Gift Card Churning – One Site to Another

One of the neatest things about gift card arbitrage is finding a gift card for sale one place and selling it somewhere else for a profit. This can often be done in just minutes and all online. Hopefully most of you get your gift cards direct during sales on eBay or when you have an Amex Offer to take advantage of. That is how I purchase 99% of my gift cards.

Other Ways to Arbitrage

There are other ways to get gift cards though. One of them is a gift card marketplace like Raise. There have been several times I have seen gift cards for sale on Raise that can immediately be sold to another site like Cardpool or SaveYa.

For example, a few weeks ago I noticed a batch of $100 Red Lobster gift cards on sale at Raise for $79.90. SaveYa was paying 81% for the cards, meaning I would make a small profit. More importantly it helps towards my minimum spending requirement on my Amex Business Platinum.

Since Raise pays 2% through a portal, my final cost was $78.70 (including shipping) and I received was set to receive $81 per card from SaveYa. Not a huge margin, but I am interested in racking up spend so it made sense at the time.

A Bad Card

The Red Lobster cards arrived in the mail about a week after I ordered them. Once in hand, I logged the card numbers, verified the values, entered them into SaveYa’s system and mailed them out. It was a quick and painless process. At the time of shipping all of my cards had their full $100 balance on them.

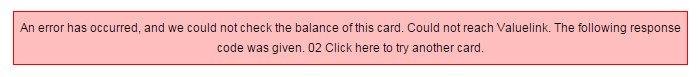

A few days later SaveYa received the cards, but was unable to verify the balance on one of them. They told me which one and I checked and noticed the system was giving an error. It wasn’t as if the card was drained, but like the card had been deactivated. All of the other cards which were presumably from the same seller still had their $100 balances.

The 100 Day Guarantee

Raise has a 100 day guarantee on purchases, so I contacted them, gave them the card number and it took them about a week to investigate. Ultimately I was issued a refund for the one card which still to this day gives an error message when you try to check the balance.

SaveYa

On the flip side, SaveYa paid me for the good cards and mailed back the bad one. So basically I am not really out any money, or am I? Well Lets take a look. SaveYa guarantees the balances on physical gift cards for one year from their sale. Or more to the point, my credit card on file with them guarantees the balance on the cards that I sold to SaveYa.

The good Red Lobster cards that SaveYa kept have already been sold, so I have about 90 days of protection from Raise on their purchase, but am guaranteeing the balance on those cards for the next 12 months. A bad move and not one that seems worth it.

Buy & Sell Guarantees

If you want to do this, to negate the risk you should make sure the protection you receive as a buyer closely matches the protection the company you sell to gives their buyers. In my case I only receive 100 days of protection while the person who buys my cards from SaveYa receives 1 year of protection.

Quite interestingly SaveYa only guarantees the balances on eGift cards on delivery. This means if I buy an eGift card from Raise and sell it to SaveYa, I should be protected on both ends of the transaction. This seems like a much better way to go, although there is still hassle and risk and this practice is not something I plan to do regularly.

Conclusion

None of the other cards I purchased had any problems, so I am not quite sure what happened. If something doesn’t go wrong within 100 days, I doubt anything will happen, however there is always the risk. In my opinion the risk just isn’t worth it for a couple of dollars in profit and a few hundred in spend. Lesson learned.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

[…] because they had already bought too much of a certain type of card. I’ve also shared about receiving bad gift cards and why it generally is not smart to buy from one exchange in order to sell to […]

So… I can also attest to this being a seriously awful idea. I was attempting to quickly (and freely!) hit some sign-up bonuses and have encountered an issue on ~75% of the 12 cards I was attempting to flip.

Merchant A- Ordered 6 cards total. Three cards that were invalid (1 of which at one point did work, but didn’t by the time the company I was selling to checked). I have gotten paid for 1 of the (seemingly) valid cards, while the other two have been “validated” by the purchasing company, but not paid out yet. I had to call and they said they are “escalating” it… Not sure what that means

Merchant B- Ordered 2 gift cards from two different companies that were indicated to only work in store. Received them and tried to verify balances online, but realized the cards don’t have a four digit pin (as this merchant’s gift cards do). This makes reselling them impossible as all places ask for gift card + pin. Furthermore, the cards themselves are clearly marked as being “non-transferrable” and include language stating that ID (matching name on card) must be presented to use them. So now I’m working with the companies where I bought them to get a refund, but one has indicated that “because they have valid balances, it’s outside the scope of the guarantee.” If I don’t get refunds/returns granted, I’ll have to start charge backs.

Buying Company A: I attempted to sell two egift cards to a company that were valid. A day later I got an email saying the transaction was declined. I called and asked and they said “it could be denied for any number of reasons. You should try sending in the physical card.” I don’t have the physical cards, so….

All in all, this has been really sucky. I’d definitely advise anyone considering this to absolutely avoid flipping cards between exchanges. I’d go a step further and make sure that you don’t buy a lot of cards from reputable places (ie. Paypal digital gifts, direct from merchant) without being okay with the risk that your intended purchasing outfit may simply reject the transaction for no reason. What was intended to be a quick and simple way to meet spends has turned out to be anything but.