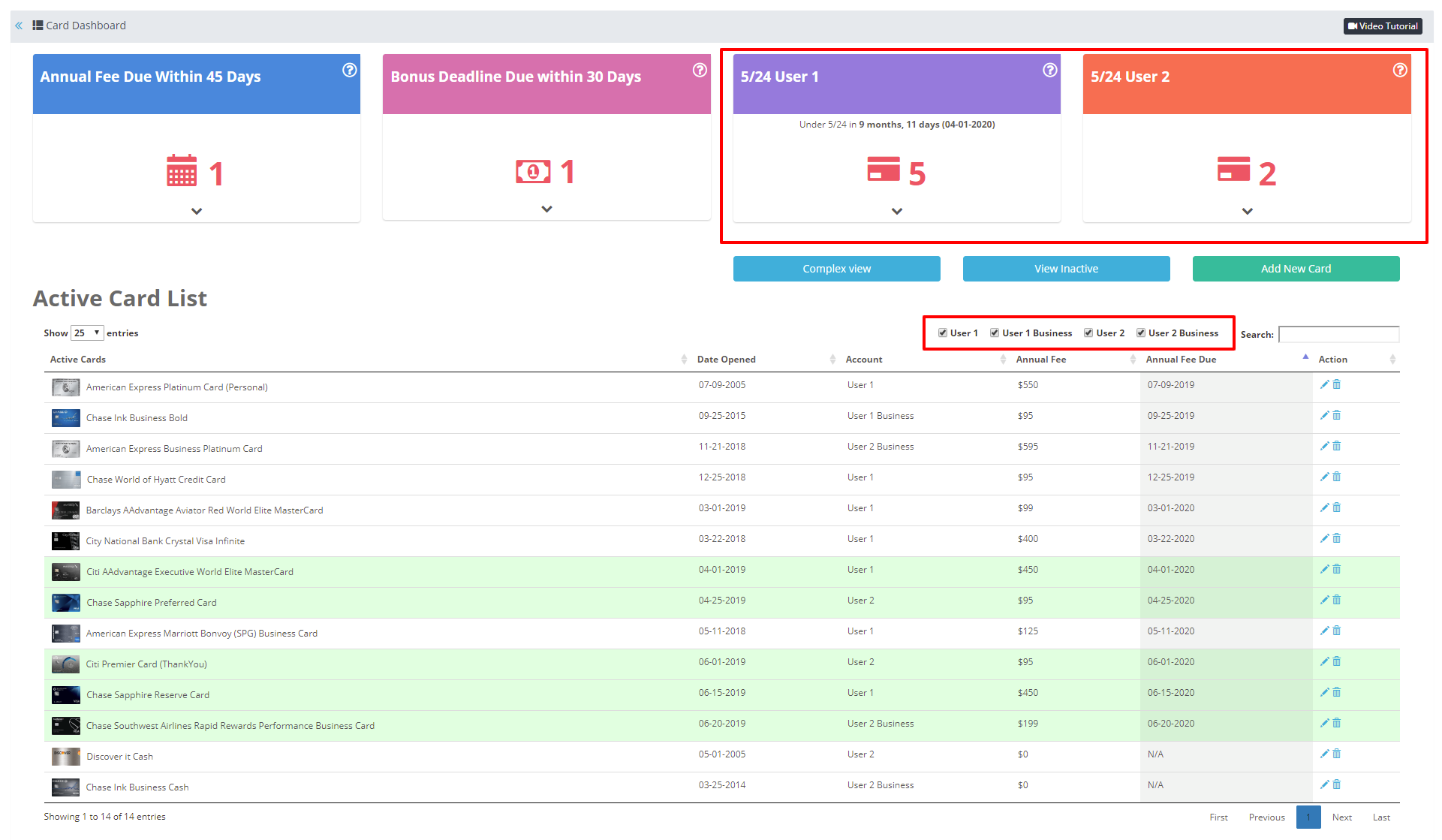

Travel Freely Credit Card Organization – Card Dashboard

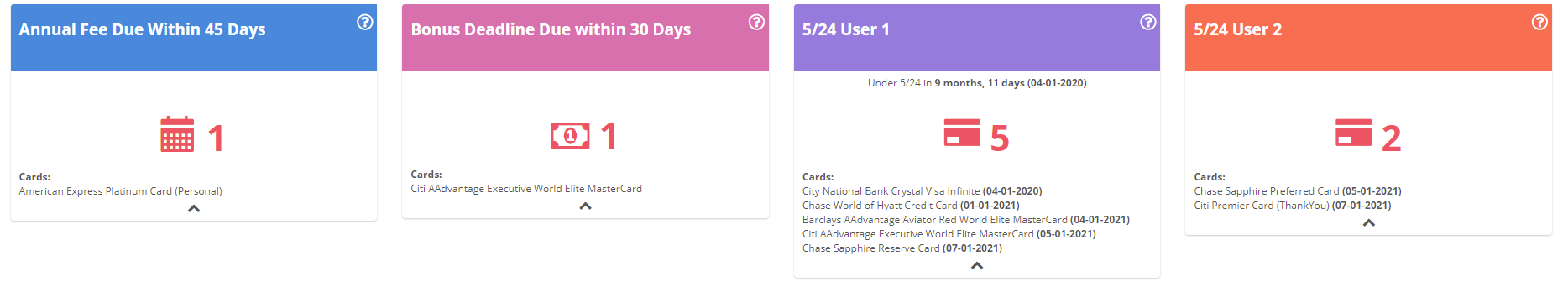

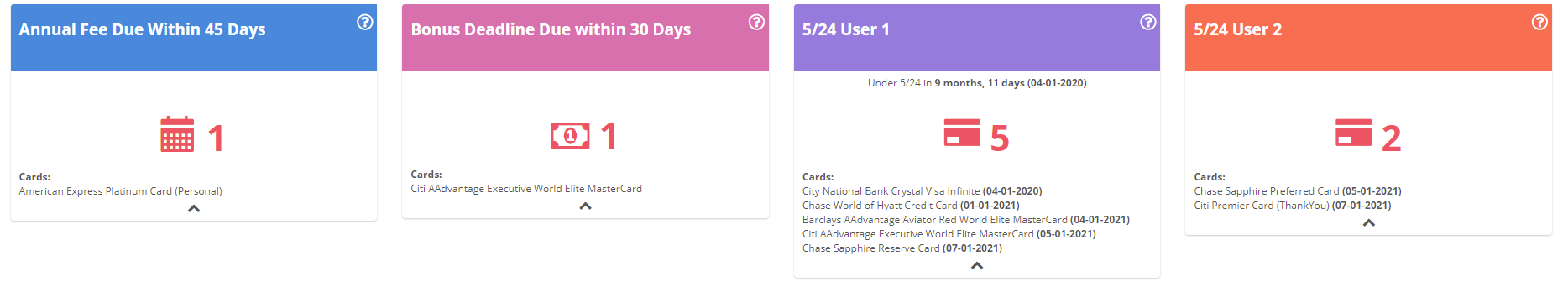

While it does take a bit of time to enter in all of your card information, that time is well rewarded. For example, Travel Freely uses that information to track key metrics that you should be aware of.

5/24 Status – Travel Freely takes into account the opening date and card type to determine if a product you have will be subject to 5/24. It then tracks your 5/24 status and when you will be below 5/24. This is incredibly useful. Don’t know what 5/24 is? Find out here.

Bonus Deadline Due – If you enter in the bonus information for your new cards then Travel Freely will remind you of when you are getting close to the deadline to meet the minimum spend requirement. This is incredibly helpful.

Annual Fee Coming Due – The service also tracks when your annual fees are due and gives you a heads up when one is about to hit. I like this since it gives you some time to decide on your strategy for that card. Incredibly useful.

