Citi Checking Account Bonus Offers

Citibank has long been generous with their checking account bonuses. A few years ago, some would argue they were too generous, given that they issued 1099s at the end of the year for the bonuses. Fortunately, that seems to have changed.

Targeted Bonuses

Most Citibank checking account bonuses are targeted. For example, they will target American Airlines cardholders with a bonus paid out in miles and other cardholders with a bonus paid out in ThankYou points. Thankfully it seems both of those offers are currently available.

The Offers

There seem to be two main offers making the rounds. Lets take a look at them.

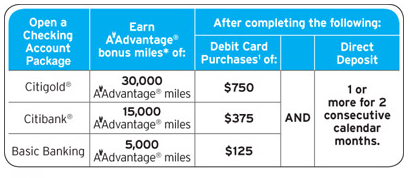

Offer 1 – AAdvantage Miles HT: Doctor of Credit via Miles Momma

Offer 2 – ThankYou Points HT: Doctor of Credit via Mile Cards

- Open a Citigold Account and make one qualifying bill payment for two months – get 40,000 points.

- Open a Citibank Account and make one qualifying bill payment for two months – get 20,000 points.

- Open a Basic Banking Account and make one qualifying bill payment for two months – get 10,000 points.

Targeted/Promo Codes

Officially these offers are targeted, meaning you need to have a promo code to get either of them. For the AAdvantage offer, Miles Momma has a code in the post I linked to above. Google is also your friend. In the past, these codes have worked multiple times.

If you have a promotion code, head over to this page and enter it. If you don’t have one, you can try to mention the offer to them via phone by calling 866-810-9043. In my opinion though the easiest way to go is to open an account in branch. (Note: Citi runs a SOFT credit inquiry when opening a checking account.)

Strategy

In my opinion it only makes sense to open a Citigold account to get the maximum miles. The Citigold account has a $30 monthly fee. Fortunately Citi doesn’t start charging the fee until the third month, meaning it is possible to get the bonus for free. In my case it took 3 months for the miles to post, meaning I paid $30 for 30,000 miles. Once the bonus posts, you can cancel the account, or downgrade to another Citi product.

You can only get one of these bonuses every two years, so it is as good a time as any to get in on the fun. (Update: One of my readers reports doing it 4 times in the past 2-3 years, so the “two year” rule may not be strictly enforced.) Personally I would go for the ThankYou offer if you have a card that allows for transfers like the Premier or Prestige. ThankYou points are worth a lot more than they used to be now that they have transfer partners.

My Experience

My wife and I both were able to get the AAdvantage miles offer back at the end of 2013. I was originally targeted in early 2013, but I was out of the country and kept running into problems with their online application website. I decided to wait until we returned home.

Unfortunately by the time we got back, our promotional code had expired, so I thought we were out of luck. Thankfully I decided to call in and was given the promotion without an issue. Similarly, my wife applied for her account in branch and was able to get the offer by simply mentioning it. (The agent looked in the system and was able to find it.)

Taxable Income

As I mentioned before, Citi used to send out 1099s for these bonuses since they valued them at greater than $600. Thankfully, it seems as though their policy has changed. While they publicly state the ThankYou points are worth $400, the AAdvantage miles are a grey area.

Fortunately I can report in 2013 I wasn’t sent a 1099 for the miles. Others have reported the same thing. (Of course this policy can revert back at any time, so it is something to keep in mind.)

Conclusion

Since these checking account bonuses can generally be had every two years (people have had success doing it more often), I recommend signing up (or attempting to sign up) for one of them. Many people who haven’t been targeted have reported being able to sign up and earn the bonus

Have you ever received an offer like this from Citi? What has your experience been? Let me know in the comments!

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

[…] Churning Citi Checking Account Bonuses – The Offers, Strategy & Real World Experiences – A good overview of how to get lucrative checking account bonuses from Citi. […]

Hi ,

I spoke to CSR . They said you can do initial funding to open the checking . I asked how much Max …She said 50K , if thats what you want …Thinking could this be an option for MS , if not which card is best to apply fund from . Barclay Arrival + does not put Cash advance when you load on line ….Do you recommend any other CC to do initial checking deposit .

2nd note – My wife is home maker but an extra (Of her own) AA card but no thank you card . i probably will open a checking account for her separately . In income should i put my income as her making house maker .

Appreciate someone’s comment

@Santosh:

would that (funding the account with a Credit Card) not be counted as a cash advance? If anyone has information about this, I’d appreciate it!

It varies by bank. Loading with a Citi card generally triggers a cash advance, some Chase cards as well. Barclay’s has worked for me in the past without a cash advance fee. The best way to make sure is to switch the cash advance limit on the card you want to use to $0. That way it won’t go through if they run it as a cash advance.

[…] Churning Citi Checking Account Bonuses – The Offers, Strategy & Real World Experiences – A look at two lucrative Citi checking account bonuses and the best strategy for getting them. […]

When I did this a two or three years ago (when they were sending out 1099’s), if you had a mortgage with Citi above a certain amount that would qualify you to have the Citigold fee waived. Looks like they’ve changed the language on that and now only count deposits past a certain level to waive the monthly $30 fee.

The terms you posted say you need two direct deposits–I don’t really want to change my direct deposit–where do you get that bill pay would work as well?

Thanks for catching that. The graphic I used is outdated. I will fix when I get in front of a computer. If you click the Doctor of Credit link you will see the correct offer. It doesn’t require a direct deposit, but $750 in debit card purchases.

Hi Shawn. I don’t see a current promo code on the Doc of Credit site, just the expired ones from last year. Any advice?

They sent me 1099 form for CitiGold. Applied last month.

A 1099 for the bonus or just for the interest earned? Which offer did you apply for?

What if you already have a city checking account?

Will this work if I don’t have an AA credit card?

Based on other people’s experiences, if you are able to sign up with a valid promo code, you should receive the miles, even if you don’t have a current AA credit card.

Closed mine back in March 2013. So I’ve added it to the calendar for another go round. Yes did the maximum amount and no 1099. Miles posted no problem. I did end up paying one month of fees I think. I’ll have to look into the details and see if I can avoid it with a minimum balance this time.

Obvious question I guess is whether there is any evidence of a backlash for such quick in and out behavior? Reduced likelihood of credit card approvals in the short term? Anything? I never had any issues myself and got LOTS of Citi AA cards in the interim (churned the Platinum when that was doable then the Exec too) so I certainly haven’t seen any problems myself.

Does Citi do a hard pull when you open a checking account?

It is a soft pull.