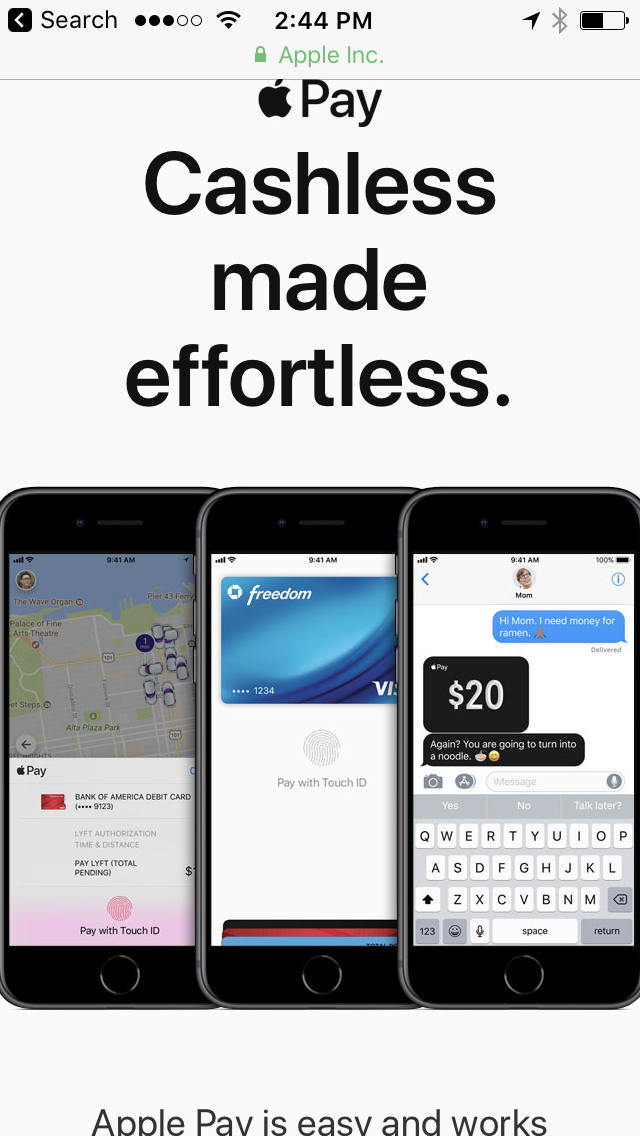

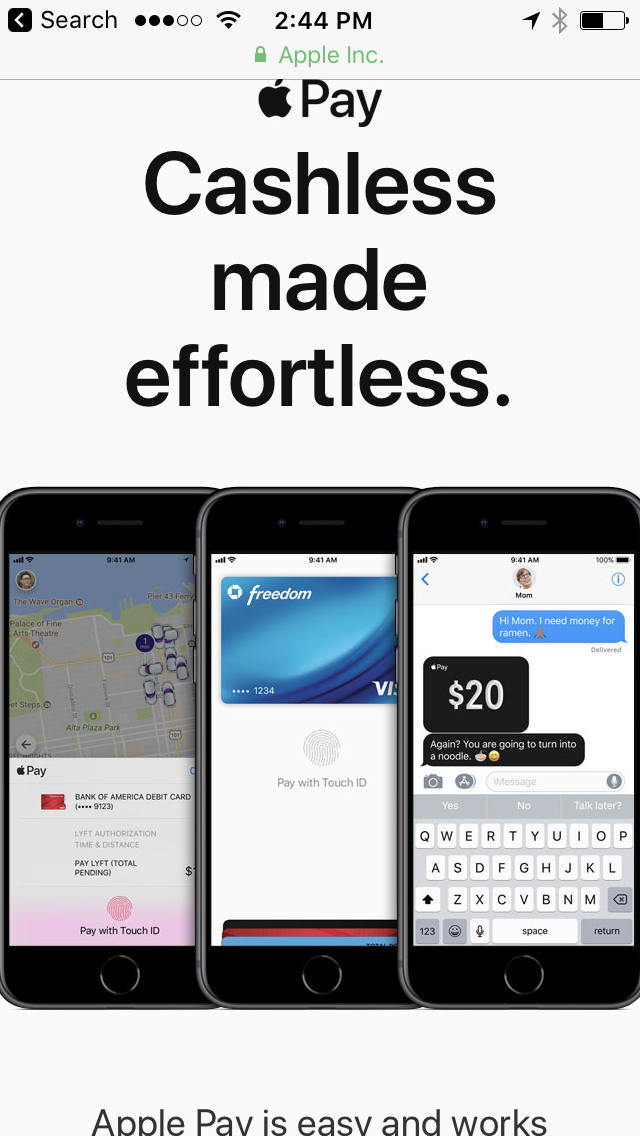

Apple Pay: Pay Friends In iMessage Using a Credit Card with No Fee

Peer to Peer payments have long been possible with apps like Venmo and Chase QuickPay. Basically, with Venmo, users can pay anyone through the app with linked bank accounts and debit cards for free and are charged a 3% fee to use credit cards to make payments. This new Apple Pay feature will streamline the process for paying your friends and potentially introduce a lower cost way to do so with credit. You can simply use the credit cards you already have saved in your iPhone wallet to make payments.

The Basics

In June, Apple announced the new IOS 11 Update which will allow users to request payment through iMessage. It’s been reported that we may be able to use a credit card to make the payment and there will be no additional transaction fees. The payment would then be added to the payee’s Apple Pay account and can either be used as payment or withdrawn to a bank account.

Analysis

While the idea of no-fee credit card payments to friends seems like a really exciting FREE way to increase credit card spend, I’m skeptical. First, we’ve seen things like this before, they don’t last. Think Amazon Payments, where you could send up to $1,000 a month with credit cards at no fee. (Didn’t last very long!) Also, we haven’t heard if there will be a limit. I’m guessing there will be an aggregate limit per month and possibly per transaction.

Conclusion

The prospect of free peer to peer credit card payments is exciting, but not for people looking to increase spend or earn tons of free miles and points. I think it’s really cool to be able to send money to your friends with an iMessage and the ability to do so with a credit card at no fee is definitely a huge convenience factor. It’s also great that there’s no separate app required for these payments, which will also make it an easy way to split your next dinner bill.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

2014

Love to hear more about the history of Amazon Payment. What time era was that?