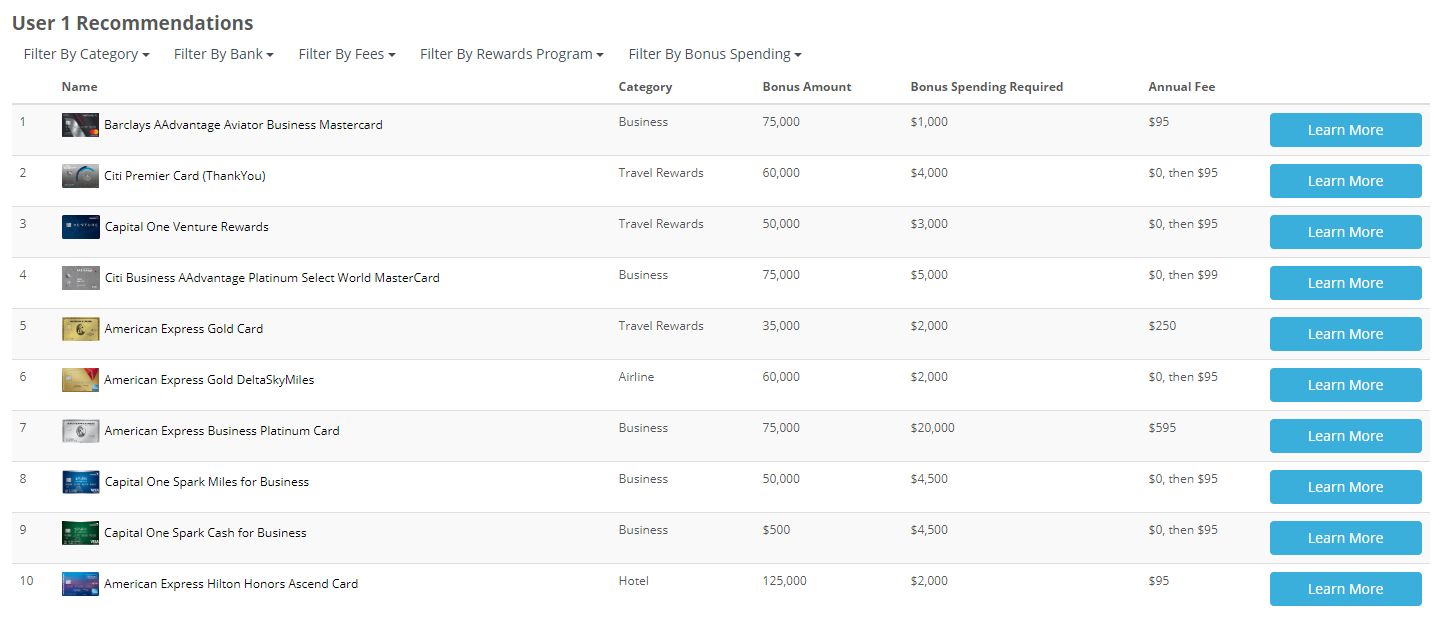

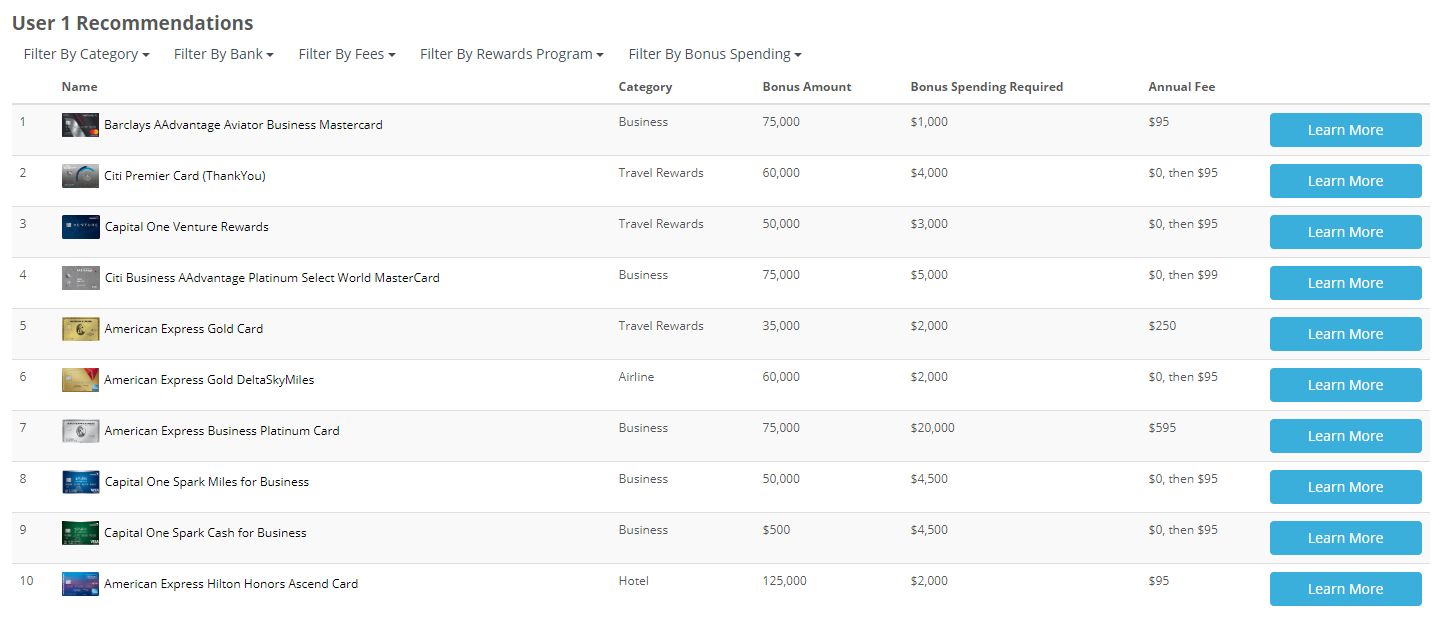

Travel Freely – CardGenie Recommendations

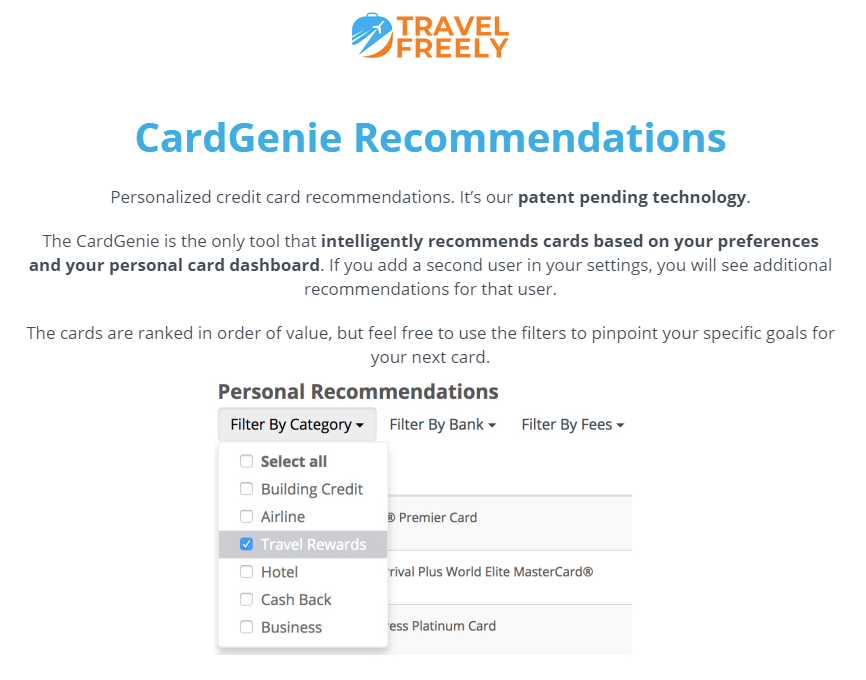

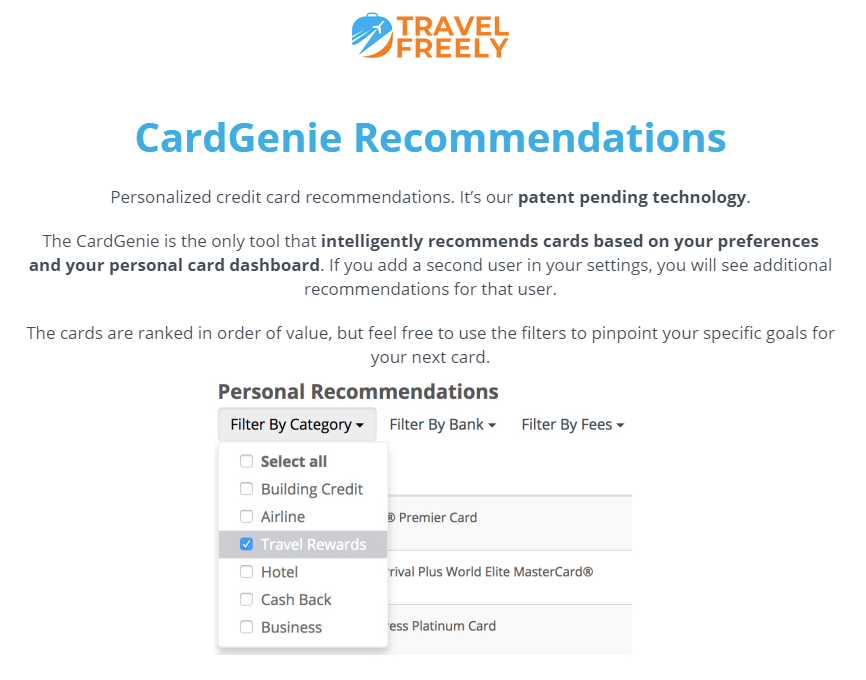

CardGenie is the real gem of the Travel Freely tool in my opinion. Think of it as a best offers page on steroids. To start, Travel Freely only lists the best known public offer for any given card. Even if they aren’t going to receive a commission they will list the best known offer. We would not have partnered with them if this wasn’t the case.

Second, CardGenie knows which cards you have and then tailors its recommendations around that. When visiting CardGenie it will look something like this.

While the service presents a lot of information, it is done in a simple and easy format. Additionally you can click on each of the cards to learn more about any specific features or benefits you are interested in. When you are ready to apply you can click right over to the application and before you know it hopefully you’ll have added a shiny new card to your lineup.

Travel Freely – Sign-Up For Free!

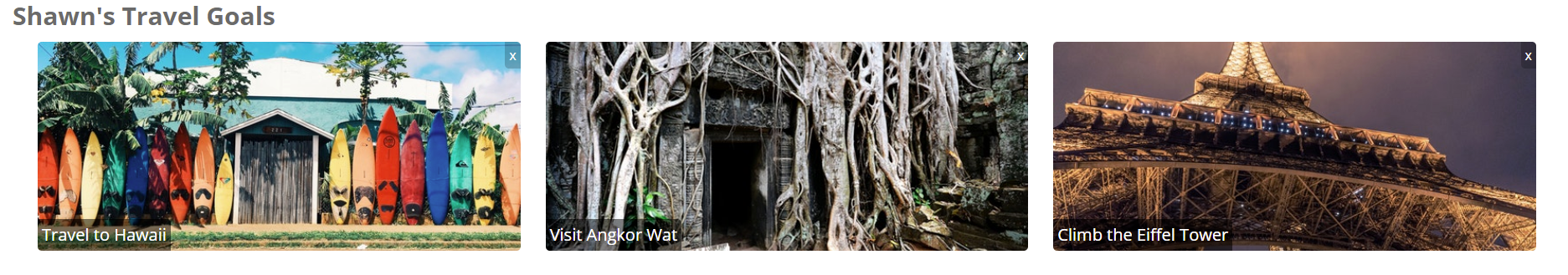

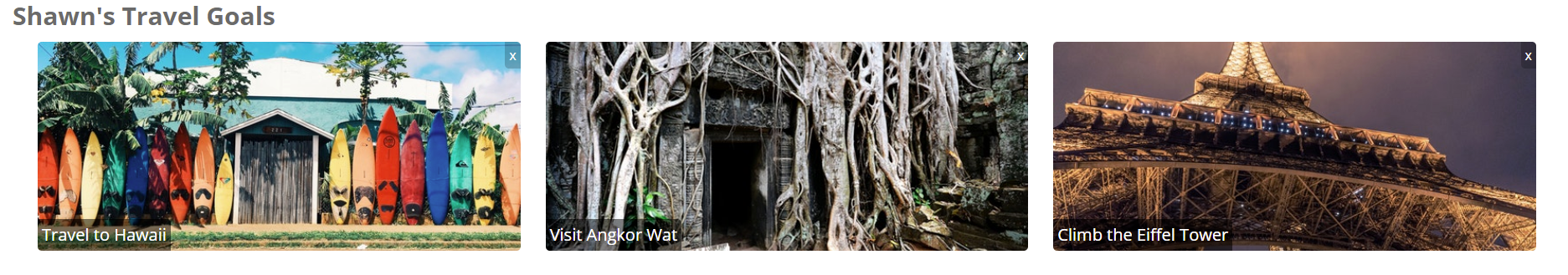

Travel Goals & Lifetime Earnings

While not as much a core part of the service as the credit card organization component, there are a couple of other unique things I enjoy about Travel Freely. First, you are asked to setup travel goals along with pictures to visualize them. These are shown when you login to remind you of exactly what you are doing this for.

Additionally on the homepage you will find the lifetime amount of points you have earned from sign-up bonuses along with the estimated value of those points. Once again this is a great motivation and a great reminder of the value of this hobby.

Resources & Guides

I mentioned it briefly earlier, but Travel Freely has developed a lot of resources to help newer people out as well. If you are new and looking to get up to speed I can definitely recommend their resources. They have spent time and effort to make sure their information is relevant and accurate. I really appreciate that.

Emails

Finally, there is one last way that Travel Freely is incredibly useful. It takes the information provided and keeps you informed via email of what is going on. For example, you’ll receive notices when your annual fee is coming due or bonus deadlines are approaching. These emails often have tips pertaining to the subject matter. Travel Freely will even remind you when it is time to apply for new cards if you want it to. Really helpful!

How Does Travel Freely Make Money?

To start, I love that Travel Freely is run by one of us. Travel Freely’s founder Zac developed the tool to fill a hole he saw in the market. Not only did he feel the need for better organization was there, but he decided he needed a way to get his friends/family up to speed on miles/points without having to walk them through everything one on one.

So if the service is free, then how do they make money? Actually the answer is quite simple. Travel Freely is a credit card affiliate and they get paid when you apply for credit cards through their links. Remember they are only showing the best offer even if they don’t have an affiliate link. That is the most important part to me.

Conclusion

We are happy to be partnering with Travel Freely to bring a tool to our readers that adds a ton of value. As someone who has struggled to keep up with organization over the years I like that Travel Freely takes my data and helps to make my life just a bit easier. Given the incredibly low price of $0 and the fact they only show the best offers I have no choice but to recommend giving Travel Freely a try.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

What type of security issues should we think through before using a site like this?

You input your the card info (not the actual number) and the dates etc. so they don’t have any sensitive information.

Gotcha!

I’ve used this site for a few months and it’s a lifesaver. Makes the whole process MUCH EASIER!

Awesome Dan!

How advanced is their system? For example are they able to account for the fact that some banks report business credit cards to your personal credit report while some banks do not ( in terms of calculating 5/24)

Or for example in their recommendations are they able to account for Citibank‘s rule that states you will not be able to get a thank you points card if you have opened another thank you points card or closed another thank you points card in the past 24 months .

I just signed up and this is awesome for 5/24 tracking! Nice improvement from my excel chart. Appreicate you guys sharing this.

It is a pretty awesome tool – thanks Eric!